Can The Gas Glut Kill The Permian Boom?

The Permian basin continues to add new oil production, but shale drillers in West Texas could face an unexpected problem: too much natural gas.

Natural gas is produced as a byproduct when drilling for oil. Oil tends to be more lucrative, so shale companies typically target oil in places like the Permian, and the gas is considered an added benefit. However, the Wall Street Journal reports that shale drillers in the Permian are struggling with too much gas and not enough places to put it.

The gas pipelines from the West Texas shale fields are at capacity. To the north, the market is saturated with gas from the Rockies and Canada, the WSJ says. And while there are several natural gas pipelines under construction that would carry gas from Texas to Mexico, those projects are not yet online. One key pipeline, the Gulf Coast Express, won’t come online until 2019, and several other projects have similar timelines.

While Permian producers really want to continue to ramp up oil production, they are extracting more gas than they know what to do with. The result is plunging spot prices for gas. According to the WSJ, the Waha trading hub in West Texas has gas selling for 57 cents/MMBtu below Henry Hub prices. With Henry Hub at roughly $3/MMBtu, that puts West Texas gas at something like $2.50/MMBtu.

But gas output is expected to continue to climb. With no space left on any pipelines, prices will continue to crater. Analysts, according to the WSJ, see gas prices in the region dropping further, potentially trading for a $1/MMBtu discount relative to Henry Hub.

Cheap gas is great news for Texas utilities that burn natural gas for their electricity. Natural gas accounts for more than half of the state’s electricity, so the surplus of gas will prevent electricity prices from rising. The WSJ reports that Vistra Energy spent $350 million to acquire a gas plant in Odessa, TX, with an eye on cheap gas. Vistra was the same utility (through its subsidiary Luminant) that announced in October that it would shutter three large coal-fired power plants, with a combined capacity of 4.1 GW. The utility said the coal plants no longer made sense with cheap gas and increasingly cheap wind energy.

But while cheap gas is great news for consumers, it is terrible news for producers, and not just because of low prices. The more serious problem for Texas shale drillers is that the glut of gas could force them to throttle back on output, potentially forcing them to cap wells and slowdown on drilling new wells. That could put a serious dent, or at least cut into the growth rate, of oil production in the Permian.

“We’re headed into a situation that’s never happened before,” Rusty Braziel, head of consultant RBN Energy LLC, told the WSJ. “They’re making money on crude. They need to make sure the lack of gas takeaway capacity doesn’t affect their crude production.”

The WSJ cited Centennial Resource Development, a producer that paid a premium to secure guarantees from pipeline companies that its gas would find space in their pipelines. Centennial saw its gathering and transportation costs jump by 14 percent in the third quarter, mostly because it wanted to lock in that guarantee, which it said was “a prudent measure to ensure that our gas gets to market so that oil production can proceed unabated.”

But not everyone will be able to get their gas on board a pipeline. “If Mexican pipelines are not on by the end of next year, we could even see shut ins and flaring,” Sanford C. Bernstein & Co. analysts said in a recent report.

The gas glut is the latest hurdle for Permian drillers that have run into other bumps this year. The rising midstream costs come as shale drillers are also paying more for oilfield services—fracking crews, rigs, labor, etc. At the same time, some Permian wells are actually producing a higher gas-to-oil ratio than expected—another negative sign. Pioneer Natural Resources saw its share price plunge this past summer when it told investors that its gas-to-oil ratio rose higher than expected.

