Global Energy Infrastructure Collects Data on 1,600+ Hydrogen Projects

By Maddy McCarty, P&GJ Digital Editor

There are more than 1,600 hydrogen projects happening globally, including some in research and concept phases and large-scale hydrogen production units, according to data tracked by Global Energy Infrastructure (GEI).

TYPES OF PROJECTS

The largest share of these projects — 49% — are considered grey hydrogen, said Peregrine Bush, senior cartographic editor for Global Energy Infrastructure, during a webcast this month. Grey hydrogen uses natural gas reforming technology with natural gas a feed source, resulting in a medium greenhouse gas (GHG) footprint, according to the presentation.

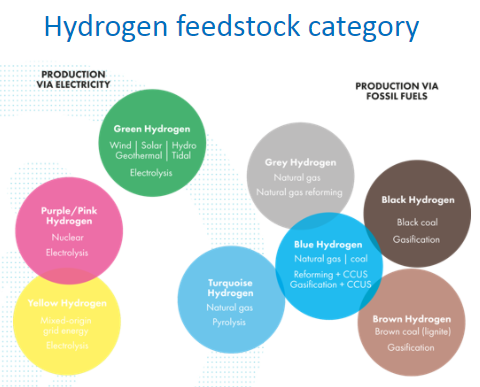

Green hydrogen, which uses electrolysis technology and wind, solar, hydro, geothermal or tidal as a feedstock or electricity source, has a minimal GHG footprint and makes up the next highest proportion of projects (25%). Blue hydrogen makes up another 14% of projects and uses natural gas reforming or carbon capture technology and natural gas or fuel as a feedstock.

The remaining percentage are a mix of different types of hydrogen projects which use electrolysis, pyrolysis and gasification technology.

GEI uses a color-coding system to show eight different types of feedstocks and their associated GHG footprints, because while hydrogen is a clean fuel that produces no emissions other than water when consumed, the processes that produce and deliver hydrogen can result in carbon emissions, Bush said.

PROJECT DATA

There are far more projects operating in the grey sector currently (89% of the documented grey projects are operating) than in the green sector, Bush said. He estimated 15 green projects are operating.

“So, you can see at the moment that within the hydrogen (sector), according to our data, that the grey hydrogen is far more mature than the green hydrogen sector,” Bush said.

Since hydrogen is “clearly an important part of the energy transition,” the GEI team has collected data on the hundred of projects for more than a year, he said. The GEI database can be searched by numerous columns of information.

“Now these columns of information include the project, data and description, the technology type, the specific processes, the products that may result from these processes, which may include hydrogen, carbon dioxide and methane, the status of the project, whether it's operating, under construction, proposed or planned, when the project has started up or if it has an expected start year,” Bush said.

The data also includes the owners and operators and their contact information where known, he said, as well as financial data and location information.

PROJECT AND INDSUTRY TRENDS

While grey hydrogen makes up the largest share of existing projects, 61% of the 200 projects added to GEI’s database in the last five months have been green hydrogen projects, said Gulf Energy Information President & CEO John Royall.

“That's the major trend in the new projects coming online,” Royall said.

It is more difficult to ascertain investment in the hydrogen project field, though, because of the number of aspirational projects or projects without solid funding, he said.

“But in looking at the market and what we have in the database, there are forecasts that the market will be anywhere from $90 billion of investment by 2030 to $500 billion dollars by 2030,” Royall said. “The EU alone has announced by that time frame 500 billion euros in clean energy investments, which include hydrogen.”

GEI’s project data and a Hydrogen Council report estimate a $300 billion figure by 2030, he said.

The largest number of projects and investments in hydrogen by far are in Europe, Royall said, followed by Asia Pacific and North America, then there are fewer in the Middle East, South America and Africa.

Of the 816 projects in Europe, 150 are in Germany and most of those are around the North Sea.

To explore more information about individual projects or project data overall, click here.

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Valero Plans to Shut California Refinery, Takes $1.1 Billion Hit

- Three Killed, Two Injured in Accident at LNG Construction Site in Texas

- Tallgrass to Build New Permian-to-Rockies Pipeline, Targets 2028 Startup with 2.4 Bcf Capacity

- TC Energy Approves $900 Million Northwoods Pipeline Expansion for U.S. Midwest

- New Alternatives for Noise Reduction in Gas Pipelines

- EIG’s MidOcean Energy Acquires 20% Stake in Peru LNG, Including 254-Mile Pipeline

- Construction Begins on Ghana's $12 Billion Petroleum Hub, But Not Without Doubts

- DOE Considers Cutting Over $1.2 Billion in Carbon Capture Project Funding

- Valero Plans to Shut California Refinery, Takes $1.1 Billion Hit

Comments