Matador Closes $600 Million Pronto Midstream Deal, Strengthens Balance Sheet

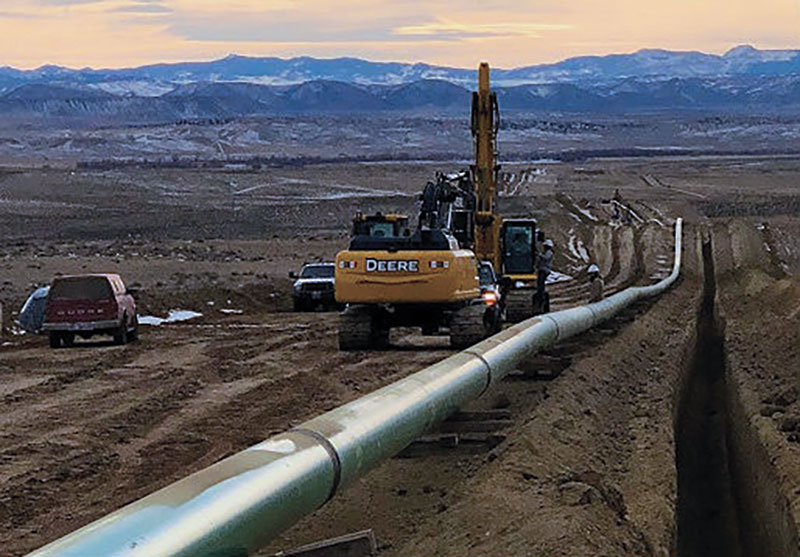

(P&GJ) — Matador Resources Company has finalized the contribution of its wholly-owned subsidiary, Pronto Midstream, LLC, to its midstream joint venture, San Mateo Midstream, LLC. The deal values Pronto at approximately $600 million and brings San Mateo's total estimated asset value to over $1.5 billion, net to Matador.

Matador received $220 million in upfront cash from the transaction, with the potential for an additional $75 million in performance incentive payments. The company plans to use the initial cash payment to reduce outstanding borrowings under its revolving credit facility, improving its leverage ratio.

“This transaction is expected to have substantial benefits for Matador and its shareholders,” said Joseph Wm. Foran, Matador’s Founder, Chairman, and CEO. He highlighted key advantages, including enhanced flow assurance, a long-term sour gas solution for northern Lea County, New Mexico, and expedited capacity growth at the Marlan Processing Plant, which could reach its designed capacity of 260 million cubic feet by 2026.

The agreement also includes a collaboration with Northwind Midstream Partners LLC, an affiliate of Five Point, to treat sour gas and deliver it back to San Mateo for processing. This partnership is expected to support Matador’s development plans and open new growth opportunities for San Mateo.

With this deal, San Mateo emerges as one of the leading natural gas processors in New Mexico, with an inlet capacity of over 700 million cubic feet once the Marlan Processing Plant expansion comes online in the first half of 2025.

Matador’s midstream business will benefit from the transaction’s scale, enabling San Mateo to pursue strategic growth and enhance its services across crude oil, natural gas, and water production streams in the northern Delaware Basin.

Foran expressed gratitude to Five Point for their partnership, noting their expertise and investment have been instrumental in San Mateo’s growth over the past seven years.

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Valero Plans to Shut California Refinery, Takes $1.1 Billion Hit

- Three Killed, Two Injured in Accident at LNG Construction Site in Texas

- Tallgrass to Build New Permian-to-Rockies Pipeline, Targets 2028 Startup with 2.4 Bcf Capacity

- TC Energy Approves $900 Million Northwoods Pipeline Expansion for U.S. Midwest

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- Enbridge Adds Turboexpanders at Pipeline Sites to Power Data Centers in Canada, Pennsylvania

- Great Basin Gas Expansion Draws Strong Shipper Demand in Northern Nevada

- Cheniere Seeks FERC Approval to Expand Sabine Pass LNG Facility

- US Poised to Become Net Exporter of Crude Oil in 2023

Comments