February 2025, Vol. 252, No. 2

Features

Thirst for LNG Could Bolster Expansion in Europe, Elsewhere

By Michael Reed, Editor-in-Chief

(Editor’s note: Due in large part to the expanded data sets available through Global Energy Infrastructure, this year’s P&GJ Construction Report has been expanded to two parts. In Part 2, we focus on Europe and regions outside of North and South America.)

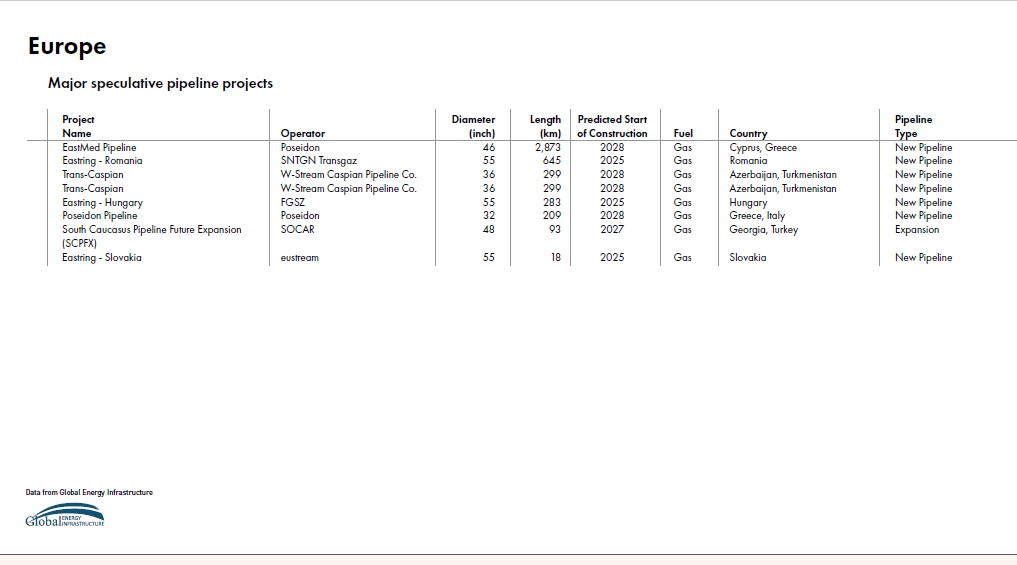

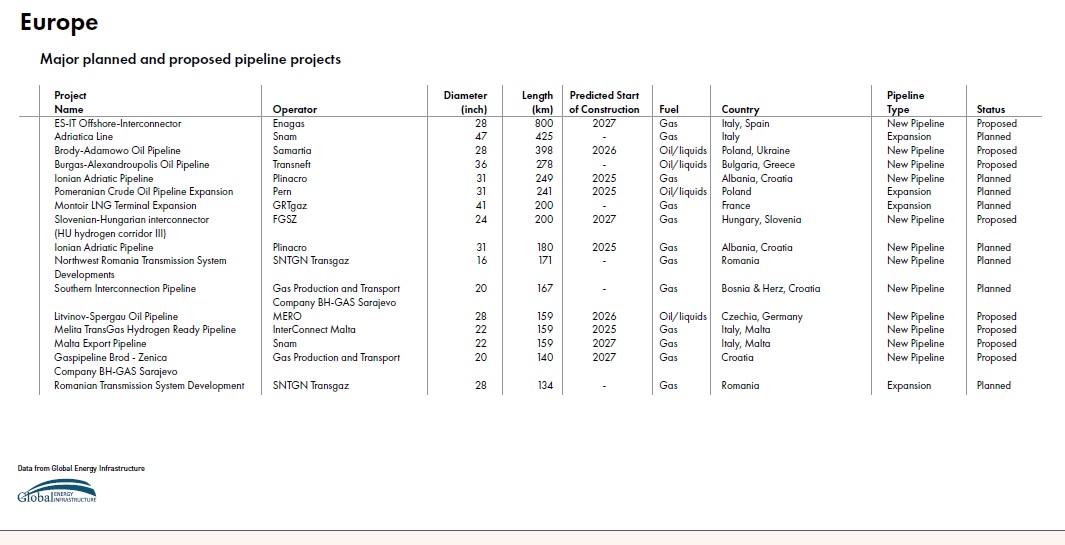

EUROPE

Pipeline Miles Under Construction: 4,609

Pipeline Miles Planned: 9,283

Total: 13,892

(P&GJ) – Europe is taking major steps to expand its gas pipeline networks to support gas flows from new LNG terminals. Germany, for instance, is planning to add 355 miles of pipeline over the next few years to accommodate new LNG imports, almost all of which will be high-capacity pipe, with diameters of 39 inches or greater.

