January 2010 Vol. 237 No. 1

Features

Sailing Into Unknown Waters: A New World Order For Natural Gas?

It only seems like a short time ago that oil prices were over $100 a barrel, natural gas prices in the U.S. and UK were high, spot LNG cargoes into the Far East were priced at over $20 per MMBtu, the world economy was growing rapidly, especially in China, and experts in the energy industry were mainly concerned about whether the world could afford the high prices and where the hydrocarbon resources required would come from.

All this was brought to a shuddering halt by the global financial crisis which tipped the world into the deepest recession since the 1930s. Oil prices collapsed, although they have subsequently bounced back, while spot gas prices at Henry Hub and national balancing point (NBP) also fell sharply with no sign of recovery, as gas demand declined.

Will we see a slow recovery or return to rapid growth? A key preoccupation of experts now, however, is the speed with which the world economy, energy demand and natural gas demand will recover and the impact this will have on prices, projects and trade. In their new study – Sailing into Unknown Waters – Nexant’s Global Gas team have developed three scenarios – Reference, Surplus and Constrained – to look at the possible impact that different developments in the world economy, and the energy markets, might have on the natural gas market and global gas trade, and prices in particular.

Outside the natural gas market, the key assumptions in each scenario concern world economic growth and the level of oil prices. In respect of oil prices, a long-run level of $70 per barrel for the Brent marker price at real 2007 prices has been assumed in all three scenarios. In the Reference and Surplus Scenarios, a moderate economic recovery has been assumed with a return to positive growth in 2010, but with a slow recovery of world GDP of 2% per year through to 2015 before rising to just over 3% per year from 2015-2030. In the Constrained Scenario, a more rapid economic recovery has been assumed, with world growth averaging almost 4.5% per year between 2010-2015 before moderating to just over 3.5% per year from 2015-2030.

The impact on gas demand and consumption of differing world economic growth rates is significant. In the Reference and Surplus Scenarios, world gas consumption grows from 3,158 billion cubic meters (Bcm) in 2008 to over 3,820 Bcm by 2030 – an increase of just over 20% or less than 1% per year. In the Constrained Scenario, world gas consumption rises to 4,070 Bcm by 2030 an increase of almost 30% or 1.2% year.

There is no shortage of gas but what about infrastructure? It is a widely held view that there is no shortage of gas reserves in the world and the key question is whether there will be sufficient infrastructure to transport the developed reserves to market. This involves pipeline infrastructure, and LNG liquefaction, shipping and regasification capacity.

In the Surplus Scenario, largely everything planned and proposed gets built. Major new pipelines include the Central Asia Gas Pipeline (Turkmenistan to China), South Stream, Nabucco, Nordstream (both phases), Alaska Gas Pipeline (from 2020) and the Iran-Pakistan-India Pipeline (also from 2020). The only major announced pipelines that are assumed not to be developed are the Turkmenistan-Afghanistan-Pakistan-India and Trans-Saharan Gas Pipeline. In respect of total liquefaction capacity, the Surplus Scenario includes an additional 481 Bcm – compared to end 2008 capacity of some 267 Bcm.

In the Reference Scenario, fewer new pipelines are built with Iran-Pakistan-India not going ahead, and Nabucco and Nordstream phase 2 being canceled. There is also much less additional liquefaction capacity – only some 262 Bcm compared to 481 Bcm in the Surplus Scenario. In the Constrained Scenario, the pipelines built are assumed to be the same as in the Reference Scenario, but more liquefaction capacity is built responding to higher demand – some 318 Bcm compared to 262 Bcm in the Reference Scenario, but still below the 481 Bcm in the Surplus Scenario.

The result of all of this is that the Surplus Scenario has abundant supply and capacity relative to demand, the Reference Scenario has “just enough” supply and capacity to meet demand, while the Constrained Scenario is tight since supply and capacity do not increase quickly enough to meet the potential increase in demand. As a result, there is a degree of “demand destruction”, with total world gas consumption being some 8% below the projected potential demand because of supply constraints.

In all scenarios, developments in North America significantly impact world gas trade – especially the Alaska pipeline. The impact of developments in the North American gas market, and the U.S. in particular, on the global gas trade, in all three scenarios, cannot be overstated. This is not just due to the size of the U.S. market, but also because it is a competitive traded gas market which is more responsive to shifts in supply and demand with corresponding effects on prices. At the regional level, North America only imports gas as LNG, although there are significant intra-regional pipeline flows.

