June 2013, Vol. 240, No. 6

Features

Shale Plays Remain Key To Nations Economy, Jobs And Energy Security

Pipeline & Gas Journal, in partnership with the Interstate Natural Gas Association of America (INGAA), held its 9th annual Pipeline Opportunities Conference March 26 at the JW Houston Marriott Hotel and Convention Center in Houston. Among the topics discussed were oil and gas prospects for 2013 and beyond, the shale gas boom, prospects for LNG exports and pipeline infrastructure to satisfy new supply sources.

Jeff Share, conference founder and organizer, said the single-day event drew 480 attendees, attesting to the intense interest in the nation’s pipeline industry.

“Though we’re seeing a lag in new pipeline construction, interest in the industry has never been greater,” Share said. “What Keystone XL and the shale plays have done is accentuate the need for more and better pipelines to service the oil and gas industry. Where there are opportunities there are also challenges; today people all over the country are now aware of the pipeline industry. Which means we can’t afford mistakes.”

In the first session, Pipeline Research Council International (PRCI) President Cliff Johnson and Richard McNealy, Program Manager-Operations & Integrity, provided overviews of PRCI’s partnership with the natural gas industry and its research focus on an industry-wide goal of zero leaks and the industry’s top 10 R&D needs.

Johnson announced establishment of PRCI’s Technology Development and Deployment Center that recently opened in Houston. He explained PRCI has been progressively building a unique, world-class repository of pipeline damage samples to support technology development and educational opportunities.

McNealy explained PRCI’s project to evaluate data and establish the reliability of inline inspection (ILI) crack detection tools. The project will include a complete and comprehensive study of existing ILI and NDE/in ditch data that is available from pipeline operators to establish the performance reliability of detecting, identifying, and sizing/characterizing cracking and crack-like features in pipelines.

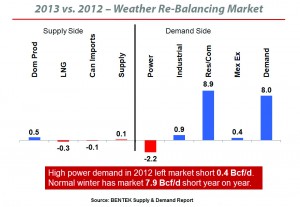

In the Oil and Natural Gas Outlook session, BENTEK Energy’s Director-Energy Analysis, Jack Weixel, offered an informative forecast for each commodity and how things are shaping up in 2013 to set things in motion. Weixel said there is a robust market emerging for natural gas. “There is more demand, more supply and natural gas is becoming a larger piece of the energy solution for the U.S.,” he said.

He shared the accompanying slide showing incremental supply and demand for the first three months of 2012 vs. the first three months of 2013. As shown, domestic production rose by about 0.5 Bcf/d, though both LNG imports and Canadian imports fell slightly, while total supply rose about 0.1 Bcf/d.

The figure also shows: power demand falling 2.2 Bcf/d; an increase in commercial demand of 8.9 Bcf/d; and an increase in Mexican exports of 0.4 Bcf/d.

On natural gas prices, Weixel said, “It’s going to be a new game going into this summer vs. last. We’re entering the summer with a higher gas price which is going to have some impact on supply and demand going forward.

“Price-wise, we’re anticipating April prices to settle out at $3.76, which is nearly double the price of gas as we entered last summer. Higher prices will make gas less attractive, particularly for the power utilities, but good for production.”

Turning to domestic crude production, Weixel said production through 2018 is projected to grow by 4.4 MMbpd, which is impressive though there are ramifications for the global oil market with that as well.

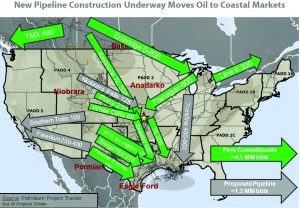

Weixel said big increases are expected in the Eagle Ford of light sweet crude. Big growth is also likely in the Bakken, Rockies and the Permian. In Canada, oil sands production from Alberta is expected to reach 1 MMbpd, along with oil coming from just north of the Bakken, in what is considered the Saskatchewan portion of the Bakken.

Insert Bentek Slide: New Pipeline Construction Underway Moves Oil to Coastal Markets.

He also anticipates a large portion of the oil production to go to coastal markets via new pipelines shown in the accompanying figure.

Turning to energy prices, Weixel warned that industry should get ready for cheaper energy. “With the Henry Hub expected to average in the $4.30 range, WTI prices are expected to drop by more than 25% over the next five years,” he said.

Weixel said the U.S. is on track to export more gas than it imports. “In 2005, the U.S. needed net imports of 10 Bcf/d from Canada. In the past year, that dropped to 6 Bcf/d. Going forward, the outlook is even grimmer for Canadian pipelines that are exporting to the U.S.” He anticipates net gas imports to be negative in 2017 to the point where the U.S. is actually a net exporter.