Also, in Germany, where hydrogen has been transported – as is the case with most E.U. states – almost exclusively as compressed gas in special pressure containers on trucks – a major step has been taken toward having an efficient H2 infrastructure system in place by 2032.

The gas industry Association of Transmission System Operators has told Pipeline & Gas Journal that the German Gas TSOs recently published a draft for the German Hydrogen Core Network, which would include about 6,025 miles (or 9,700 km) of pipelines.

This would entail 60% of these pipelines being newly built, while 40% pipelines will be repurposed gas pipelines.

The majority of Phase 1 of the Hydrogen Backbone, with significant portions located in France, Germany, Belgium and Austria, is expected to begin operations between 2026 and 2030, with future expansions planned. Many hydrogen pipelines are also being built as part of hydrogen clusters across the continent.

In Italy, the company that manages the Italian gas pipeline network, SNAM, has announced plans to add more than 265 miles (425 km) of new hydrogen ready pipelines to its system.

The first phase of work (approved for REPowerEU funds) is scheduled to be completed by 2026. It will increase daily transportation capacity from 4.44 Bcf/d (126 MMcm/d) to 4.63 Bcf/d (131 MMcm/d).

The second phase will be completed by 2027 and will increase daily transport capacity another 12.7% to 5.3 Bcf/d (150 MMcm/d).

Europe Expectations: Several critical oil and gas pipeline projects are set to begin or complete construction in Europe during the period from 2025 to 2027.

Cyprus is looking to start production from offshore gas fields, potentially in 2026 or 2027. The plans could include pipelines connecting to a proposed LNG terminal in Greece. The development of these resources is crucial for enhancing the gas supply in Europe in the coming years.

Also, Algeria, along with Italy’s Eni, have agreed to increase its gas exports significantly and focus on developing new gas fields, aiming to raise its contributions to the European market via pipelines. Algeria would like to export 20 Bcm annually by 2030.