In all three scenarios, net LNG imports to North America increase, as indigenous production declines – lower Canadian and conventional U.S. production – which is only partly offset by rising unconventional production. In the Reference and Surplus Scenarios, some of the higher cost conventional and unconventional gas, certainly prior to 2020, is not economically viable at the projected spot prices, while LNG imports from Latin America, Africa and the Middle East are economically viable.

LNG imports in the Surplus Scenario generally remain above those in the Reference Scenario because of the availability of imported supply. Post 2020, in all three scenarios, LNG imports decline. This reflects generally stagnating or declining North American demand, combined with increasing indigenous supply. The Constrained Scenario has significantly lower LNG imports reflecting the reduced infrastructure capacity to move gas and the higher demand in the main LNG-exporting countries.

In the Reference Scenario and, to an even greater extent in the Constrained Scenario, the main change is the assumed completion of the Alaska pipeline in 2020. This brings a large quantity of potential new supplies to the lower-48 U.S. market and has knock-on effects around the whole global gas market. These new supplies displace LNG from North America, some of which is diverted to Europe, which in turn reduces the need for pipeline gas into Europe, mainly from the Former Soviet Union (FSU). This releases more gas for the FSU to supply Asia and in turn reduces the need for Asia to import LNG.

The Middle East becomes the swing supplier with Africa emerging as an increasingly important supplier.

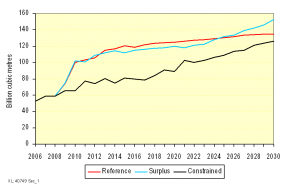

Figure 2: LNG Exports from Middle East by Scenario.

The Middle East, and Qatar especially, is expected to become an increasingly important supplier of LNG to world markets. In 2008, exports were around 60 Bcm, principally to Asia Pacific, with smaller quantities to Europe and Asia. In the Reference and Surplus Scenarios, exports are projected to double by 2015 and while Asia Pacific is still the largest market for Middle East LNG supplies, there are significant quantities exported to North America, Europe and Asia.

In the Constrained Scenario, growth is slower, as more gas is required for domestic Middle East consumption, North America’s demand for Middle Eastern LNG declines, and as Asia Pacific requires less gas supplies.

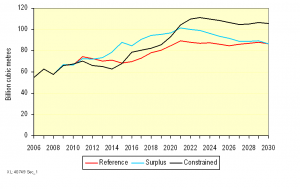

Africa is also a major exporter of LNG – mainly Algeria and Nigeria – passing the 100 Bcm level post 2020 in the Constrained and Surplus Scenarios. African LNG exports are principally to the Atlantic Basin markets of North America and Europe. In the Reference and Surplus Scenarios, African exports to North America remain between 30-50 Bcm a year for most of the projection period. In the Constrained Scenario, there is a sharp increase in exports to Europe, which is suffering from reduced supplies from other regions.

Figure 3: LNG Exports from Africa by Scenario.

Contract prices and spot prices diverge in the outlook. Long-term contract prices in continental Europe and Asia Pacific are linked to crude oil and/or oil product prices. With the assumption of constant real $70 a barrel oil prices (Brent marker) over the long term in all three scenarios, it would be expected that German import prices would settle at around $9.50 per MMBtu (around the LSFO energy equivalent), and Japan LNG import prices somewhat higher at just under $12 per MMBtu, which is equivalent to JCC parity.

In the Reference and Surplus Scenarios, spot prices remain well below the long-term contract price levels. Post 2015, Henry Hub prices are projected to be in a range between $5.20-5.35 per MMBtu in the Surplus Scenario, and between $5.35-5.60 per MMBtu in the Reference Scenario. National balancing point (NBP) prices are generally below Henry Hub prices in both the above scenarios, although the differentials narrow over time. NBP being at a discount to Henry Hub is what might be expected if, as described above, the Middle East is effectively the swing supplier in the global gas market and, therefore, a key driver in the price-setting process, since the transportation costs to ship LNG to the UK from the Middle East are less than to the U.S. In respect of estimates of Japan Spot LNG prices, they are at a discount to Henry Hub in both the Reference and Surplus Scenarios through to 2016 and thereafter at an increasing premium, reflecting the tightening of the Japanese market relative to the U.S. market.

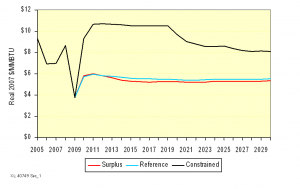

Figure 4: Henry Hub Spot Prices by Scenario.

