Permian to Need More Crude Takeaway Capacity After Brief Overbuild: WoodMac

7/8/2019

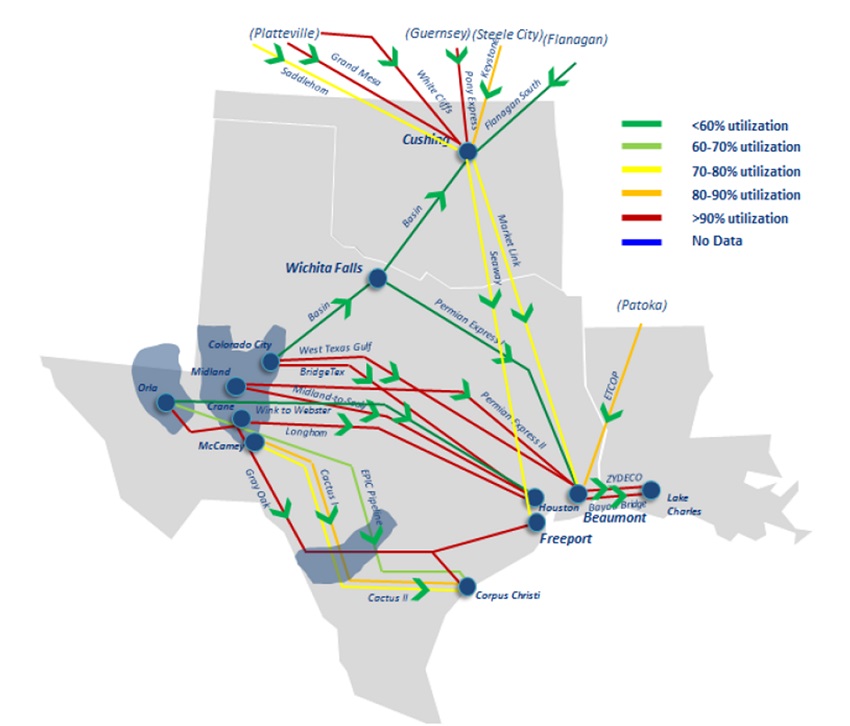

2021: Broad Permian long-haul utilization troughs with massive buildout largely in place. (source: Wood Mackenzie)

HOUSTON (P&GJ) – Planned crude oil pipeline projects may result in a "moderate overbuild" of Permian Basin crude oil capacity in the early 2020s, but Wood Mackenzie analysts project this period of overcapacity will be fairly short-lived before even more capacity is needed.

“We are in the midst of one of the largest crude infrastructure investment booms in US history, with much of the investment focused on the Permian basin," said John Coleman, Wood Mackenzie's principal analyst for North America crude markets.

“As massive as this current investment wave is, we don't think the story is yet finished," he added,"More capacity additions will be needed again by the end of the next decade."

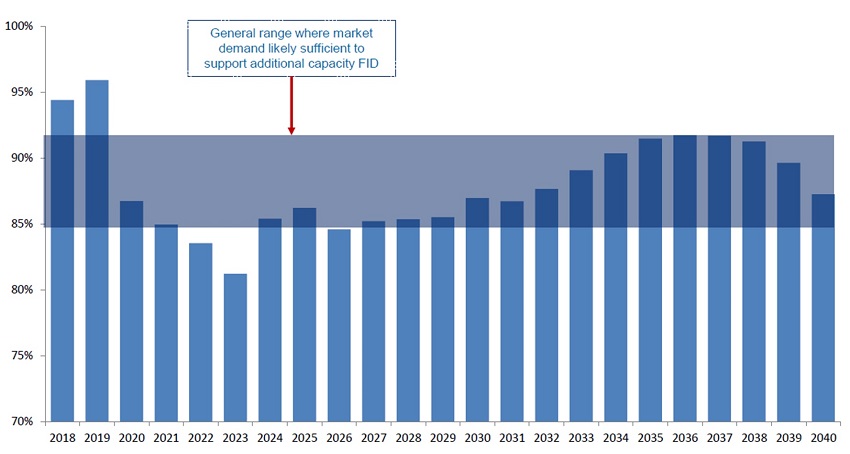

The latest Wood Mackenzie North America Crude Markets Service long-term outlook shows that even with the rapid buildout in the early 2020s, there will be one more call for additional Permian-to-Gulf Coast pipeline capacity. The analysis indicates at least 300,000-500,000 bpd of crude takeaway capacity will be needed. Based on forecast market demand, an FID on the next needed pipeline may come in the late 2020s, WoodMac said.

"The early 2020s will see a massive build-out in a short period of time – we estimate more than 3.5 million b/d of Permian-to-Gulf Coast crude takeaway capacity by the end of 2022, effectively doubling long-haul capacity from the basin. This burst of buildout will likely lead to overcapacity short term," according to the report.

A current wave of investment includes seven proposals for new Permian pipelines, with four ultimately reaching a final investment decision (FID). More than 2 million bpd of this new capacity will flow into the Corpus Christi market for export.

The rapid addition of pipeline capacity will result in two to three years of overbuild, before normal long-haul capacity supply and demand conditions begin to re-emerge, Wood Mackenzie found.

Analysts cited three key drivers:

1. Resilient Permian oil production into the 2030s

2. New pipeline capacity to fill up on export routes between 2021 and the mid-2030s

3. Long-haul capacity will need a slight boost in the early 2030s.

“As production growth expands well into the 2030s, U.S. Gulf Coast-bound pipeline capacity will tighten," Coleman said. "By the mid-2030s, Permian-to-Gulf Coast pipeline utilization will surpass 92% in the absence of further investment, necessitating pipeline expansions or greenfield capacity.”

“The next chapter in this story will be focused on ensuring sufficient export terminal capacity in coastal markets. As these new pipelines move into service later this year, we expect a surge in crude export volumes out of Corpus Christi.”

Related News

Related News

Sign up to Receive Our Newsletter

- Energy Transfer to Build $5.3 Billion Permian Gas Pipeline to Supply Southwest

- Enbridge Sees High Demand to Expand 593-Mile Canada-to-U.S. Gulf Oil Pipeline

- Strike Pioneers First-of-Its-Kind Pipe-in-Pipe Installation on Gulf Coast with Enbridge

- 208-Mile Mississippi-to-Alabama Gas Pipeline Moves Into FERC Review

- Chesapeake, AEP to Build $10 Million Ohio Gas Pipeline for Data-Center Power

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- Enbridge Sees High Demand to Expand 593-Mile Canada-to-U.S. Gulf Oil Pipeline

- LNG Canada Start-Up Fails to Lift Gas Prices Amid Supply Glut

- Strike Pioneers First-of-Its-Kind Pipe-in-Pipe Installation on Gulf Coast with Enbridge

- Trump Claims Japan, U.S. to Form Joint Venture for Alaska LNG Exports

Pipeline Project Spotlight

Owner:

East African Crude Oil Pipeline Company

Project:

East African Crude Oil Pipeline (EACOP)

Type:

TotalEnergies in discussions with a Chinese company after Russian supplier Chelpipe was hit by sanctions.

Length:

902 miles (1,443 km)

Capacity:

200,000 b/d

Start:

2022

Completion:

2025

Comments