Permian Basin to Gain 7.3 Bcf/d in Pipeline Capacity Amid Gas Glut

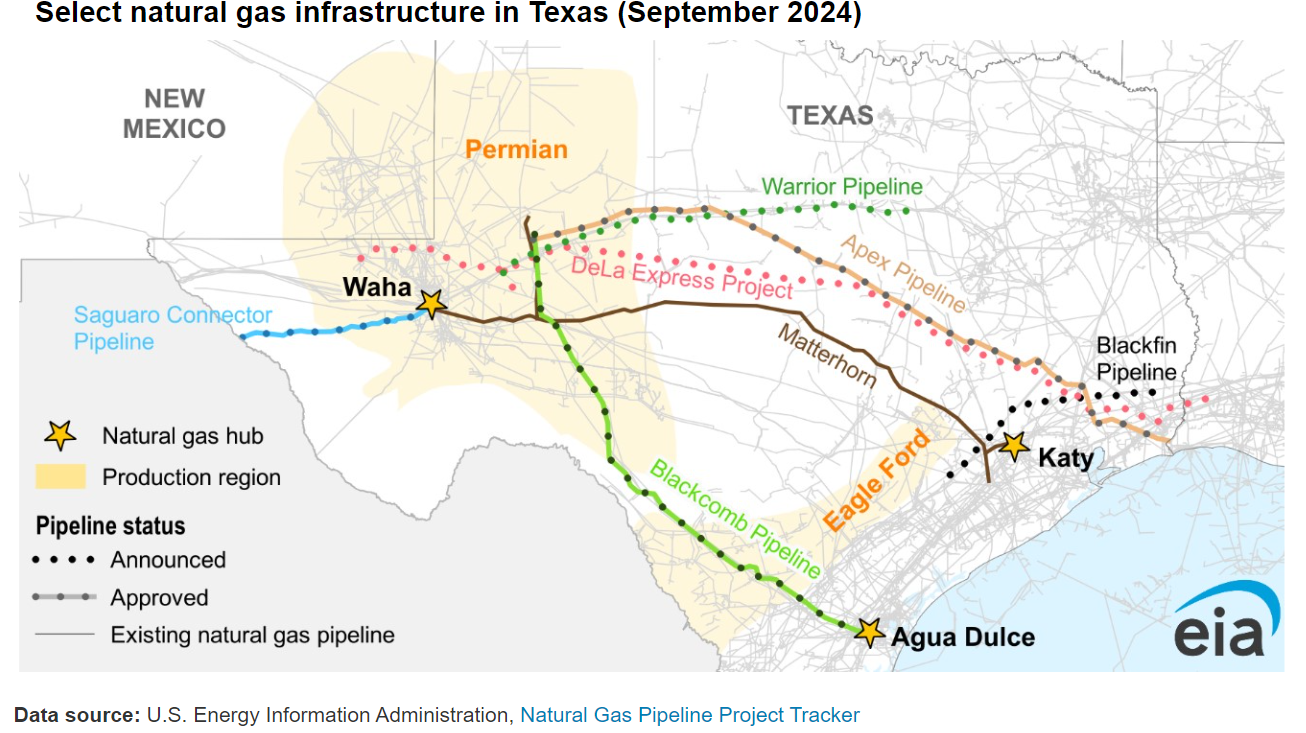

(P&GJ) — Natural gas pipeline capacity in the Permian Basin is set to grow with the expected start of the Matterhorn Express Pipeline this month, according to the U.S. Energy Information Administration (EIA).

The pipeline, backed by EnLink Midstream and other stakeholders, will add 2.5 billion cubic feet per day (Bcf/d) of takeaway capacity, transporting gas from the Permian to Katy near Houston, Texas.

Matterhorn, a joint venture involving Whitewater, EnLink Midstream, Devon Energy, and MPLX, aims to ease the bottleneck in natural gas transportation from the Permian, where production has more than doubled since 2018. This surge, driven mainly by associated gas from oil operations, has suppressed regional spot prices and created a push for more pipeline capacity.

Beyond Matterhorn, three additional pipeline projects are underway, totaling 7.3 Bcf/d in new capacity:

- Apex Pipeline (2.0 Bcf/d): Expected to enter service in 2026, it will transport gas from the Permian to Port Arthur, Texas, operated by Targa Resources.

- Blackcomb Pipeline (2.5 Bcf/d): Set to connect Permian gas to Agua Dulce in south Texas by 2026, operated by Whitewater Midstream.

- Saguaro Connector Pipeline (2.8 Bcf/d): This pipeline will move gas to the U.S.-Mexico border, linking with the Sierra Madre pipeline by 2027-28.

Other announced projects could add another 7.0 Bcf/d capacity between 2025 and 2028, targeting markets in Mexico and along the Texas Gulf Coast.

As pipeline capacity struggles to keep pace with growing production, regional spot prices, particularly at the Waha Hub near Permian output, have faced downward pressure. This year, Waha prices have dropped below zero on nearly half of all trading days, with a record low of -$6.41 per million British thermal units in August. The price difference between Waha Hub and the benchmark Henry Hub has averaged $2.07 this year, compared to just 42 cents in late 2021.

The upcoming addition of the Matterhorn pipeline could help ease these constraints, allowing increased gas flows from the Permian Basin and potentially boosting prices at the Waha Hub.

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- Tallgrass to Build New Permian-to-Rockies Pipeline, Targets 2028 Startup with 2.4 Bcf Capacity

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- A Systematic Approach To Ensuring Pipeline Integrity

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- US Poised to Become Net Exporter of Crude Oil in 2023

- EIG’s MidOcean Energy Acquires 20% Stake in Peru LNG, Including 254-Mile Pipeline

Comments