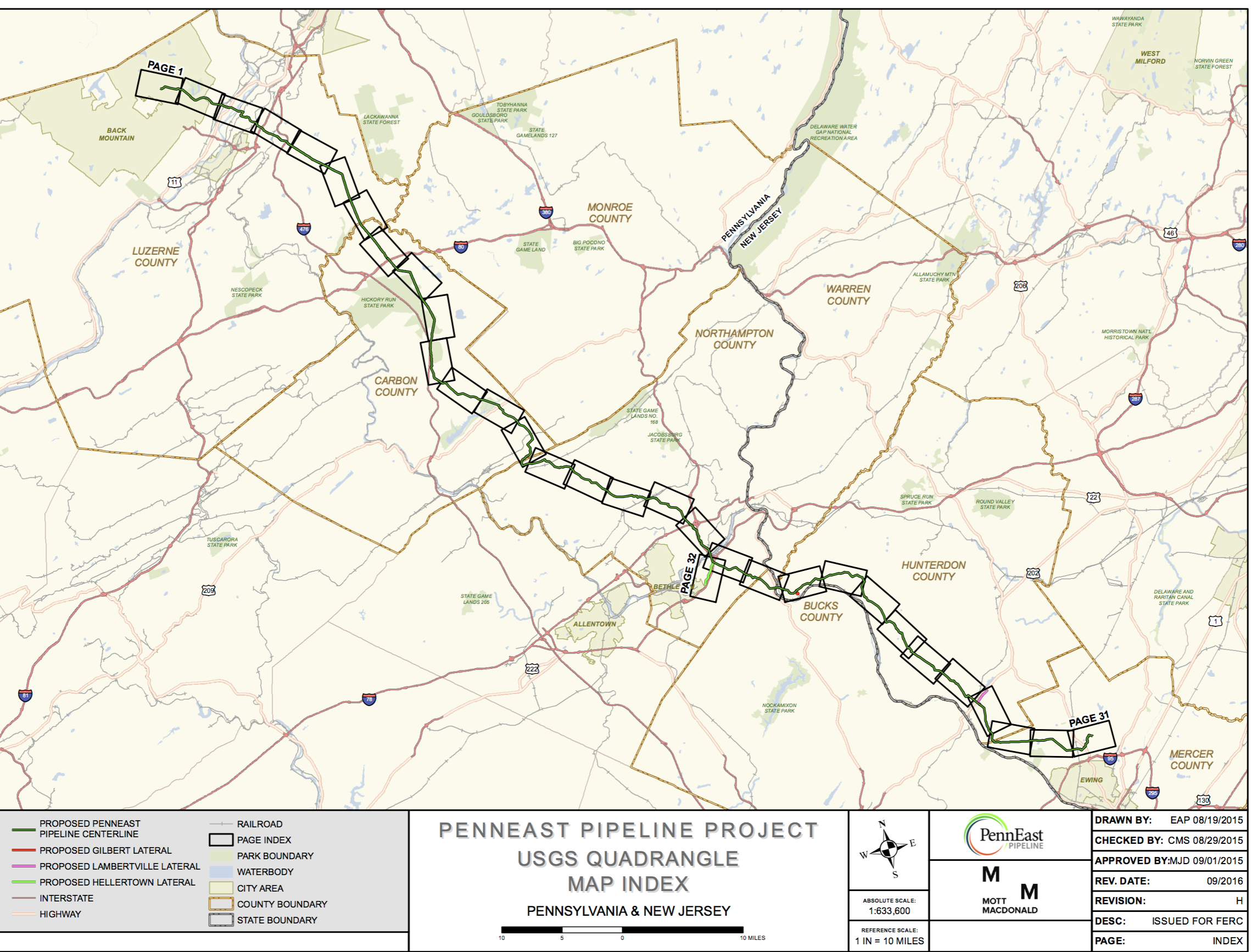

PennEast Files with FERC for 26 Route Modifications in Pennsylvania

PennEast Pipeline Company has filed with the Federal Energy Regulatory Commission (FERC) 26 route deviations in Pennsylvania.

Examples include:

• In Luzerne County, PennEast, in conjunction with landowner consultation, is altering the Pipeline’s current route and relocating the proposed Auburn/Leidy/Transco Meter Station. The proposed Pipeline will now be co-located with a Williams-Transco pipeline, and the meter station will now be co-located with an existing UGI Utilities meter station.

• Also in Luzerne County, PennEast is working with what is known locally as Popple Quarry to re-route the Pipeline to avoid active quarry operations. The proposed location will co-locate the proposed Pipeline with a Pennsylvania Power & Light (PP&L) easement within the existing asphalt operation. This location will minimize impacts related to quarry operations as it will be outside the minimum distance Pennsylvania regulations require for the quarry operator to take special precautionary measures. It also will be well outside the range PennEast’s technical experts deem necessary to avoid adverse impacts on the Pipeline by quarry activities.

• Owners of the Blue Mountain Ski Resort in Carbon County are working with PennEast to align the Pipeline’s path with a different ski slope than the one originally designated. This deviation avoids a hang gliding area and further avoids existing underground infrastructure – without increasing the potential for adverse environmental impact – while still directly benefitting a local employer.

• In consultation with the Pennsylvania Game Commission, in Carbon and Northampton counties, PennEast modified the crossing location of the Appalachian Scenic Trail to accommodate a trenchless crossing of the trail and the implied 400-foot buffer area surrounding the trail to avoid impacts to the trail’s scenic viewshed.

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- Tallgrass to Build New Permian-to-Rockies Pipeline, Targets 2028 Startup with 2.4 Bcf Capacity

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- A Systematic Approach To Ensuring Pipeline Integrity

- US Poised to Become Net Exporter of Crude Oil in 2023

- EIG’s MidOcean Energy Acquires 20% Stake in Peru LNG, Including 254-Mile Pipeline

- Enbridge Sells $511 Million Stake in Westcoast Pipeline to Indigenous Alliance

Comments