October 2024, Vol. 251, No. 10

Features

U.S. Northeast Outlook: Permitting Reforms Seen as Crucial to Region’s Energy Woes

By Richard Nemec, Contributing Editor

(P&GJ) – The state of Massachusetts earlier in 2024 joined its fellow New England states, along with Delaware, Maryland, New Jersey and New York in signing a memorandum of understanding (MOU) to establish a framework for coordinating their activities to improve interregional transmission planning and development.

In 2023, Massachusetts also led a request to the U.S. Department of Energy (DOE) to convene and lead a multi-state group, the Northeast States Collaborative on Interregional Transmission, a first-in-the-nation effort to explore mutually beneficial opportunities to increase the flow of electricity between three different planning regions.

The clear point is that if any U.S. region understands the importance of intrastate and interstate energy flow, it is the Northeast. And it is the Northeast that is a clear example of what is and is not happening in terms of building more U.S. energy infrastructure transportation additions these days.

According to the U.S. Energy Information Administration (EIA), 5.2 Bcf/d of intrastate natural gas pipeline capacity was added nationwide in 2023, but the bulk of it was confined to two states – Texas and Louisiana.

At the same time, EIA notes that interstate pipeline capacity additions annually have declined each year since 2018. Gas consumption set annual and monthly records in 2023, hitting 89.1 Bcf/d, and since 2018, gas consumption has increased at an annual rate of 4%. Nevertheless, the interstate capacity additions last year were less than 1 Bcf/d.

“New capacity on pipelines crossing state lines accounted for 14% of the total new capacity in 2023, compared with 65% in 2017,” EIA analysts noted. “Nearly all the intrastate pipeline capacity additions in 2023 were to serve gas demand in the U.S. Gulf Coast markets, including liquefied natural gas (LNG) export demand.”

Proposals Await

There is no shortage of pipeline expansion proposals for the Northeast, according to both EIA and the Interstate Natural Gas Association of America (INGAA) officials. An EIA tracking system for gas pipeline projects counted 14 during the summer of 2024, and INGAA notes more than a dozen proposals since 2023, including one project dating back to 2021.

Permitting issues at all levels of government have led to the cancellation of several proposed major pipeline projects in recent years, according to INGAA officials. “In fact, from 2013-21, five interstate natural gas pipeline projects were canceled or deemed unviable due to permitting challenges after receiving federal approvals and certificates to build.”

The projects were Atlantic Coast Pipeline, Constitution Pipeline, Northeast Energy Direct, Northeastern Supply Enhancement, and PennEast. Four of the five would have moved Marcellus and Utica shale supplies.

This past spring, Moody’s Investors Service offered a stable outlook for oil and gas globally, without specifying certain regions.

“Growth in demand is tapering to its long-term trend in line with GDP growth for the world's largest economies into mid-2025. Producers continue to constrain supply to support prices and maintain sizable production capacity to respond to geopolitical events,” according to Moody’s half-dozen leading energy analysts.

The Moody’s analysts indicated they would consider changing their global sector outlook to “negative” if sector fundamentals substantially weaken, and there are projections that aggregate EBITDA will decline by more than 10% in the next 12-18 months from current levels.

“[Conversely,] we would change our outlook to ‘positive’ if we believe aggregate EBITDA will rise by more than 10% over the next 12-18 months,” they noted.

In painting a picture of the outlook for production and transportation of gas in the Northeast, Jose Costa, CEO of the Northeast Gas Association (NGA), echoes these national statistics, outlining continued growth in production and demand, but little or no additions to the transportation systems – intra- or interstate.

“Demand is going to continue to rise, particularly in the gas and electric sectors,” Costa notes. “We saw that in 2023, and in the gas sector in the Northeast you are still seeing a lot of residential and commercial customers switching over to natural gas. A lot of it has to do with the affordability and reliability of the energy source.”

INGAA’s President and CEO Amy Andryszak sees the Northeast as a poster child for inadequate fuel supplies and lack of energy.

It’s a region “infamous for having some of the highest energy costs in the country despite there being a clear solution to this predicament.,” she told P&GJ. “The Northeast is the most extreme example of demand/supply mismatch in recent years, thanks to local court decisions and policy changes that have brought any gas infrastructure developments to a screeching halt.

“Challenges facing the region will only persist, if not get worse, until adequate infrastructure is built to bring energy into the region. This includes natural gas from the United States’ most prolific natural gas basins – the Marcellus and Utica shale formations – located in neighboring states. Without the continued buildout of our natural gas transmission system, the Northeast will continue to face a growing demand-supply imbalance, hurting the region’s energy reliability and affordability.”

‘Ample Supplies’

However, NGA’s Costa envisions no concerns on the supply side in 2025, citing his region’s proximity to the Appalachian shale plays of the Marcellus and Utica in Pennsylvania, West Virginia and Ohio. “There are no concerns there since there are ample supplies,” he notes.

“The concerns for years have been focused on the actual infrastructure to take gas from the supply basins to the market,” he said. “We continue to still have a constrained market in the Northeast and that will continue. There are no actions for any new pipelines.”