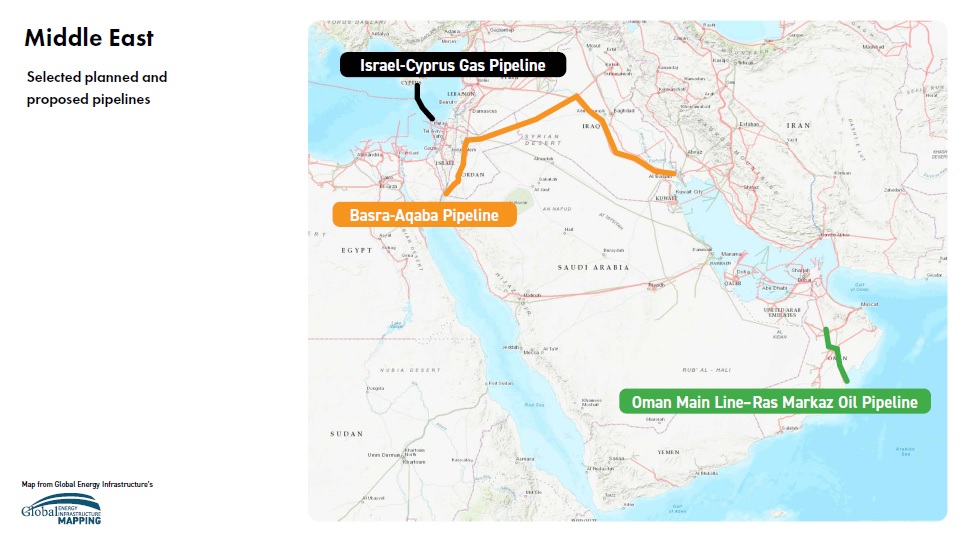

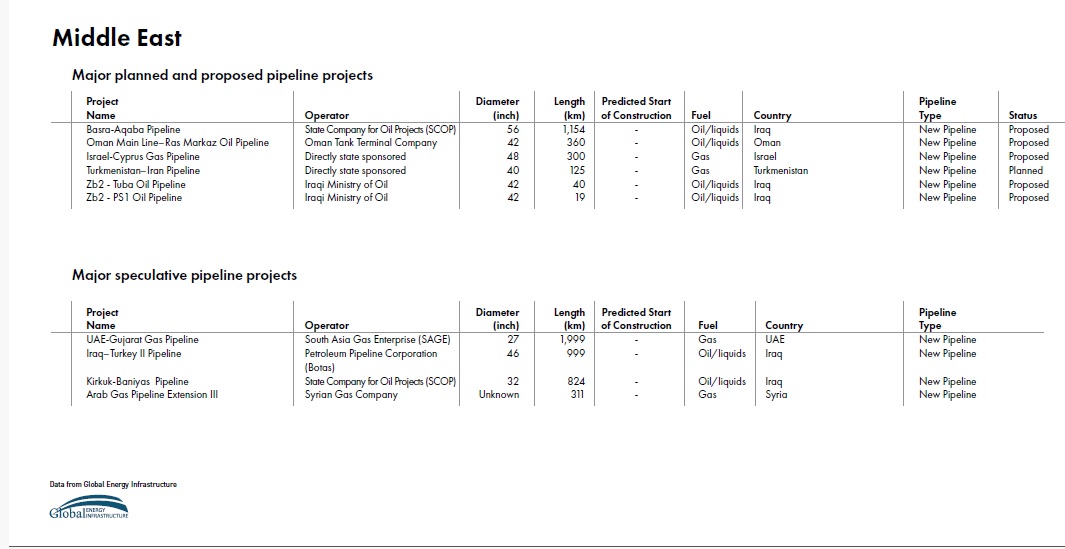

Middle East

MIDDLE EAST

Pipeline Miles Under Construction: 1,211

Pipeline Miles Planned: 6,117

Total: 7,388

In the Middle East, most new pipelines will be shorter and will connect new fields across the region to existing pipeline networks with little in the way of major transmission pipelines that are in development for either oil, refined products or gas.

In 2022, the Iraqi Cabinet approved the framework agreement for the long-studied Basra-Aqaba Oil Pipeline. Last year, the ministry noted that the cost should be brought under $9 billion for the project to go ahead. However, there have been reports that the project is taking longer than expected and has stalled as Iran tries to block its construction.

The pipeline would carry crude oil to the Jordan Petroleum Refinery Company’s plant in Zarqa to meet Jordan’s needs and to the Aqaba Port for export purposes. The first phase of the project would be constructed in Iraq, across a 435-mile (700-km) stretch between Rumaila and Haditha.

Separately, Kazakhstan has begun construction on a new gas pipeline to supply natural gas to more than 124,000 people in 66 settlements in 2026. The 188-mile (302-km) Taldykorgan-Usharal in the Zhetisu region will have the capacity to deliver 385 MMcf/a of gas, according to the Prime Minister’s office.

The project includes six pipeline branches and automatic gas distribution stations and will be part of the Almaty-Taldykorgan main gas pipeline system.

Middle East Abu Dhabi National Oil Company (ADNOC) has two pipelines planned to start up in 2025.

The first, the 53-mile (85-km), 34-inch Lower Zakum-to-Das Island offshore pipeline, has an estimated capacity of 270 MMcf/d, while the second, the 34-mile (56-km), 24-inch Arzahah-Zirku Island pipeline, has a 600 MMcf/d capacity, according to Gulf Energy Infrastructure data.

The geopolitical situation in the region can affect project timelines and feasibility. For instance, the Basra-Aqaba Oil Pipeline has reportedly faced delays due to potential opposition from Iran. Therefore, while these projects are significant, their exact completion dates may be subject to change.

