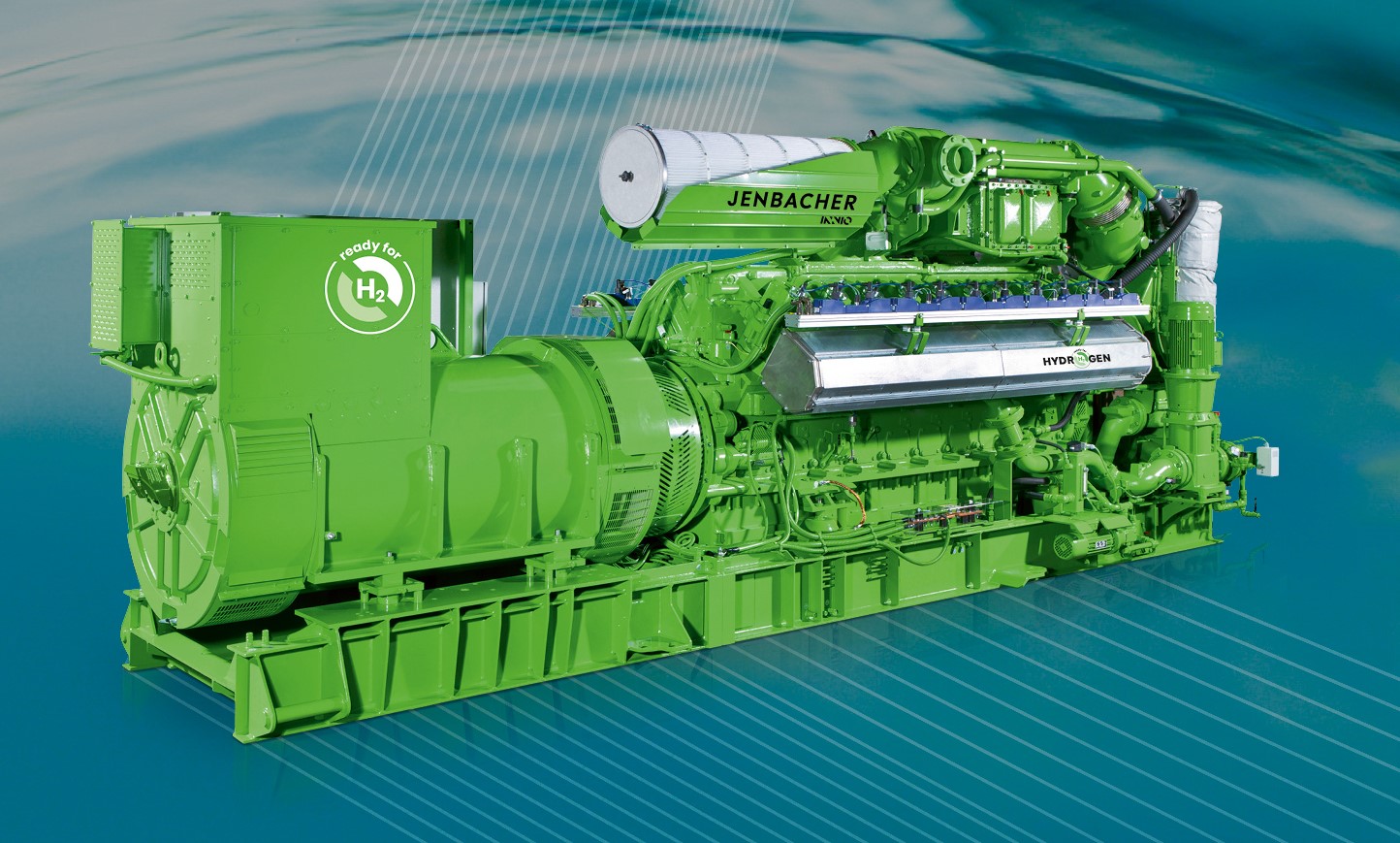

INNIO Jenbacher Launches Hydrogen-Ready Gas Engines

As a key enabler and an integral part of the energy transition, INNIO announced the launch of its “Ready for H2” portfolio that includes 100% hydrogen-fueled Jenbacher H2-engines. INNIO’s “Ready for H2” gas engine portfolio is built on a long history of innovation with more than 30 years of experience and expertise in the use of renewable fuels and hydrogen-rich fuels, such as syngas and process gases for power generation.

As of today, Jenbacher Type 4 gas engines – with an approximate output of 500 to 900 kilowatts (kW) - are available for operation with 100% hydrogen or mixtures of natural gas and hydrogen.

As of 2022, all other INNIO Jenbacher gas engines will be offered with a “Ready for H2” option, capable of running with up to 25% volume of hydrogen in pipeline gas or being converted from natural gas to 100% hydrogen operation.

In addition, most of the currently installed INNIO Jenbacher natural gas fueled fleet can be upgraded to operate with up to 25% volume of hydrogen in pipeline gas or converted from natural gas to 100% hydrogen operation.

INNIO Jenbacher gas engines are uniquely positioned to deliver hydrogen power generation.

Building on decades of experience

Twenty years ago, the first Jenbacher 150 kW pilot engine ran on 100% hydrogen at a demonstration plant in northern Germany. Two decades later, in 2020, following several additional demonstration projects, INNIO and HanseWerk Natur collaborated on the application of industrial-scale hydrogen-fueled gas engines. The companies demonstrated a flagship project using variable hydrogen-natural gas mixes including 100% hydrogen on the world’s first 1-megawatt (MW) gas engine.

“I am proud of INNIO’s announcement of the first ‘Ready for H2’ product portfolio in the 200 kW – 10.4 MW power generation space. Our broad portfolio of innovative and fuel flexible Jenbacher gas engines - capable of operating on natural gas, carbon neutral biogas or hydrogen-rich fuels – are helping to pave the way to a greener energy future,” commented Carlos Lange, president and CEO of INNIO. “Jenbacher gas engines running on natural gas today can be converted to H2 operation when hydrogen becomes more readily available. This means that customers who invest in Jenbacher natural gas engines today, are also investing for the future.”

With about 90 hydrogen-rich fuel projects across 28 countries, INNIO has more than 30 years of experience with engines running on up to 70% volume of hydrogen in the fuel, yielding more than 250 MW. These installations can be found on all continents with various INNIO Jenbacher Type 2, Type 3, Type 4 and Type 6 gas engines.

The power of hydrogen

Green hydrogen, as an energy carrier for storage of volatile renewable energy, can store renewable energy for months or seasons. This will make renewable energy sources reliable and dispatchable and support the acceleration of fossil fuel replacement across the energy sector.

INNIO is committed to leading the deployment of H2-engines which will facilitate the acceleration and transformation from fossil fuels to renewable energy sources. Typically, INNIO Jenbacher hydrogen-fueled gas engines will be operating in a combined heat and power configuration, achieving around 90% hydrogen fuel utilization.

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- Court Ruling Allows MVP’s $500 Million Southgate Pipeline Extension to Proceed

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- A Systematic Approach To Ensuring Pipeline Integrity

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- LNG Canada Start-Up Fails to Lift Gas Prices Amid Supply Glut

- Kinder Morgan Gas Volumes Climb as Power, LNG Demand Boost Pipeline Business

Comments