Two weeks before Costa made his comments to P&GJ, the U.S. Court of Appeals for the District of Columbia Circuit tossed out an approval for a Northeastern gas pipeline project, which was reported as a major victory for New Jersey’s climate ambitions and advocates who want federal regulators to rethink how they weigh the need for new fossil fuel infrastructure.

The appeals court found that the Federal Energy Regulatory Commission (FERC) had failed to consider significant environmental consequences and a lack of market demand for additional gas capacity when it granted a certificate for the contested Transcontinental Pipe Line Co. Regional Energy Access Expansion project in 2023. The court also found that FERC had not accounted for New Jersey state laws requiring reductions in gas consumption.

INGAA’s Andryszak thinks the Northeast shortage of new energy infrastructure is a national problem.

“The U.S. is in critical need of additional pipeline capacity to maintain system reliability and supply energy to consumers across the country,” she said. “This is particularly true in regions like the Northeast where regulatory barriers have, for years, made building pipelines and other natural gas infrastructure nearly impossible. With natural gas demand projected to grow, this points to a troubling outlook for the region.”

Is the gap between supply and transportation capacity widening? Andryszak gives an emphatic “yes” to that question. As the U.S. has become the largest natural gas producer in the world and now produces, nearly all of the natural gas that it uses, she sees a “burdensome and often cumbersome permitting landscape stifling much needed pipeline capacity additions to move the product from where it is produced to end-users.”

At the distribution level, safety continues to be a concern because the Northeast is sprinkled with some of the oldest pipeline systems in the nation, although local utilities have greatly reduced the amounts of cast iron and bare steel pipe still being used.

According to the National Association of Regulatory Utility Commissioners’ (NARUC) tracking of pipeline replacements and modernization, bare steel and cast iron nationally still accounts for 5.1% of the gas mains in the United States and 2.7% of the gas customer service lines, and the highest percentages are found in the Northeast.

While distribution mains that are still cast/wrought iron or bare steel are well below 5% in several states, in five of them they are above 10%: Connecticut, 13.5%; New York, 13.5%; Pennsylvania, 14.9%; Maine, 15.3%; and Rhode Island, 22.7%, based on 2022 data released in 2023.

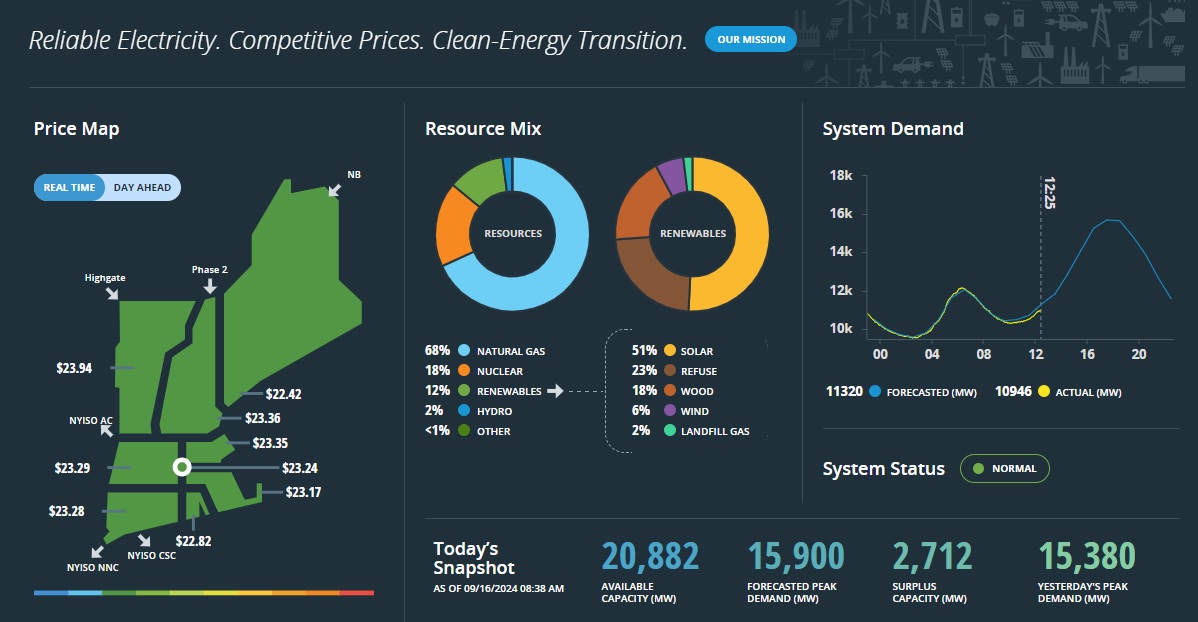

For more than two decades, the Northeast has had deregulated energy markets. Electric utilities are responsible for distribution, operations, and billing, but not generating the electricity. Generating companies produce the power and sell into competitive markets. And the regional grid is operated by the New England Independent System Operator (ISO).