The Constrained Scenario is radically different from the other two scenarios. The tight supply–demand situation, as a result of a return to strong economic growth, and sharply rising gas demand, is quickly reflected in spot gas prices. Henry Hub prices range between $10.50-10.75 per MMBtu between 2011-2019, which is a slight premium to NBP prices. From 2020 onwards, however, Henry Hub prices are on a declining trend, falling to almost $8 per MMBtu by 2030. This reflects the impact of the Alaska pipeline coming onstream, together with additional Lower-48 U.S. States supplies, which, as was discussed above, leads to sharp reductions in North American LNG imports.

NBP prices, however, remain in the $10.50-11.00 range. The implication of this is that U.S. prices have effectively decoupled from world gas prices post 2020. The Japan Spot LNG price quickly rises to just below the Japan contract price in the Constrained Scenario, which is around the level at which demand in the Japanese market would switch in large quantities away from gas.

The difference between spot prices and contract prices, especially in the Reference and Surplus scenarios, is significant and sustained over a long period of time. If there were such substantial differences over a sustained period between contract and spot prices, this would likely lead to tensions between buyers and sellers of wholesale gas, which in turn may lead to significant changes to long-term contracting practices. Even in the Constrained Scenario where spot prices are, at least in Europe, slightly above contract prices, there might be some pressure, from sellers at least, to renegotiate contract terms.

A number of conclusions can be drawn from the pattern and range of spot prices in the different scenarios:

1. The closeness of the outcomes for spot prices in the Surplus and Reference Scenarios suggests that there is a “floor” price for gas prices which is just over $5 per MMBtu for Henry Hub and just over $4 per MMBtu for NBP. This is not to say that actual prices for some period of time would not go below these levels, since that is what has been observed in recent months, particularly for Henry Hub, as a result of market volatility and price setting based on short-run production costs.

2. At the other extreme, the level of prices in the Constrained Scenario suggest that there is a long-run “ceiling” to wholesale prices of maybe around $11 per MMBtu or so in all markets, which is the point at which long-run gas demand would start to fall away in large quantities as other fuels would become significantly more attractive, especially in the new-build power generation market, which is the largest market for gas. Again, that is not to say that gas prices could overshoot these levels, sometimes for a number of years, as the market can take time to adjust to the new equilibrium level of prices.

3. Prices are very sensitive to apparently small movements in demand and/or supply, even in the long run, at least within a certain range. Anyone who has observed the Henry Hub or NBP gas markets knows that these markets are very responsive to small short-term changes in supply and demand, as evidenced by short-term market volatility. The three scenarios suggest the range of potential prices that might be seen over the longer run, for, what might be considered, relatively small changes in the supply-demand balance.

A new world order for gas? When the global economy eventually emerges from the recession – whether rapidly as in the Constrained Scenario or more moderately as in the Reference and Surplus Scenarios – many of the old assumptions of the past – continued high prices and demand growth – will have gone. While we may be sailing into unknown waters, as the title of this study suggests, key conclusions can be drawn from the analysis of the three scenarios:

- Changes in gas demand and the availability of gas supply in North America have significant effects on all the whole of the world’s gas markets. If, and when, the Alaska gas pipeline is completed, the effect will be felt in all regions of the world.

- The Middle East will increasingly become the swing supplier to all the major markets for gas, replicating, to some extent, its position in the oil market.

- The volatility of spot gas prices in the short term is well known, but the scenarios suggest that the long-term equilibrium price is also quite sensitive to what might be perceived as relatively small changes in the supply-demand balance.

- The potential divergence between long-term contract prices, linked to oil, and spot gas prices, is likely to increase tensions between end users and consuming countries’ regulators on the one hand and gas producers on the other hand, possibly leading to the renegotiation of pricing terms in long-term contracts.

The full 280-page report, “Sailing into Unknown Waters” is available from the authors -mfulwood@nexant.com or blittle@nexant.com.The report contains details on existing and future natural gas infrastructure as well as on supply, demand, trade and prices.

Authors

Mike Fulwood is a Principal in Nexant’s Global Gas practice. He has 30 years of experience in the energy industry, the last 10 years in consultancy. Previously, he worked as Director at British Gas Transco, the gas transportation business unit of British Gas. Before that, he was President of British Gas Americas and led a high-caliber team responsible for developing downstream gas projects and investments in North and South America.

Brian Little is a Principal in Nexant’s Global Gas practice. He has over 35 years of experience in the energy industry, including 15 years in consultancy and over 20 years working for British Gas. His experience in British Gas included the evaluation of long-term supply contracts, as well as the development of the spot market for gas. His areas of expertise include all aspects of market analysis, modeling, and forecasting.

Comments