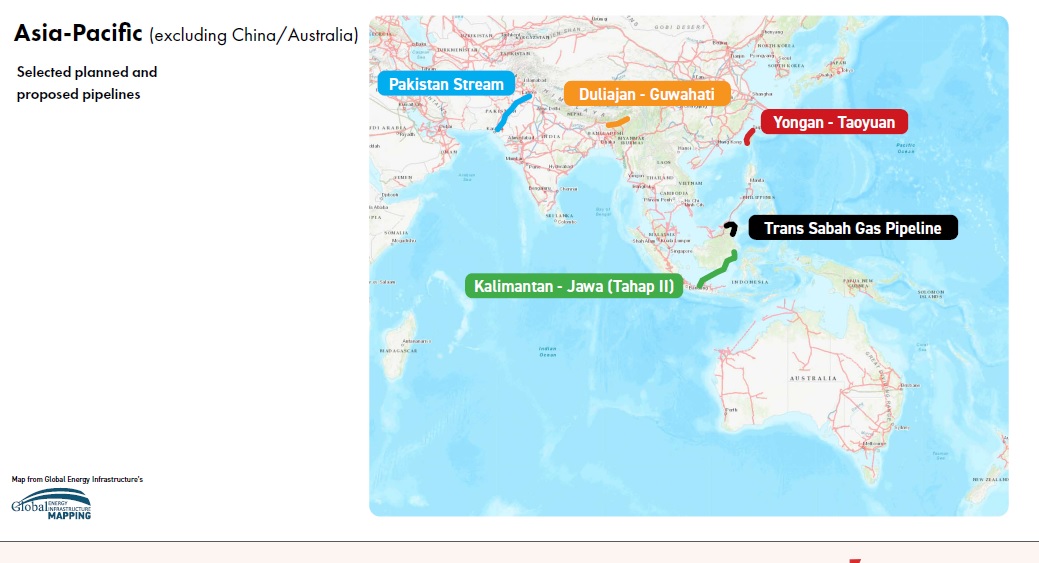

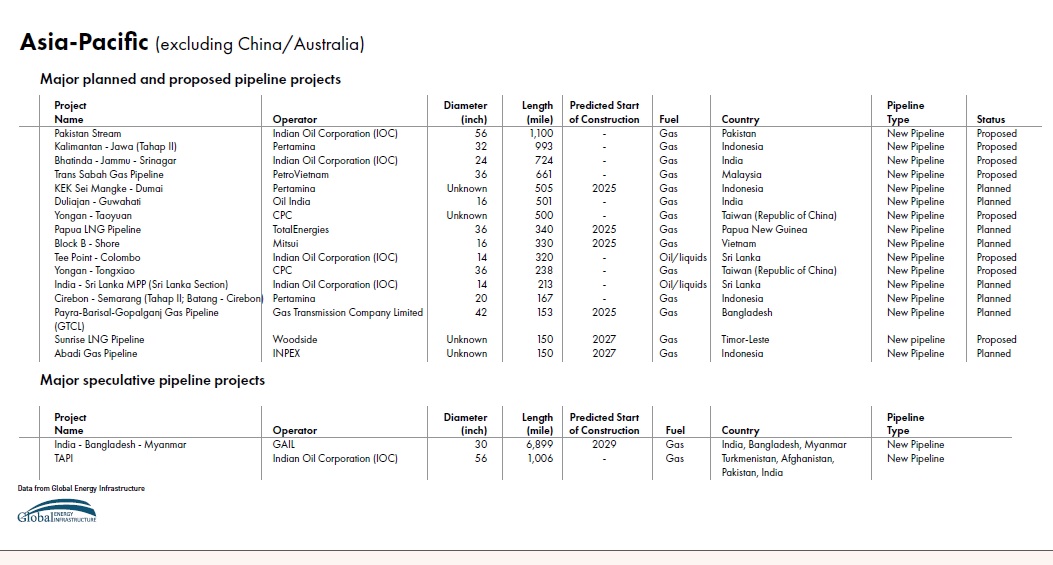

Asia Pacific

ASIA PACIFIC

Pipeline Miles Under Construction: 13,970

Pipeline Miles Planned: 22,287

Total: 36,257

The region continues to be the place with most new pipeline activity, due in large part to the fast-growing infrastructure of the world’s two largest countries, China and India.

Globally, pipeline development in the two countries continues to drive growth, accounting for about a quarter of the planned and under-construction projects, according to Pipeline & Gas Journal’s annual Construction Report.

We project that the Asia Pacific is expected to lead in pipeline project starts between 2023 and 2027, with 402 projects, accounting for 31% of global upcoming midstream oil and gas project start-ups.

However, some projects continue to face delays due primarily to permissions and geopolitical hurdles.

