FERC Approves Site Prep for Tellurian's Driftwood LNG Export Plant

U.S. energy regulators approved Tellurian Inc's request to start site preparation work at its proposed $27.5 billion Driftwood liquefied natural gas (LNG) export project in Louisiana.

The U.S. Federal Energy Regulatory Commission (FERC) said on Wednesday that Driftwood could start vegetation clearing and grading, demolition and removal of existing buildings, and dredging of marine berths, among other activities.

"With FERC’s approval, we are doing some preliminary work on the site," Tellurian spokeswoman Joi Lecznar said in an email on Thursday, noting "we have progressed to completing over 27% of our engineering, and we have ordered some equipment in order to prepare for construction."

Driftwood is designed to produce 27.6 million tonnes per annum (MTPA) of LNG or about 3.6 Bcf/d of natural gas. Tellurian has said it plans to start building the liquefaction plant in early 2020 and produce the first LNG from the facility in 2023.

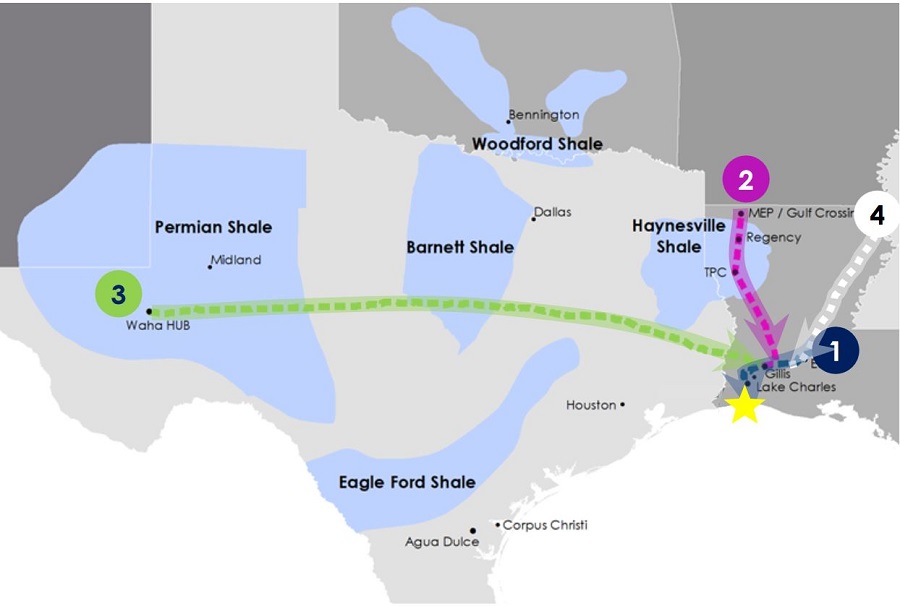

The company plans to source natural gas from the Permian Basin to Driftwood via its proposed Permian Global Access Pipeline (PGAP), Tellurian said drew strong interest during an open season from West Texas natural gas producers seeking delivery to the rapidly growing natural gas market in Southeast Louisiana.

The $3.7 billion PGAP is a proposed 625-mile, 42-inch interstate natural gas pipeline originating at the Waha Hub in Pecos County, Texas, and terminating at Gillis, Louisiana, north of Lake Charles, Louisiana. Construction could begin as early as 2021, and the project could begin service as early as 2023 with a capacity of 2 Bcf/d.

PGAP is one of three proposed pipelines that would comprise the estimated $7.3 billion Tellurian Pipeline Network, which is integral to its planned $15.2 billion Driftwood LNG export project near Lake Charles.

The pipeline network also includes the proposed Haynesville Global Access Pipeline (HGAP) and the Driftwood Pipeline. HGAP would be a 200-mile, 42-inch pipeline with capacity to transport 2 Bcf/d to the same interstate pipelines near Gillis. The 96-mile, 48-inch Driftwood Pipeline would provide 4 Bcf/d transport from Gillis to the Driftwood LNG facility.

Driftwood is one of about a dozen LNG export projects in North America that said they could decide to build their plants in 2020. Together those plants, which analysts said will not all be built, would produce over 160 MTPA of LNG.

Several of those projects, including Driftwood, had previously said they could make that final investment decision in 2019.

The U.S.-China trade war and a global oversupply of the fuel that caused gas prices in Europe and Asia to fall made it difficult for several LNG developers to sign enough long-term customer agreements this year. Those agreements are needed to secure financing for their billion dollar projects.

Total world demand for LNG reached a record 316 MTPA in 2018 and is projected to soar by around 100 MTPA by 2023, according to the U.S. Energy Information Administration.

Unlike most proposed U.S. LNG export projects that will liquefy gas for a fee, Tellurian is offering customers the opportunity to invest in a full range of services from production to pipelines and liquefaction.

- Reuters and P&GJ staff report

Related News

Related News

- Trump Aims to Revive 1,200-Mile Keystone XL Pipeline Despite Major Challenges

- Valero Considers All Options, Including Sale, for California Refineries Amid Regulatory Pressure

- ConocoPhillips Eyes Sale of $1 Billion Permian Assets Amid Marathon Acquisition

- ONEOK Agrees to Sell Interstate Gas Pipelines to DT Midstream for $1.2 Billion

- Energy Transfer Reaches FID on $2.7 Billion, 2.2 Bcf/d Permian Pipeline

- U.S. LNG Export Growth Faces Uncertainty as Trump’s Tariff Proposal Looms, Analysts Say

- Tullow Oil on Track to Deliver $600 Million Free Cash Flow Over Next 2 Years

- Energy Transfer Reaches FID on $2.7 Billion, 2.2 Bcf/d Permian Pipeline

- GOP Lawmakers Slam New York for Blocking $500 Million Pipeline Project

- Texas Oil Company Challenges $250 Million Insurance Collateral Demand for Pipeline, Offshore Operations

Comments