May 2024, Vol. 251, No. 5

Features

Challenges to Growth Remain Key Story in Appalachian Basin

By Richard McDonough, U.S. Correspondent

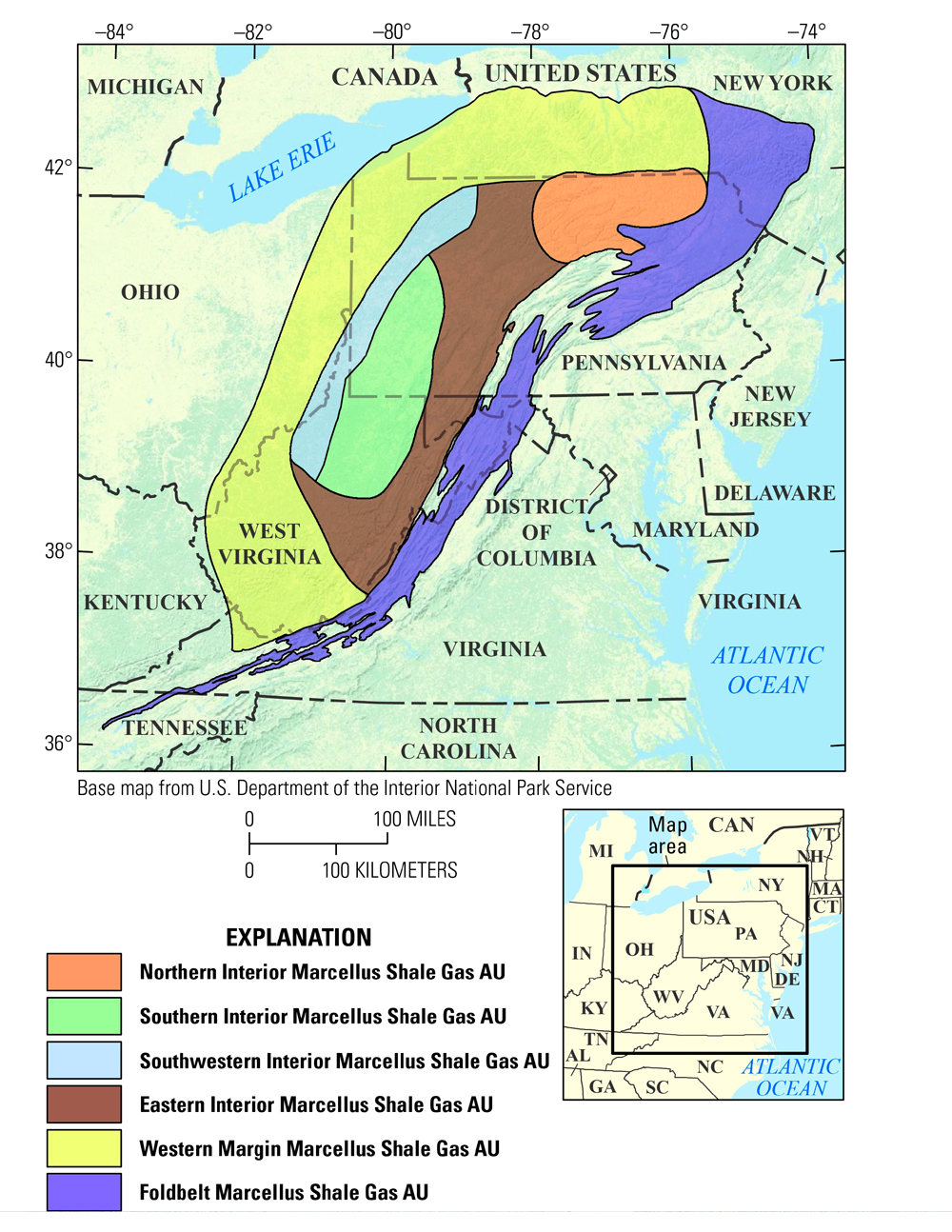

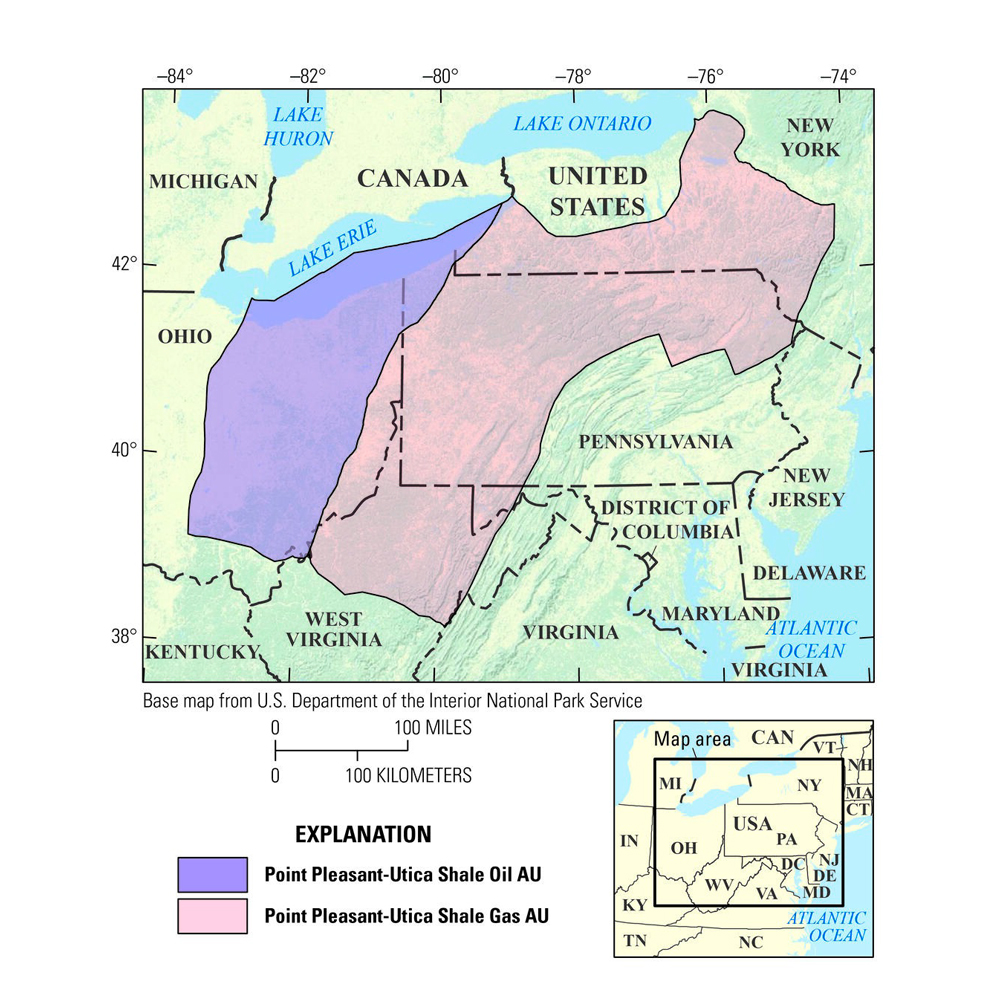

(P&GJ) — The Marcellus Shale and Point Pleasant-Utica Shale formations of the Appalachian Basin contain an estimated mean of 214 Tcf of undiscovered, technically recoverable continuous resources of natural gas, according to the United States Geological Survey (USGS).

This estimate and other estimates for energy reserves in the Appalachian Basin were issued in 2019 and re-confirmed by the USGS in April of 2024 as its latest estimates. As to the joint name used by the USGS for the Point Pleasant and Utica Shale formations, Christopher Schenk of the USGS explained that “the Utica Shale directly overlies the Point Pleasant formation, so in 2019 we combined the two units for the assessment.”

The USGS indicated in a statement that while the combined Point Pleasant-Utica Shale formation “…occupies similar areas as the Marcellus Shale formation, it was formed during the Ordovician Period, millions of years prior to the Marcellus…the Marcellus is much younger, having formed in the Devonian age.”