As for LNG, he sees exports at 3.6 Bcf/d, along with an increase of 2.3 Bcf/d of increased exports to Mexico. “Right now, we’re exporting 1.3-1.5 Bcf/d of gas to Mexico, which is projected to increase to 700-800 MMcf/d by 2018 due to increased power sector growth,” he said.

Turning to drilling, Weixel sees activity dampening in some areas because dry gas regions can’t support increased drilling. He said dry gas drilling in the Marcellus is down vs. 2010, along with the Haynesville, where 27 rigs were active in March 2013 vs. 102 rigs in 2010.

Looking to areas that have experienced gains, he said, “This is mostly related to liquids-rich regions in the Bakken and Permian. Activity is also strong in the Eagle Ford where 235 rigs are working. Associated gas is also coming out of all those basins as well.”

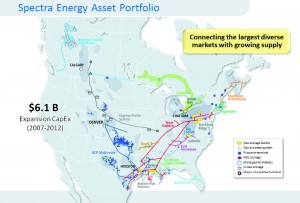

In Spectra Energy’s Pipeline Construction Outlook and Projects session, Brian McKerlie, vice president-Business Development, reiterated the commitment to keeping up with plans to spend $1 billion annually between 2007 and 2012 on expansion projects.

He called attention to the fact that the Asset Portfolio slide shows the Express-Platte Pipeline System. The company recently purchased 100% interest in the 1,717-mile, crude oil system for $1.49 billion. The Express pipeline carries 380,000 bpd of crude to refining markets in the Rocky Mountain states. The Platte pipeline, which interconnects with the Express pipeline in Casper, WY, transports crude predominantly from the Bakken and Western Canada to refiners in the Midwest. Platte’s capacity ranges from 164,000 bpd in Wyoming to 145,000 bpd in Illinois.

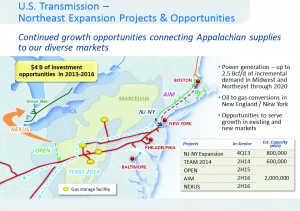

He also discussed the company’s New Jersey-New York expansion, Team 2014, AIM, Open and Nexus projects with in-service dates ranging from 2013-16.

Also in the session, Joseph Ramsey, group vice president, Spectra Energy, described project execution and obstacles the industry needs to overcome.

According to Ramsey, who is also chairman of the INGAA Foundation for 2013, it is getting harder to get regulatory approval for projects, especially interstate pipelines that go through the FERC process.

“Along with the permit delays is opposition from landowners that often results in having to resort to condemnation in order to obtain right-of-way,” he said.

“Certainly we are also dealing with legal and public relations challenges because of public opposition to projects, especially where companies are trying to undertake new pipeline construction, an expansion or Greenfield project in an area where there has not been a lot activity in recent years,” he said.

Giving Spectra’s New Jersey-New York project as an example, he said, “We’ve found in the Northeast these folks are very vocal, very opinionated and they know how to work the social media and to get the ear of politicians.”

Ramsey said the NJ-NY project is the first major large-diameter, high- pressure gas pipeline to be built into Manhattan since the 1950s.

“It involves only 5 miles of pickup and relay of 12- and 20-inch pipe with 42-inch pipe, primarily coming out of our Linden, NJ compressor station. Plus 15 miles of Greenfield 30-inch pipeline from Staten Island through Bayonne and Jersey City and under the Hudson River to Manhattan. It also requires nine horizontal directional drills,” he said.

As to the cost, he said the capital expenditure for the project ran $1.2 billion. “When you work out the cost per mile, it is $60 million a mile.”

Construction began in July and it is about 60-65% complete. So far, three of the nine directional drills have been completed. Of the remaining six, five are drilling and an 8,500-foot pullback is scheduled within days on the longest drill.

Noting that project completion is scheduled for Nov. 1, he said, “It may be finished early which is a tribute to the folks we’ve hired to handle this project. Our main contractor is Henkels & McCoy and Michels Corporation is responsible for the drills. J.L. Allen Co. is doing the compressor station work and Gulf Interstate Engineering is responsible for a lot of the detail design work.”

Cathy Landry, director of communications for INGAA, suggested what could be expected in the near-term in Washington, DC. She said the situation is similar to last year, summed up in one word, “stalemate”.

“When it comes to natural gas and natural gas pipelines, gridlock in Washington is a good thing,” Landry said. “The less Congress can do to mess up the situation for gas – since gas is winning on the environmental front – the better. If Congress, or the administration, steps in and does things that impinge upon the ability to find and development new markets, it could mean problems.”

