November 2009 Vol. 236 No. 11

Features

Are Investors Prepared To Capture The Opportunity Of LNG That Emerges From The Recession?

Despite the global financial crisis which has led to a fall in energy demand and prices, the market for liquefied natural gas (LNG) is expected to regain its steep growth trajectory in the mid and long terms.

Despite the global financial crisis which has led to a fall in energy demand and prices, the market for liquefied natural gas (LNG) is expected to regain its steep growth trajectory in the mid and long terms, spurred by anticipated increases in demand, particularly in emerging markets. The exact extent of this surge in demand and related investments in infrastructure is difficult to project, but to capitalize on opportunity when it arises, investors must be prepared to mobilize quickly and establish flexible business and operational models for an unpredictable, high-stakes future.

The LNG industry has developed slowly over the last half century because in most heavy-consuming nations, the domestic energy supply has been sufficient to meet demand. However, as energy consumption has continued to increase around the world (most dramatically in emerging nations), it has become more difficult for many nations to satisfy their energy needs locally. Complicating the situation further, more than a third of the world’s natural gas reserves are located in low-consumption countries, far from where energy demand is highest. Increasingly, nations are turning to the mobility and flexibility of LNG to resolve these imbalances.

Indeed, from 2006-2015, the global market for LNG is expected to increase by 70% and more than triple by 2030. Not surprisingly, investors are anxious to grab their share of this opportunity.

The rise in energy demand led to a peak in energy prices around mid-2008, followed by a recession-generated steep decline. As the short-term impact of the global recession subsides, however, natural gas prices are expected to stabilize again through 2011 and then increase for the foreseeable future. These higher gas prices will make it economically feasible for businesses and nations to again invest in LNG. The cumulative 2007-2030 investment in gas supply infrastructure is expected to be US$5.5 trillion (in 2007 dollars). Out of this, an investment of US$440 billion is expected to be made specifically in LNG infrastructure.

However, the same high prices that spur investment in LNG could eventually become detrimental to the industry. Forecasts by the International Energy Agency suggest that high natural gas prices may ultimately prompt consumers to turn to other fuels.

The question is: will investors be able to scale their LNG infrastructure quickly enough to capitalize on this bubble of opportunity? And equally important, how can they make their businesses flexible enough to withstand the cyclic nature of this industry?

LNG: The Opportunity

Driven by population and economic growth, global primary energy demand is expected to increase by 45% between 2006-2030, with 87% of projected growth coming from non-OECD countries. As a result, their share of world primary energy demand is expected to rise from 51% to 62%. China and India are expected to account for 51% of incremental world primary energy demand from 2006-2030. Even established nations such as the United States are likely to see energy use rise by more than 11% between 2007-2030.

Most of the world’s known gas reserves are concentrated in just a few regions – far from where energy is needed most – and so LNG, as a means of delivery, has become a more attractive alternative in recent years. Industry analysts anticipate LNG’s share of inter-regional natural gas trade will rise from 52% in 2006 to 69% in 2030.

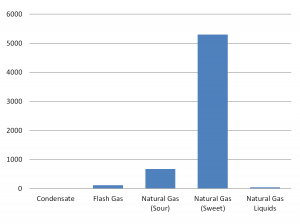

Not surprisingly, investors are anxious to capture their share of this revenue opportunity. Many were rushing to establish the infrastructure necessary to capitalize on this upswing in LNG demand before the recession shocked the world energy market, halting a great number of these projects (Figure 1). The industry was considering proposals to more than double the world’s 2008 regasification (regas) capacity by 2013, with more than 100 new plants under planning or construction globally. On the production side, 30 new liquefaction plants were in some stage of planning or construction to start operation by 2013. Investors are no doubt urgently re-evaluating their portfolio of LNG investments, trying to decide which to reactivate, which to mothball and which to accelerate going forward.