These three formations include parts of seven states: Kentucky, Maryland, New York, Ohio, Pennsylvania, Virginia and West Virginia.

Beyond natural gas reserves, the USGS detailed that “the Marcellus Shale [formation] also contains an estimated 1.5 billion barrels of natural gas liquids, while the Point Pleasant-Utica Shale [formation] also contains an estimated 1.8 billion barrels of oil and 985 million barrels of natural gas liquids. Natural gas liquids are liquid hydrocarbons like propane, butane and/or ethane.”

MVP Overview

The long-awaited Mountain Valley Pipeline (MVP) is back on track and under construction after securing necessary governmental approvals. The MVP is designed to provide transit for natural gas produced in the Appalachian Basin. When completed, it is projected to be 303 miles long as it travels through 17 counties in West Virginia and Virginia.

The MVP is owned and being constructed by Mountain Valley Pipeline, LLC, a joint venture formed among affiliates of each of Equitrans Midstream Corporation, NextEra Energy, Inc., Consolidated Edison, Inc., AltaGas Ltd., and RGC Resources, Inc. Equitrans Midstream owns a significant interest in the joint venture and will operate the pipeline.

“MVP is being recognized as a critical infrastructure project that is essential for our nation’s energy security, energy reliability, and ability to effectively transition to a lower-carbon future,” said Natalie Cox, Spokeswoman for MVP. “With construction well underway, Mountain Valley remains committed to completing construction and flowing domestic natural gas for the benefits of energy reliability and affordability in the form of lower natural gas prices for consumers.”

Demand to utilize this pipeline is strong.

“Capacity for MVP remains fully subscribed under long-term, binding contracts,” Cox stated. “The project is strongly supported by a broad coalition of elected Federal, state and local officials; state chambers of commerce and other business groups; landowners; public utilities; natural gas producers; and other non-governmental organizations.”

Two smaller pipelines are also in the process of development in the region.

“The Eastern Panhandle Expansion project is being developed to support economic growth in the Eastern Panhandle region of West Virginia,” from TC Energy said. “Once complete, this new pipeline will deliver new supplies of natural gas to Mountaineer Gas in Morgan County.”

“At approximately 3.5 miles (5.6 km) in length,” the statement continued, “this eight-inch-diameter pipeline will provide more than 47 million cubic feet per day of clean-burning natural gas to meet the energy needs of homes and businesses in the region.”

Eastern Gas Transmission and Storage (EGTS), a BHE GT&S company, is in the process of developing the Morgantown Connector Project.

This pipeline is designed to provide transit for natural gas from Greene County, Pennsylvania, according to a company statement, “…to a proposed combined cycle power plant in Monongalia County, West Virginia. This site will power homes and businesses using natural gas from the Marcellus Shale region…The project will also provide natural gas supply to other locations in the vicinity of the power plant.”

The Morgantown Connector Project is projected to include the installation of approximately 20 miles of 20” natural gas pipe and support structures to connect to the proposed power generation site in West Virginia. I should generate 1,200 MW of power using natural gas.

Natural Gas Production

“Ohio, Pennsylvania, and West Virginia are the third largest natural gas production region in the world,” said Mike Chadsey, Director of External Affairs of the Ohio Oil and Gas Association. “Investment, drilling and production have rebounded since the end of the Covid 19 Pandemic and continue to track in Ohio.”

He indicated that “the Utica Shale play has seen investments in over $100 billion in the last ten years supporting over 208,000 jobs in Ohio.”

“The demand for natural gas continues to be strong,” Chadsey continued. “The Marcellus and Utica are excellent formations with low-cost production and close proximity to markets.”

Utilities are among the major customers for natural gas produced in the region.

“There are several new natural gas-fired power plants in Ohio,” he stated. “Additionally, natural gas makes its way west via the Rockies Express, and up north via Rover and Nexus lines and down south via several pipelines.”

The keystone to much of the natural gas production in the Marcellus Shale region continues to be Pennsylvania.