She expressed concern regarding PHMSA’s efforts to ensure that grandfathered pipelines (built before 1970) are certifiable and can be safely operated. Landry said it is unknown what PHMSA will ask the pipelines to do to prove older systems are certifiable and safe. “It could mean more inline inspection or hydrostatic testing, which could turn out to be a big issue.”

Other hot-button issues she discussed included LNG exports and cybersecurity.

Keynote speaker Nick Stavropoulos, executive vice president of Gas Operations, PG&E Corporation, described to a packed luncheon crowd the ongoing efforts designed to make the company’s natural gas system the nation’s safest following the 2010 explosion in San Bruno. He backed that up with statistical accomplishments in safety-related areas the past year, with PG&E having satisfied seven of the 12 National Transportation Safety Board’s (NTSB) recommendations.

Of the five remaining safety recommendations, the NTSB considers PG&E’s progress “open,” which means acceptable pending completion. PG&E expects to complete action on three more recommendations by year-end, including revisions and improvements to its integrity management program.

“Our employees continue to work hard every day to make our natural gas system the safest in the nation,” said Stavropoulos. “We are making real progress that can be seen and felt by our customers, employees and regulators. We still have work to do to achieve our ambitious goal but the change that is underway is real and measurable.”

A major focus of the Pipeline Construction Outlook session was new and planned projects. Kelly Wilkins, senior manager, Enbridge Business Development, said they have spent more than $20 billion since 2007 expanding and extending their pipeline systems across North America.

He discussed Enbridge’s $35 billion worth of projects to re-pipe, re-connect and expand domestic supply to U.S. and Canadian markets.

“What has happened in the last three to five years is amazing and it is an incredible time to be in this business. The fundamentals between supply and demand are charting new territory and creating a whole new venue for infrastructure demands.

“Who would have dreamed we would be building two-way pipelines across the country? Who would have dreamed we would have nearly 1 million barrels hauled on crude oil rail cars to different markets?”

Turning to mainline expansions, he mentioned the Upper Clipper and Southern Access projects. “These projects came online in 2008 and we are already expanding their capacity to 570,000 bpd and 560,000 bpd, respectively.”

In discussing the Eastern Access, PADD II, he said some of the projects underway include Line 5, a light sweet system from Superior, WI to the Sarnia Upper Great Lakes region that feeds expansions into Line 9, which goes from Sarnia to Montreal.

Enbridge is working with Energy Transfer Partners to convert a natural gas line to crude service that will provide more supply to the East Coast, increase capacity into Montreal and Quebec and provide an initiative to feed East Coast refineries.

Also in the session, Mark Bridgers, principal, Continuum Advisory Group, described changes pipeline contractors and engineers face near-term.

To put this in perspective, he said, “The pipeline and energy sector is operating in a bubble that is protected from what is going on in the rest of the U.S. There is 8% unemployment outside of the pipeline and energy industry today. States, excluding Texas, North Dakota and a handful of others, have significant budget troubles. The political process is at a logjam and we’re getting no long-term legislation.”

The shale oil and gas market has been a major job creator since 2009 but potential regulations could choke that off, he warned. He still expects domestic oil and gas to continue to create jobs, making the pipeline and energy sectors the most attractive in the entire U.S. economy.

The accompanying figure was provided listing seven major pipeline market drivers.

Studying market drivers affecting pipeline activity, Bridgers said, “Replacement activity is being almost entirely driven by aging infrastructure and regulatory requirements.”

Bridger expects 10-20 years of various types of pipeline replacement activity in the U.S. “The challenge will be how to get that work paid for and do it at a pace without punishing the ratepayers.”

Looking at how overhead, underground and pipeline contractors are doing, he said, “Going back to 2003 this has been a very attractive market in terms of returns. There was a little dip in performance in 2011 but we’re already beginning to see some of the financial statements from FERC for 2012 which indicate that 2012 is going to be a good year for most utility contractors. Also, 2013 is likely to be fairly good year.”

On LNG, Bridgers does not see a widespread LNG export market. “Much more likely is very structured and focused exportation of LNG. There is a financial upside to keeping that product in the U.S. and not allowing other countries to access that cheap resource.”

He also discussed natural gas liquids, the resurgence of manufacturing and the likelihood of multibillion-dollar chemical plant construction.

Marylee Hanley, director of Stakeholders Outreach with Spectra Energy, discussed the New Jersey-New York project and the early steps taken to inform local, state and federal officials as well as the general public. She told how Spectra responded to incorrect information that was being spread by opponents. Hanley said that when completed, the project will be one of the safest pipelines built in North America.

In the final session, Gary White, president and CEO of, PI Cofluence Inc., told of the need for stakeholder confidence and suggested ways to build trust through communications.

Comments