Indian Energy Company ONGC Videsh Eyes Oil, Gas 'Hot Spots' in Africa, Latin America

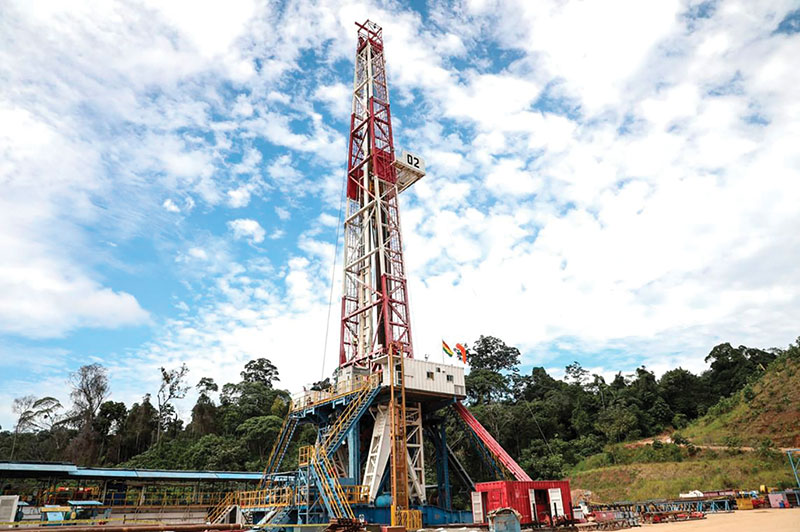

(Reuters) — ONGC Videsh (OVL) Ltd., the overseas exploration arm of India's Oil and Natural Gas Corp., is looking for exploration and production investment opportunities in Africa and Latin America, such as in Ghana and Surinam, managing director Rajarshi Gupta said.

The company already has a presence in both continents through stakes in projects in Mozambique, Brazil and Venezuela among others.

"It's better to invest in bigger hot spots where you can get larger discoveries... Africa and Latin America still hold a lot of potential. Ghana is there, Suriname is there, all of the continental shelf. Brazil is also an interesting proposition," Gupta told reporters at the India Energy Week in Bengaluru.

Some of the hydrocarbon assets in Africa and Latin America hold large volumes, he said, adding his company is also looking for assets in southeast Asia and Middle East.

OVL currently has a stake in 32 oil and gas projects in 15 countries, spanning projects in various phases, including exploration, development, production and pipelines.

OVL's crude and gas output will decline from 12.5 million tonnes in 2021/22 due to lower production in Russia's Sakhalin 1 project, in which ONGC has a stake.

Output at Sakhalin 1 collapsed after the exit of its previous operator Exxon Mobil Corp XOM.N due to Western sanctions against Russia after it invaded Ukraine in late February last year.

Gupta said current production at Sakhalin 1 is about 150,000 barrels per day and the production would rise to 200,000 bpd by June. ONGC's has a 20% stake in Sakhalin 1 project.

He said ONGC does not face any issues in raising funds and has debt of $3-4 billion compared to net worth of more than $6 billion.

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- Court Ruling Allows MVP’s $500 Million Southgate Pipeline Extension to Proceed

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- A Systematic Approach To Ensuring Pipeline Integrity

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- LNG Canada Start-Up Fails to Lift Gas Prices Amid Supply Glut

- Kinder Morgan Gas Volumes Climb as Power, LNG Demand Boost Pipeline Business

Comments