“Continued natural gas development and investments in the industry are vitally important to achieving decarbonization goals while keeping energy affordable and reliable across the globe,” said Dave Callahan, President of the Marcellus Shale Coalition. “The Appalachian region is America’s largest natural gas producing region and consistently has the lowest greenhouse gas emissions intensity associated with production.”

The Coalition views natural gas as a critical part of sustainability efforts in the region and beyond.

Callihan noting that while “development across Pennsylvania, Ohio, and West Virginia increased 13% between 2018-2020, greenhouse gas (GHG) emissions intensity declined 20%.”

Charlie Burd, executive director of The Gas and Oil Association of WV, Inc., noted that West Virginia is the fourth largest producer of natural gas in the U.S. and that the industry is a key driver of the economy in the Mountain State.

In West Virginia natural gas, oil and NGLs account for over 17,000 direct jobs and 73,000 total jobs, he said, adding that the industry contributed about $714 million in severance taxes to the state in fiscal year 2023 and approximately $184 million in property taxes to governmental entities in that same fiscal year.

Total natural gas production has been on the increase in West Virginia, according to Burd. He cited production of 1.514 Tcf in 2017, increasing to 2.845 Tcf in 2022.

Much of the natural gas produced in West Virginia is exported out-of-state.

“Aside from that used in industrial processes in various parts of the state, the vast majority of natural gas produced in West Virginia is shipped to markets outside the state via interstate pipelines,” he said.

In New York State, Mary Gilstrap, executive director of the Independent Oil and Gas Association of New York, stated that natural gas is delivered via transmission and distribution pipelines to end-customers in the state.

“Natural gas produced in New York state is mainly used by homeowners and businesses for heating or backup power generation,” she said.

Oil Production

Both natural gas and oil production levels are decreasing in New York state, according to Gilstrap.

“The oil and gas industry has been around since the late 1800s,” she said. “A few years ago, we were exporting natural gas to the rest of the world in addition to meeting our gas needs in the USA. There is even a family-owned oil and gas company that operates in New York approaching 150 years in business.”

The situation has changed in the past few years.

“Oil and gas production is declining in New York State,” Gilstrap said. “Conventional well operators are pursuing drilling programs, but material and equipment inflationary pressures are impacting the economic viability of drilling wells.”

Drilling additional wells is the primary method of offsetting oil and natural gas production decline in the region, but lengthened drilling timelines and fewer new drilling programs will accelerate the decline in oil and gas production.

Gilstrap explained that oil produced in New York is sent to refineries in Pennsylvania where it is refined into lubricants and gasoline.

Pipelines are not a major source of transit for oil produced in New York State, she stated.

New York-produced oil reaches these refiners by truck and railway. Lubricants are put into a product distribution network for delivery to end-users. The gasoline is trucked to retail sales stations.

“The lubricants made are engine oils, gear oils, hydraulics oils, industrial oils, railroad lubricants, transmission fluids, etc. which are purchased by a wide variety of industries,” she continued. “Two of the largest lubricant customers are Norfolk Southern and CSX Railway companies.”

The decline of the oil industry in the area has prompted a change in operations at one area refinery.

“Reduced oil production in New York and northern Pennsylvania has forced a refinery to start bringing oil from other states to meet minimum refinery capacities,” Gilstrap said.

Oil production in West Virginia had been on the increase for several years, but levels have recently decreased.

“West Virginia is not a major oil producing state, but we are seeing a moderate decline that may likely be attributed to our current administration’s nationwide bans on oil production and exports,” according to Burd.

He noted that oil production steadily increased from 2017 through 2020 – from 7,558,169 barrels of oil in 2017 to 19,425,914 barrels of oil in 2020, however, levels decreased to 17,899,108 barrels of oil in 2021 and then to 15,367,036 barrels of oil in 2022.

Burd indicated that both pricing and access to secondary markets have also affected oil production.

The situation is different in Ohio where oil production is on the increase.

“The Marcellus and Utica formations have been traditionally thought of as natural gas plays but that is changing in the Utica as producers are having some early and exciting success with the oil window expanding the Utica west,” said Chadsey of the Ohio Oil and Gas Association. “We are cautiously optimistic and will know more when the next set of production reports become available shortly.”