Unpredictability

Yet, the demand for LNG – perhaps more than other energy sources – is characterized by unpredictability. There are inherent uncertainties in any industry based on constrained natural resources. New natural gas sources are increasingly difficult and expensive to find and develop, more and more remote, and production volumes are harder to anticipate and realize.

Geopolitical issues also aggravate the economics of LNG supply and demand. Most nations strive for energy self-sufficiency, but for many, this desire for independence is outpaced by GDP growth and its corresponding energy demands (Figure 2).

The most volatile factor influencing demand for LNG is alternative fuel prices. LNG is inherently caught up in a tug-of-war between the price of natural gas and oil, with coal expected to eventually dominate. Lower natural gas prices tend to raise overall demand for gas. The price must also remain high enough to support the higher costs of LNG delivery, but not increase too much or consumers will switch to alternative fuels.

As the most “mobile” form of natural gas supply, LNG imports are particularly vulnerable to regional and even local price shifts. When higher natural gas prices lower overall demand, LNG imports tend to be the first cut.

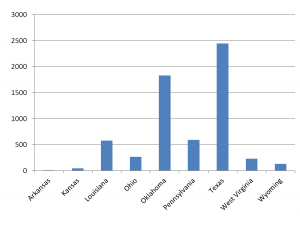

For LNG, this competition among fuels creates a window of opportunity. But the extent and duration of this opportunity are difficult to project precisely. The U.S. Department of Energy forecasts that high LNG prices will spur domestic supply, leading to a decline in U.S. imports over the long run (Figure 3). As a result, LNG industry participants face difficult choices about how much to invest, where, and how fast.

Complexity And Risk

As the LNG supply chain becomes larger and more flexible – with more globally distributed liquefaction and regas facilities – the nature of the LNG business is changing, with commensurate increases in complexity and risk.

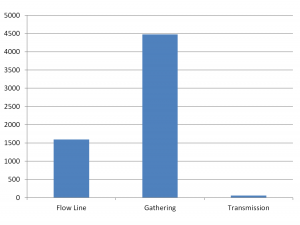

The supply chain – or more precisely, the LNG value chain network – has become inordinately more complex to manage. Historical point-to-point delivery has evolved into an intricate network of origination points, transportation partners and shipping destinations. Each player must manage a complex value chain, constantly monitoring both physical and transactional flows in order to react in realtime as situations change (Figure 4).

As the supply network expands and importers demand more purchasing flexibility, the industry’s historical long-term contracts are steadily giving way to commodity marketplaces. In the 1990s, less than 2% of all natural gas transactions were spot trades; by 2007, that figure had grown to 11%.

In addition to the financial complexity introduced by the expanding commodity market, LNG ventures face another possible side effect. The thinner margins that often accompany commodity trades will likely expose operational inefficiencies in the supply chain previously hidden by higher-margin, long-term contracts.

The scale and complexity of the LNG business is matched only by the financial stakes involved. Constructing a regas terminal, for example, typically costs about US$900 million – and the price tag for a gas liquefaction plant begins in the billions.

Because of the magnitude of the investment (and the risk), most LNG projects are accomplished through joint ventures. These capital projects involve a complex collaboration among engineering firms, equipment suppliers, producers, pipelines, liquefaction plants, shippers, regas facilities, and storage and distribution networks. However, the joint venture structure, in turn, complicates visibility of investments, assets, inventory and financials.

Early Readiness

So how can industry players and nations protect the investments they are making to meet global energy demand? How can they mitigate risk amid ever-increasing complexity? It is important for new LNG ventures to focus on actions that can accelerate successful scale-up, while positioning themselves for long-term flexibility. We believe investment partners should consider four key actions early in the joint venture process:

1. Focus constrained joint venture resources. By nature, most joint ventures operate with limited staff. Adding to the challenge, most of the specialized skills required by new LNG ventures are in short supply. These ventures are often competing with the petroleum and utilities industries for a shrinking pool of talent and expertise. Thus, it is crucial for investors to focus their scarce resources on areas of the business that are most strategic, as well as those that carry the highest stakes because of safety risks or the degree of capital involved. Equally important, investors should consider turning low-risk, low-investment functions over to external specialists that can often perform those activities more economically and at a higher level of quality.

