Paris Climate Talks Point to Boon for Energy Storage

As the world leaders come together in Paris to tackle the hot issue of climate change, there is one market that not only remains crucial for growth of renewable energy sources; but also remains the most talked about market in the global investment circles: the energy storage market.

Energy storage is steadily turning out to be one of the hottest markets in the energy sector. We are witnessing several exciting new developments in this field related to utilities, transportation and the military sector. The U.S. market continues to be the largest energy storage market. As the latest report from IHS re-affirmed that the U.S., along with Japan and South Korea, will prove to be the driving forces behind the developing energy storage sector

Leading Investors

According to the IHS report, the U.S., South Korea and Japan would be easily exceeding 100 MW of annual installations between 2015 and 2016. The report suggests that these three countries might contribute almost 59% percent of the total global energy storage installations in 2016. The U.S. could install 650 MW followed by 510 MW of energy storage in Japan and 280 MW by South Korea.

“Demand for energy storage in South Korea is driven predominantly by [state-owned utility] KEPCO’s frequency regulation program, which will procure 500 MW of batteries for frequency regulation over the next four years,” said Sam Wilkinson of IHS.

The IHS report said the cost of Lithium Ion Batteries have fallen by as much as 53% between 2012 and 2015. However, energy storage costs will fall even further as Tesla’s upcoming Gigafactory is expected to reduce the production costs of Lithium Ion batteries by an additional 30%. In fact, Tesla’s Elon Musk claims that with close to 1.9 million square feet of space, the upcoming Gigafactory would “blow everyone’s mind.”

It is interesting to note that there is a significant amount of Japanese investment in Tesla’s Gigafactory. Panasonic, the biggest global supplier of Lithium Ion batteries, has invested close to $2 billion in the Gigafactory. Even South Korea is looking at the U.S. market as LG Chem (a fierce competitor of Panasonic) has teamed up with Tesla, supplying batteries for its Roadster model.

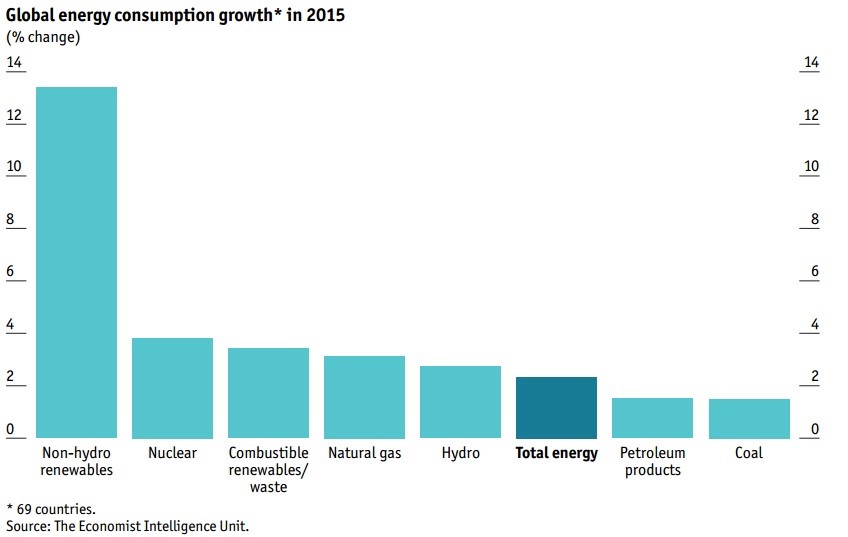

Effect on Renewables’ Share

The performance of the energy storage market has a direct effect on the renewable’s share of the total energy mix. Most renewable energy sources suffer from intermittency issues and a proper energy storage system can solve the problem of intermittent power generation.

The IHS report said the cost of 10-MW battery storage systems would fall to about $5 million by 2019 from $11 million in 2013.

“For a typical 30-minute duration utility-scale li-ion system, more than 60% of the total reduction in system costs between 2013 and 2019 will come from the balance-of-plant equipment, rather than from batteries alone,” said the report.

With falling energy storage costs, renewable energy generation could become much more attractive and cost effective soon.

Climate Conference as Foundation

One of the important goals of the Paris climate change summit is to bring down the cost of renewable energy and to make this happen, 28 global business leaders like Bill Gates, Mark Zuckerberg, Jack Ma and political leaders like Barack Obama, Francis Hollande and others came together to launch a joint initiative to help promote global use of renewable energy sources through a public-private project backed by the governments and a ‘’Breakthrough Energy Coalition.”

In fact, the world’s leading energy stakeholders such as the United States, China, Saudi Arabia, India, Australia, France, Canada and Norway are likely to pledge to almost double their investments in clean energy sources in the next five years.

“We’ll work to mobilize support to help the most vulnerable countries expand clean energy and adapt to the effects of climate change we can no longer avoid,” said President Barack Obama on his official Facebook page.

For now, it is unclear how significant and how quickly the investments will translate into concrete advancements and innovations, but one thing is clear: the cost of energy storage will steadily decline.

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- Tallgrass to Build New Permian-to-Rockies Pipeline, Targets 2028 Startup with 2.4 Bcf Capacity

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- A Systematic Approach To Ensuring Pipeline Integrity

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- LNG Canada Start-Up Fails to Lift Gas Prices Amid Supply Glut

- TC Energy’s North Baja Pipeline Expansion Brings Mexico Closer to LNG Exports

Comments