Conventionally-produced oil is taken to the ARG and Ergon refineries, while unconventionally-produced oil is taken to the Marathon refinery. Marathon refinery is connected via the Cornerstone Pipeline, while conventional oil is trucked out.

Challenges

A variety of challenges face the energy sectors in the Appalachian Basin. Some are related to business activities and economic conditions, but many of the challenges involve decisions of governmental entities.

“Recent national elections, global conflicts, Covid 19, and the price of the commodity have all had an impact on production here in Ohio and beyond,” said Chadsey.

Future challenges for oil production in Ohio and the region, he explained.

“Access to markets, pipeline take away, price, and uncertainty with end users –

who wins the White House, which party has the majority of seats in the U.S, Congress, and the price all will be drivers in 2024 and into the near future,” Chadsey said.

According to Burd, challenges to natural gas production include the lack of pipeline takeaway capacity and future downstream market development and utilization. In his view unless pipeline capacity becomes available or downstream market access improves, growth in natural gas production will likely be negatively impacted.

“The results of the Presidential election this year will be very telling about the future of natural gas and oil development in the Utica and the Appalachian Basin,” he continued. “The pending methane rule and methane tax will be a huge challenge for all of our producers. The pause on LNG is creating uncertainty.”

A number of external forces are also projected to impact natural gas production in the region.

Challenges also remain for natural gas production in Pennsylvania, noted Callahan.

“Permitting and moving natural gas to market (infrastructure constraints) remain a challenge for producers in the Appalachian Basin,” he said.

Policies implemented by officials in Albany have directly affected oil and natural gas production in New York State, explained Gilstrap.

“The biggest impact on oil and gas production in this region was the withdrawal of the large oil and gas producers’ operations due to New York’s large hydrofracturing ban,” she said. “Since this change, well service companies have relocated operations out of state.”

As a result, we have few companies nearby to provide well equipment.

“The producers are paying transportation fees to get the equipment on site, Gilstrap added. “In addition, the average number of oil and gas workers in this area is rising. Recruiting new qualified workers to the oil and gas industry is challenging.”

Governmental actions are impacting and will likely further impact not only producers and others directly involved in the oil and gas industries, but also regular folks, according to Gilstrap.

“The Federal and state governments’ actions to ban the sale of natural gas appliances has made this real for the average citizen,” she stated. “It is no longer just an oil and gas industry problem; many individuals will be impacted by these costly requirements. The value of access to safe, reliable, affordable energy sources is being recognized.”

Gilstrap indicated that pipelines will remain an important transit option.

New York state continues to use natural gas as an energy source and as natural gas production drops off within the state, the shortfall will need to be made up through transporting larger amounts of natural gas from surrounding states via pipelines.

“Currently, there are no significant new pipeline projects in New York that I am aware of, except for one or two short interconnects to improve flexibility in gas movement,” Gilstrap said. “Oil and gas production within the state is declining so there is ample pipeline capacity.”

She added that other factors that limit additional pipelines are the Regional Greenhouse Gas Initiative (RGGI) and the New York State Climate Leadership and Community Protection Act (Climate Act or CLCPA).

The Climate Act (CLCPA) establishes specific CO2 and methane reduction targets within the state by 2050. “It is among the most rigorous emission reduction efforts of any major economy in the world. This act requires New York to reduce emissions to 85% below 1990 levels by 2050.

Separately, the Regional Greenhouse Gas Initiative (RGGI) is a cooperative, market-based effort among the states of Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, and Vermont to reduce power sector CO2 emissions. It is the first cap-and-invest regional initiative implemented in the nation.

“New York State producers want to be here for the long run,” Gilstrap concluded. “They have raised families here and made their livelihoods from oil and natural gas production. Most producers understand the importance of the service they provide … The New York State oil industry is smaller now; but until a safe, reliable, affordable replacement energy source is found, this industry will continue to find ways to deliver needed energy to the public.”

Author: Richard McDonough writes about energy infrastructure-related issues in the United States, including the column The Nuacht of Pipelines. He can be reached at newsaboutamerica@gmx.us.

Comments