As the NEISO sees it: “Over the past 20 years, the region’s market and policy approach has driven change in the direction that states have been seeking, spurring private investment in some of the most efficient, lowest-emitting power resources in the country, shifting investment costs and risks away from consumers, lowering wholesale prices, reducing carbon emissions, and enabling the transition to a system that emits even less carbon. Markets have worked in tandem with transmission improvements to help lower energy costs.”

NEISO officials indicate that over recent years, system upgrades have nearly eliminated congestion costs in the New England energy market and, with the aid of low natural gas prices and other factors, have helped drive down and mitigate “uplift” payments to run specific generators to meet local reliability needs. NGA notes that natural gas is shipped by pipeline to customers via contracts, of which there are two basic types:

- Firm transportation – service for which facilities have been designed, installed and dedicated to a certified volume. Firm transportation service is not subject to prior claim by another customer and is the highest quality service offered to customers. Firm transportation service takes priority over interruptible service.

- Interruptible transportation – service which is subject to interruption when deliveries under such service would interfere with or restrict deliveries under transportation services having higher priority.

“While LDC’s regularly have firm contracts, generating companies do not always contract this way,” according to NGA’s Costa. “In cases where generating companies’ service is interrupted to meet higher priority deliveries, they can be forced to turn to the spot market, and when prices are too high, they can decide not to bid [not generate] into the electricity market at all, until electricity market prices get high enough, or the dual fuel generators will turn to cheaper, more polluting fuels.”

So, it is not the electric utilities that have interruptible deals, but rather the merchant electric generating companies.

Costa said the typical residential energy user doesn’t recognize the tie-in between gas burning and climate change. He thinks customers are more concerned about affordability and reliability. When it is looked at by advocacy groups on a statewide level, the idea of getting away from fossil fuels is real.

“We’re working together in the industry to deal with this transition and to make sure as we go through it that it is handled in a way in which reliability remains and it is cost-effective,” Costa said.

At one of the region’s largest gas distributors, National Grid (NG) stated, the need to decarbonize is clearly recognized in the company’s long-range plans for renewable natural gas (RNG) and hydrogen.

Like many fossil fuel supplying companies, NG has a strategy for reaching net zero carbon emissions by 2050, and many skeptics and supporters for this approach can be found in and outside of the industry.

The assumption is that climate change is the greatest challenge facing the world, the nation, and the Northeast, so NG supports states’ goals in reducing greenhouse gas (GHG) emissions economywide.

“We recognize that decarbonizing our electric and gas systems will require resolving many questions and seeking new partnerships, technologies, energy policies, utility regulatory models, and transformative investments,” the company states on its website.

Net Zero in 2025

NG acknowledges that it does not have all the answers, and it intends to collaborate on solutions and to step up in addressing these challenges. It will strive for net zero GHG emissions by 2050 in all the natural gas and power it sells.

“Decarbonizing the gas network with renewable natural gas and hydrogen is one of the key pillars in achieving this goal. We will transition away from delivering traditional geologic natural gas to our customers to providing them with low- and zero-carbon RNG and hydrogen, NG’s website said. “We will scale utilization of RNG from sustainable biomass feedstocks [wastewater, landfills, food waste, livestock manure, and others], looking for the most readily scalable and affordable supplies for our customers.”

More immediately, the Northeast is girding for the coming winter (2025) and beyond, facing the short-term with less than adequate renewable power supplies and battery storage for the region. Thus, the reliance on fossil fuels will continue, according to Costa and others.

As a result, on the electric side, there are not firm contracts or LNG to boost supplies. he said, noting that merchant power generators in the region have interruptible gas deals.

“If we run into a period of a long cold snap of a week or more, that’s where more challenges will occur in ‘25 and beyond,’” Costa said.

During peak demand periods, LNG makes up about 35% of the region’s gas supplies. So, natural gas distributors have the infrastructure and contracts to handle these extreme peaks, but the power producers do not.

As INGAA’s Andryszak notes, a lot of the fallout from the Northeast’s continuing infrastructure shortage is both economic and financial, hurting consumers and energy providers alike. Observers note that Wall Street surely is aware of the policy and regulatory hurdles in the region and thus, is discouraged by the track record in the Northeast in recent years.

“We need our nation’s regulatory and policy regimes to send more positive, consistent, and clear, signals to investors that our natural gas infrastructure is worth investing in, or else we won’t be able to meet our energy needs down the line,” said Andryszak.”

As an example, she said the U.S. Northeast and New England, in particular, have access to an abundance of natural gas, but challenges to build new infrastructure have made it nearly impossible for the region to take advantage these resource.

“This not only puts a chilling effect on investment, but causes consumers to miss out on the economic benefits associated with natural gas,” Andryszak said.

Ultimately, INGAA and its member pipeline companies would like “bold comprehensive permitting reforms” that involve shaking up the national political status quo with changes to the Clean Water and Environmental Policy acts.

“We feel that such changes could increase certainty and facilitate build-out of infrastructure tied to gas pipelines and LNG export facilities,” Andryszak added.

Richard Nemec is a long-time Los Angeles-based contributing editor for P&GJ. He can be reached at rnemec@ca.rr.com.

Comments