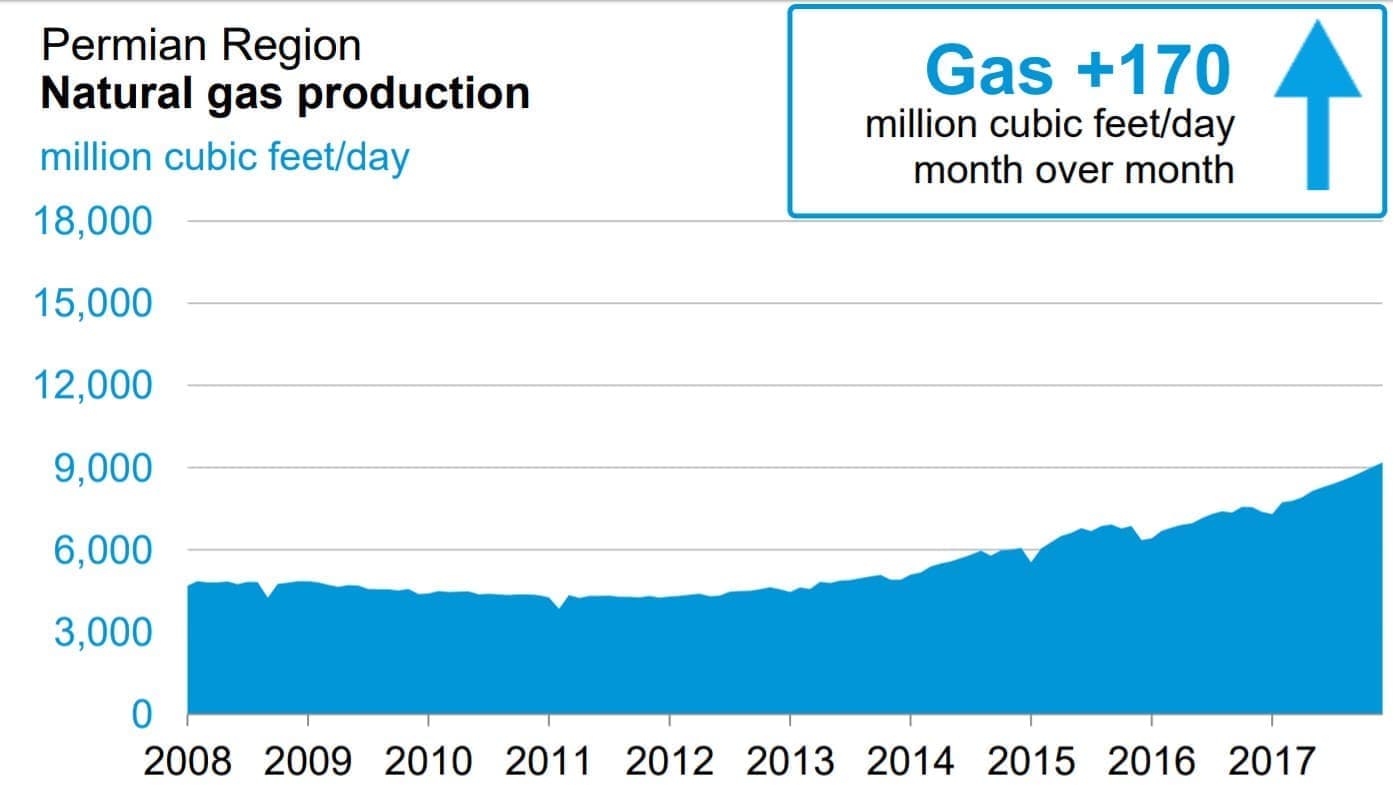

For now, Permian oil production continues to rise. In its November Drilling Productivity Report, the EIA estimated that Permian oil output would jump by 58,000 bpd in December, while its gas production would rise by 170 mcf/d. In that sense, the coming slowdown in the Permian has yet to materialize in the data, but as the WSJ notes, the obstacles are starting to pile up for Texas shale drillers.

Related News

Related News

- Trump Aims to Revive 1,200-Mile Keystone XL Pipeline Despite Major Challenges

- Valero Considers All Options, Including Sale, for California Refineries Amid Regulatory Pressure

- ConocoPhillips Eyes Sale of $1 Billion Permian Assets Amid Marathon Acquisition

- ONEOK Agrees to Sell Interstate Gas Pipelines to DT Midstream for $1.2 Billion

- Energy Transfer Reaches FID on $2.7 Billion, 2.2 Bcf/d Permian Pipeline

- U.S. LNG Export Growth Faces Uncertainty as Trump’s Tariff Proposal Looms, Analysts Say

- Tullow Oil on Track to Deliver $600 Million Free Cash Flow Over Next 2 Years

- Energy Transfer Reaches FID on $2.7 Billion, 2.2 Bcf/d Permian Pipeline

- GOP Lawmakers Slam New York for Blocking $500 Million Pipeline Project

- Texas Oil Company Challenges $250 Million Insurance Collateral Demand for Pipeline, Offshore Operations

Comments