India

India continues to see tremendous pipeline build-out, with GDP expected to grow between 6% and 7% during the next 12 months. India’s government is optimistic that gas will reach a 15% share of the energy mix by 2030, up from about 6% in 2022.

To that end, pipelines are also increasingly reaching out from the coasts to central India.

However, some projects in India are being plagued by delays. GAIL’s Mumbai-Jharsuguda Pipeline has been a case in point. The project planners had hoped to avoid delays by choosing a route adjacent to a government highway, thereby removing the need to obtain permission to build from private landowners but are at least a year of schedule.

Last year, GAIL claimed the 451-mile Mumbai-to-Nagpur section was about 80% complete, with GAIL citing technical issues for the delay. The 874-mile, 32-inch pipeline would deliver 580 MMcf/d of gas to new markets in central India.

Problems aside, India’s pipeline expansion remains exceptional. Construction on IGGL’s North East Gas Grid continues, and the pipeline system is expected to be fully commissioned in 2025.

Russia

The prospects for new pipelines in Russia between 2025 and 2029 are mixed, with several major projects facing challenges and uncertainties.

The 50 bcm/a Power of Siberia 2 pipeline to China has faced challenges, including a breakdown in negotiations with China due to disagreements over pricing and volume commitments.

Additionally, China is said to be demanding prices close to Russia’s subsidized domestic rates and has only been willing to commit to a small fraction of the planned capacity. If built, the pipeline could potentially reach 15 Bcm/y by 2030, increasing volume to 50 Bcm/y by 2035.

Western sanctions have affected Russia’s access to technology, and global tensions, along with shifting energy markets have further affected financing and planning.

Asia Pacific Expectations: While it is difficult ascertain certain aspects of some projects in the reason, the following appear to be in good standing:

- China’s Xinjiang-Guangdong-Zhejiang SNG Pipeline is an onshore gas pipeline project. It is as 5,575-mile (8,972-km) project, and operator SNG Transmission Pipeline Co Ltd expects it to start operations in 2026, when it will begin transporting gas from western China to demand centers in the east.

- Northeast Gas Grid in India is expected to be ready in 2025 after undergoing some delays. Developer Indradhanush Gas Grid Limited (IGGL) is looking to expand gas infrastructure in India’s northeast region.

- Also in India, the Mumbai-Nagpur-Jharsuguda Pipeline, originally expected to be completed in 2023 is currently delayed until 2025. It was designed to expand gas infrastructure in central India.

Australia

In Australia, Santos’ Hunter Gas Pipeline (HGP) is planned a 261-mile (420-km) pipeline from the Wallumbilla Gas Hub in Central Queensland to Newcastle, North West Shelf (NSW), where it will interconnect with the Eastern Gas Pipeline.

Originally expected to go online in 2025, the pipeline is being reassessed due to Santos’ decision not to make a final investment decision on the Narrabri gas project until next year.

A 37-mile (60-km) lateral pipeline would also connect to the HGP, bringing gas from the Narrabri gas processing facility at Leewood to HGP.

Separately, the Crux-Concerto Pipeline is part of a project to develop the Crux gas field. It would bring gas to the Shell-operated Prelude FLNG to access the vessel’s spare liquefaction capacity. It is targeted to go online in 2027.

Expectations: Several significant oil and gas pipeline projects in Australia are expected to begin or complete construction between 2025 and 2027. These projects are integral to addressing energy demands and enhancing supply security within the country.

Surat Gas Project, Phase 2, developed by Arrow Energy, a joint venture between Shell and PetroChina, is entering its second phase, which is set to begin construction soon. The new construction will include a 17-mile (27-km) pipeline, up to 450 new gas production wells and a field compression station. First gas from is expected in 2026, with a peak production target of 130 MMscf/d.

Woodside Energy’s Scarborough Energy Project involves the development of the Scarborough natural gas field and will consist of a 267-mile (430-km) subsea pipeline measuring approximately, connecting to the Pluto LNG facility. This project is expected to yield production in 2026.

Also, Browse LNG Project, entered it feasibility stage with the hope of beginning production in 2028. The project includes distribution pipelines and involves several gas fields in the Browse Basin.

