May 2024, Vol. 251, No. 5

Global News

Global News May 2024

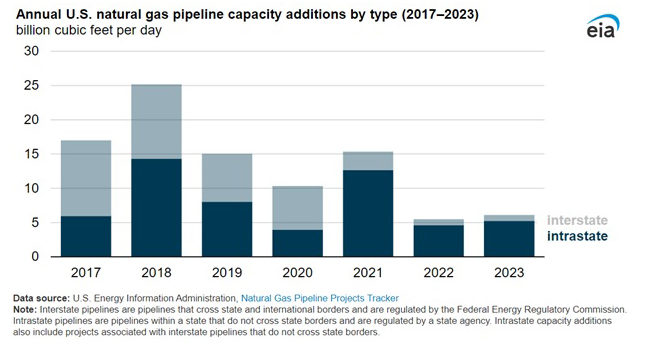

U.S. Pipeline Expansion Shifts Toward Intrastate Capacity

In a significant shift, natural gas intrastate pipeline capacity outpaced interstate additions in the United States in 2023, according to data from the Energy Information Administration’s (EIA) Natural Gas Pipeline Projects Tracker.

Unlike interstate pipelines, which cross state and international borders and fall under Federal Energy Regulatory Commission (FERC) regulations, intrastate pipelines operate within a single state and are regulated by state agencies.

Last year saw the addition of 5.2 Bcf/d of intrastate pipeline capacity, with the majority concentrated in Texas and Louisiana. These expansions primarily aimed to meet the growing demand for natural gas in U.S. Gulf Coast markets, including those driven by LNG exports.

Key intrastate projects included expansions by major players like Enterprise Products Partners, Kinder Morgan, DTE Midstream and Howard Energy Partners, targeting regions such as the Haynesville producing area and the Eagle Ford region.

Meanwhile, interstate pipeline capacity additions in 2023 amounted to 900,000 MMcf/d, marking a slight decrease compared to the previous year, as they have declined since 2018. New capacity on pipelines crossing state lines accounted for 14% of total new capacity in 2023, a notable drop from the 65% seen in 2017.

Projects such as TC Energy’s North Baja Xpress and Alberta Xpress expansions, Tennessee Gas Pipeline Company’s East 300 Upgrade and WBI Energy Transmission’s Grasslands South Expansion contributed to this interstate capacity growth.

These developments highlight the evolving dynamics within the natural gas transportation sector, with intrastate projects taking the lead in addressing regional demand while interstate expansions continue to play a vital role in interconnecting major producing and consuming regions across the country.

Nigeria’s Oil Output Surges Amid Crackdown on Theft

Nigeria’s oil production reached 1.48 MMbpd, its biggest in more than three years, according to OPEC data, as the military and private security contractors crackdown on crude theft and pipeline sabotage.

Nigeria has struggled to halt attacks on oil infrastructure which have kept the country from meeting its national budget targets and OPEC quota.

Nigerian output fell below 1 MMbpd, its lowest total in over a year, prompting authorities to call in security firms to back up soldiers who guard pipelines.

State energy company NNPC Limited had destroyed more than 6,000 illegal refineries, which process crude stolen from the company’s export pipelines, according to NNPC.

Two years ago, a team comprised of military and private security companies made it possible to reopen Shell’s Trans Niger Pipeline, which had been offline for a year because of the oil theft problem.

OPEC told Reuters its crude oil output rose by 203,000 bpd to 26.57 MMbpd in February, boosted by Nigerian and Libyan output, despite fresh voluntary OPEC+ cuts.

Kimmeridge Makes New Offer for SilverBow, Proposes Merger

Kimmeridge Energy Management offered to acquire oil and gas producer SilverBow Resources, which is valued at more than 2 billion, including debt.

Under the proposal, SilverBow shareholders would be rolling their equity into the combined company at a valuation of $34 per share, according to a statement from Kimmeridge.

Kimmeridge made two unsuccessful offers for SilverBow during the past two years, in an effort to combine gas-producing assets in South Texas.

In a separate statement, SilverBow said it “will carefully review and consider the proposal to determine the course of action that it believes is in the best interest of the company and all of its shareholders.”

As well as contributing its South Texas assets, Kimmeridge would inject $500 million into the combined company to help pay down debt.

Ukraine Declines Extension of Russian Gas Transit Deal

Ukraine does not plan to extend a five-year deal with Russia’s Gazprom to ship gas to Europe and said it will not sign a new deal either.

The Ukraine deal went into effect in in 2019 and gives Russia permission to export gas to Europe via Ukraine’s pipeline network. The deal expires at the end of December 2024.

“I can confirm that we have no plans to enter into any additional agreements or extend this (current) agreement,” Ukraine Energy Minister German Galushchenko said. A stress test last year of Ukraine’s gas transmission system and underground gas storage facilities proved that its gas system “can function without transit,” he said in a statement.

Having sufficient pressurized gas in pipelines is necessary to guarantee supplies that Ukrainian consumers can still receive the fuel if there was no longer any transportation from Russia to Europe.

Russia plans on using alternative routes and sea-borne LNG now. Russian gas has still been entering Europe, even after the Ukraine war began.

Petronas Building FLNG Facility for Argentina’s Exports

Malaysia’s state energy firm Petronas has begun the construction of a floating liquefied natural gas (FLNG) processing unit to be placed off the coast of Argentina, which aims to begin exports by 2027, a senior executive said.

The first unit planned for Argentina will be able to produce up to 2 mtpa of the super-chilled gas, said Petronas Senior Vice President of LNG Abang Yusuf told Reuters.

“The floating LNG project is progressing good, and we expect to start that (floating unit) by 2027,” he said during the CERAWeek energy conference in Houston.

Petronas eventually could expand the operation to produce up to 9 mtpa from a total of three floating LNG facilities off the South American country’s coast.

Petronas also has a separate project with Argentina’s state-controlled energy firm YPF to build an LNG facility on land. YPF is expected to own between 25% and 30% of the joint project Argentina.

The two companies have begun the front end engineering and design (FEED) study for the second project in Argentina that is expected to produce another 20 MTPA. That second project would allow Petronas to export as much as 30 mtpa of Argentine gas, he said.

Petronas expects its LNG projects could earn in excess of $15 billion per year starting in 2032, it recently told its stakeholders.

“We have done a lot of studies with our partner YPF ... the next step is to mature the project, but we are now waiting for the new investment law,” said Abang Yusuf.

Petronas also is considering new investments in the Atlantic Basin for its LNG business, he said.

The executive also told the CERAWeek conference in Houston that Petronas is aiming to increase its share of the global LNG market to 10%, but there is no set time frame to achieve that goal, he said.

Petronas separately is looking at taking an equity stake in the second phase of LNG Canada’s gas-export plant in Kitimat, British Columbia, on the west coast of Canada, he said. The plant’s first phase is scheduled to start producing chilled gas in the second half of the year.

U.S. Grants $750 Million for Hydrogen Projects Across 24 States

The U.S. Department of Energy is granting $750 million to projects across 24 states that are building capacity to produce and use hydrogen.

The funding for 52 projects in states from Rhode Island to Oregon comes from the 2021 bipartisan infrastructure law.

The projects are working on six aspects of the hydrogen industry, including research and development on production of electrolyzers, securing supply chains for the machines, and recycling critical materials used in hydrogen production, such as iridium.

Hydrogen is seen as a key to reducing cutting emissions by the Biden administration, because it is made by electrolyzers that split water into hydrogen and oxygen and can be considered green if they are powered by zero-emission sources like solar, wind, nuclear or hydro.

Comments