Tellurian Finds Strong Demand for Permian Global Access Project

HOUSTON (P&GJ) — An open season for Tellurian's Permian Global Access Pipeline (PGAP) drew strong demand from West Texas natural gas producers seeking delivery to the rapidly growing natural gas market in Southeast Louisiana.

Tellurian senior vice president Joi Lecznar confirmed that the open season, which closed May 24, was oversubscribed.

"We had more indications of interest than the pipeline capacity," Lecznar said. "We are currently working with the prospective shippers on agreements."

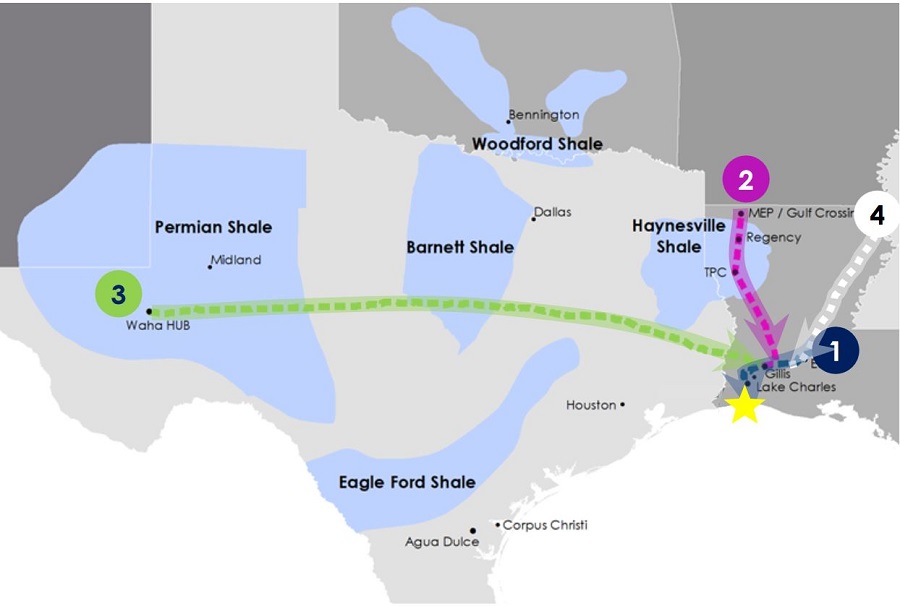

The $3.7 billion PGAP is a proposed 625-mile, 42-inch interstate natural gas pipeline originating at the Waha Hub in Pecos County, Texas, and terminating at Gillis, Louisiana, north of Lake Charles, Louisiana. Construction could begin as early as 2021, and the project could begin service as early as 2023 with a capacity of 2 Bcf/d.

PGAP is one of three proposed pipelines that would comprise the estimated $7.3 billion Tellurian Pipeline Network, which is integral to its planned $15.2 billion Driftwood LNG export project near Lake Charles.

The pipeline network also includes the proposed Haynesville Global Access Pipeline (HGAP) and the Driftwood Pipeline. HGAP would be a 200-mile, 42-inch diameter pipeline with capacity to transport 2 Bcf/d to the same interstate pipelines near Gillis. The 96-mile, 48-inch Driftwood Pipeline would provide 4 Bcf/d transport from Gillis to the Driftwood LNG facility.

Tellurian also reported success with open seasons last month for HGAP and another project, the Delhi Connector Pipeline (DCPL).

"HGAP was also fully subscribed, and Delhi had very good interest," Lecznar said. "We will continue to commercialize both projects."

DCPL, targeted for completion in early 2023, is a 180-mile, 42-inch pipeline that would provide the capacity to deliver 2 Bcf/d of natural gas to Gillis from the Perryville/Delhi Hub in Richland Parish, Louisiana.

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- Tallgrass to Build New Permian-to-Rockies Pipeline, Targets 2028 Startup with 2.4 Bcf Capacity

- TC Energy Approves $900 Million Northwoods Pipeline Expansion for U.S. Midwest

- A Systematic Approach To Ensuring Pipeline Integrity

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- Enbridge Adds Turboexpanders at Pipeline Sites to Power Data Centers in Canada, Pennsylvania

- Great Basin Gas Expansion Draws Strong Shipper Demand in Northern Nevada

- Cheniere Seeks FERC Approval to Expand Sabine Pass LNG Facility

Comments