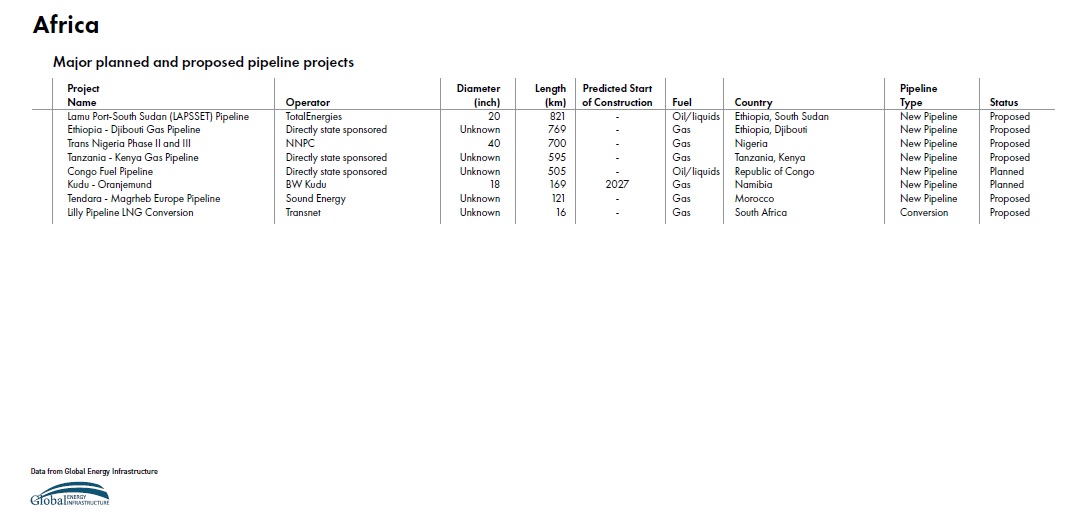

Africa

AFRICA

Pipeline Miles Under Construction: 2,967

Pipeline Miles Planned: 13,366

Total: 16,333

Africa was a quiet region for actual pipeline construction again in 2024. Within the continent, major projects continue to languish in the early stages of planning, with relatively few projects entering the construction stage or having begun operations.

However, in Uganda, Tilenga and Kingfisher petroleum projects – as well as a pipeline to carry oil to Tanzania for export – are on track for first production by 2025, according to Uganda National Oil’s chief executive.

The 898-mile (1,445-km) East African Crude Oil Pipeline (EACOP), which will transport crude from Tilenga and Kingfisher, is scheduled to come online in 2025.

EACOP is co-owned by the government of Uganda, France’s TotalEnergies, China’s CNOOC and Tanzania’s Tanzania Petroleum Development Corp (TPDC).

Another project of note involves the renewed negotiations between Kenya and Uganda on possibly revival of the stalled refined oil pipeline extension project from Eldoret in western Kenya to Uganda’s capital Kampala, where a new dedicated terminal receipt facility is be constructed.

The proposed 12-inch, 217-mile (350-km) oil products pipeline was conceived in 1995 under the Joint Co-Ordinating Commission and was set up through a MOI between the two countries. The project would allow an extension of the network from Kampala to Rwanda’s capital Kigali, covering an additional 275 miles (434 km).

Africa Expectations: Several significant oil and gas pipeline projects are expected to begin or complete construction in Africa between 2025 and 2027.

Nigeria is going forward with plans for increased LNG exports to Europe, with two new LNG export terminals under development, each with a combined capacity of 10 Bcm/a, expected to start operating in 2027.

Additionally, Nigeria is trying to “fast-track” the construction of a 3,480-mile (5,600-km) offshore gas pipeline to Morocco and Spain, which may complement European supply needs, although this project is not expected to be completed until 2046.

A big potential pipeline project would be the Nigeria-Morocco Gas Pipeline (Atlantic African Gas Pipeline), which is expected to receive a final investment decision early in 2025.

The project would have a capacity of 30 Bcm/a and connect Nigeria to Morocco, passing through 13 West African countries en route to exporting Nigerian gas to Europe via Spain. Completion is expected to take place over 25 years in phases, with initial construction likely to begin in 2025 if it has financial backing.

More speculative, the Tazama Pipeline, a 1,062 pipeline (1,710 km) oil conduit between Tanzania and Zambia has a target operational date of 2027 to start construction, but that would be dependent on a recently commissioned feasibility study. If completed it will transport crude oil from Tanzania’s Port of Dar es Salaam to Zambia’s Indeni Petroleum Refinery in Ndola.

Comments