January 2013, Vol. 240 No. 1

Features

Unconventional O&G Production Delivers New Jobs

The revolution in unconventional oil and gas production is fundamentally changing the U.S. energy outlook, generating significant job creation, economic growth and government revenues, according to a new IHS, Inc. study.

Findings indicate the entire upstream unconventional oil and gas sector will support more than 1.7 million jobs in 2012 at average wage levels that are dramatically higher than in the general economy. Furthermore, the number of jobs is expected to increase to 2.5 million over the next three years. The number of jobs supported will continue to rise to nearly 3.5 million in 2035, according to the study.

The new study, America’s New Energy Future: The Unconventional Oil and Gas Revolution and the Economy builds on previous IHS research on the economic impacts of unconventional gas to provide the most complete assessment to date of the economic contributions – in terms of jobs, economic value and government revenue – for both unconventional oil and unconventional gas in the U.S.

“The growth of unconventional oil and gas production is creating a new energy reality for the United States,” said Daniel Yergin, IHS vice chairman and author of The Quest. “That growth has not only contributed to U.S. energy security but is a significant source of new jobs and economic activity at a time when the economy is a top priority.

“The United States currently has the highest rate of growth in crude oil production capacity in the world and is virtually self-sufficient in natural gas, except for some gas from Canada. This is a stark contrast from when, prior to the unconventional revolution, it was expected that the U.S. would soon become heavily dependent on gas imports,” Yergin added.

Future growth in unconventional oil and gas production will drive continued economic expansion in both the near- and long-term, the study says.

Other findings in the survey: annual unconventional tight oil production, projected at 2 mbd for 2012, is expected to increase by nearly 70% by 2015 to more than 3.5 mbd and rise to 4.4 mbd in 2020.

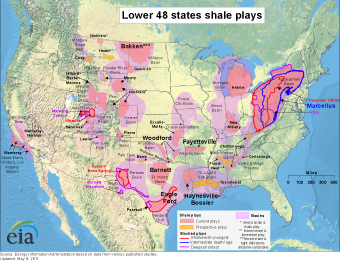

Unconventional gas production – shale, plus “tight gas” – is expected to increase 22% to nearly 42 Bcf/d in 2015 (65% of total U.S. gas production) and reach more than 76 Bcf/d in 2035 (75% of total U.S. gas production).

Among the study’s key findings:

1) Nearly $5.1 trillion in capital expenditures ($2.1 trillion in the oil sector, $3 trillion in the gas sector) will take place between 2012 and 2035 across the entire upstream unconventional oil and gas activity sectors.

2) Employment in the entire upstream unconventional oil and gas sector on a direct, indirect, and induced basis will support nearly 1.8 million jobs in 2012, 2.5 million jobs in 2015, 3 million jobs in 2020, and nearly 3.5 million jobs in 2035.

3) The jobs created tend to be high quality and high paying, given the technologically innovative nature of unconventional oil and gas activity. Workers associated with unconventional oil and gas are currently paid an average of $35.15 per hour – higher than the wages in the general economy ($23.07 per hour) and more than wages paid in manufacturing, wholesale trade and education, among others.

4) Unconventional energy activity will contribute $237 billion in value added contributions to GDP in 2012, a figure that will increase to $475 billion annually in 2035. Unconventional supplies will become the “conventional,” accounting for nearly 80% of the nation’s natural gas supplies by 2035.

5) Unconventional oil and gas activity will generate more than $61 billion in federal and state government revenues in 2012 and increase to $91 billion in 2015 and $111 billion in 2020. By the last year of the forecast period, in 2035, government revenues will increase to more than $124 billion.

A key reason for the profound economic impacts associated with unconventional oil and gas production are the lengthy, complex, domestically-sourced supply chains which support American jobs. The total employment contribution for overall upstream unconventional activity relative to total U.S. employment will average 1.5% over the short-term (2012-2015), 1.9% over the intermediate term (2015-2020) and 2% over the long-term (2020-2035), the report finds.

The industry, highly capital-intensive by nature, relies on suppliers in construction, fabricated materials and heavy equipment but it also requires a broad range of material and services such as legal and financial services and information technology, said John Larson, IHS vice president, public sector consulting.

Larson added, “Unconventional oil and gas production is unique in that it combines a highly capital-intensive industry with a broad domestic supply chain. The United States is a world leader in all parts of unconventional oil and gas activity which means that most of the dollars spent here stay and support American jobs.”

“The growth in shale and other unconventional natural gas production is a major contributor to employment prospects and the U.S. economy,” said Larson. “As this report makes clear, these benefits spread beyond producing states to deliver positive impacts across the country.”

The report, America’s New Energy Future: The Unconventional Oil and Gas Revolution and the Economy, is the first by IHS in a series measuring the economic impacts of unconventional oil and gas activity in the United States. Subsequent reports will focus on the economic impacts on a state-by-state level and the potential for a U.S. manufacturing renaissance fueled by abundant energy supply.

To download America’s New Energy Future: The Unconventional Revolution and the Economy complete report and methodology visit http://www.ihs.com/unconventionalsandtheeconomy.

On Dec. 6 the federal Energy Information Administration detailed for the first time the widespread economic impact of the new abundance of natural gas. The agency projects that the use of natural gas as a fuel for vehicles will rise nearly 12% per year through 2040, more than double the agency’s outlook last year. That increase will be almost entirely due to some segments of the trucking industry changing their fueling habits, and buying new rigs equipped to run on LNG.

Freight haulers will be willing to make the investment, EIA’s analysts reckon, because they will get the money back and save in the long run, as the LNG prices will remain 40% below diesel fuel for the next three decades. Still, natural gas will provide only a small piece of the nation’s transportation fuel. The EIA projects that share will reach about 4% by 2040, based on current policy and technology. “What really holds natural gas back is the infrastructure to refuel,” said EIA Administrator Adam Sieminski.

U.S. manufacturing output will climb an average 2% a year over three decades, according to the EIA. That’s 20% more rapidly than analysts projected a year ago, and it’s due to the extended outlook for low-priced gas due to the shale-drilling boom. Numerous petrochemical companies have announced plans to build, reopen or expand North American production. It’s an astounding turnaround for the industry, which as recently as 2004 shut down 70 U.S. facilities as uneconomic due to costly natural gas.

Comments