2. Instill a culture of safety. In the LNG industry, safety must be a core value, designed into the business from the start. This can be institutionalized through the implementation of formal, enterprise-wide safety practices and broadly communicated expectations of safety performance. Clear communication channels – up and down the management chain – must be established to surface and correct potential safety issues as they arise. Practically every decision a joint venture makes – from where facilities are located to whom they partner with – should involve a safety element. Achieving a positive return on investment is inexorably linked to safe and reliable operations.

3. Increase visibility for improved decision making. The sponsors and owners of LNG ventures often lack access to operational, financial, logistical and asset management information associated with the new business. Conflicting business practices, incompatible processes and technologies, and different information standards can make it difficult to share information across corporate boundaries. It is critically important to flatten these hurdles early in the venture. All investment partners need a common view of information to facilitate decision making and more timely responses to business changes.

4. Establish a reusable business model and associated infrastructure. New joint ventures present partners with a fresh start, an entrepreneurial environment where they can adopt industry-leading processes, practices and technologies. Partners can bring the best from their respective companies while escaping ineffective processes and current infrastructure limitations. The goal should be to merge diverse partner interests into a flexible business model with components that can be reused in future ventures. Standardization – of processes, business practices, technology platforms and such – lays the groundwork for reuse. Standardization early in the venture is even more beneficial as it helps mitigate risk and accelerate implementation timelines.

Using today’s digital technologies, for example, it is possible to electronically exploit facility design data within its new operational systems even before factory acceptance testing, helping smooth site acceptance testing, plant commissioning and both initial and long-term operations. These key steps in handover of the facility from the engineering, procurement and construction provider to the owner/operator can be streamlined and enhanced if technologies are in place early enough to leverage.

In low-risk, low-investment areas of the business, investors should consider using a centralized services approach or possibly outsourcing to speed implementation and reduce risk (Figure 5). In strategic areas, investors will also want to invest in infrastructure for standardization and automation.

Given the inherent volatility of this business, it is uncertain how long the present upswing in LNG demand will last. We believe focusing on the four key action areas just outlined can help investors move quickly enough to capture the current LNG opportunity while remaining flexible enough to thrive amid a chaotic and cyclic industry.

Are You Ready For The Race?

In those very early stages, when a liquefied natural gas joint venture is forming, investors make critical decisions that impact their long-term odds of success. Delaying those important decisions simply piles risk onto an already risky endeavor. As a participant in a new LNG venture, here are some questions to help you assess your level of preparedness:

- How quickly can we adapt to changing conditions? Are we locked into an inflexible business infrastructure that cannot be scaled easily?

- What specific steps are we taking to manage the safety risks involved in our project? Do our employees understand the safety-related aspects of their roles?

- Do all of our investment partners have access to the information they need? In which areas of our business could standardization and established governance processes help reduce costs and risk?

- How modular and reusable are our processes and business practices? What specifically do we plan to redeploy in our next LNG venture?

- Overall, how confident are we that our current LNG project will achieve its expected return on investment?

Authors

Steve Edwards is the IBM Global Industry Leader for the Chemicals and Petroleum industries. steve.edwards@uk.ibm.com.

David Haake is a Chemicals and Petroleum Industry Solutions Executive in IBM Global Business Services, focusing on asset management solutions and value network management for the LNG industry. david.haake@us.ibm.com.

Omar Ishag is the Chemicals and Petroleum Leader within the IBM Institute for Business Value. Omar.ishag@no.ibm.com.

Bibliography

“Annual Energy Outlook 2009.” U.S. Department of Energy, Energy Information Administration.

“Natural Gas Market Review 2008.” International Energy Agency.

“World Energy Outlook 2008.” International Energy Agency.

Comments