November 2013, Vol. 240 No. 11

Features

Kinder Morgan Executive Discusses Challenging Aspects Of Double Eagle Pipeline Project

Kinder Morgan is the largest midstream and the third-largest energy company (based on combined enterprise value) in North America. Kinder Morgan owns an interest in or operates approximately 80,000 miles of pipelines and 180 terminals. The company’s pipelines transport primarily natural gas, refined petroleum products, CO-2 and crude oil and its terminals store, transfer and handle such products as gasoline, ethanol, coal, petroleum coke and steel. Combined, Kinder Morgan has an enterprise value of approximately $110 billion.

Each year the company invests billions of dollars to build new energy infrastructure and expand existing assets, as well as on integrity management programs to operate our assets safely.

Don Lindley, vice president of Business Development for the Products Pipeline Division of Kinder Morgan, discussed the company’s recently completed Double Eagle Pipeline, a 50/50 joint venture between Kinder Morgan Energy Partners, L.P. and Magellan Midstream Partners, with Pipeline & Gas Journal.

Here’s what he had to say:

Lindley: The Double Eagle pipeline came to us through an acquisition which was completed in the second quarter of 2013. It was initially announced in December 2011 as a joint venture project between Magellan and Copano Energy LLC, however, Copano was later acquired by Kinder Morgan.

The pipeline predominantly runs in the Eagle Ford play in the condensate window and was anchored with long-term contracts from Statoil and Talisman.

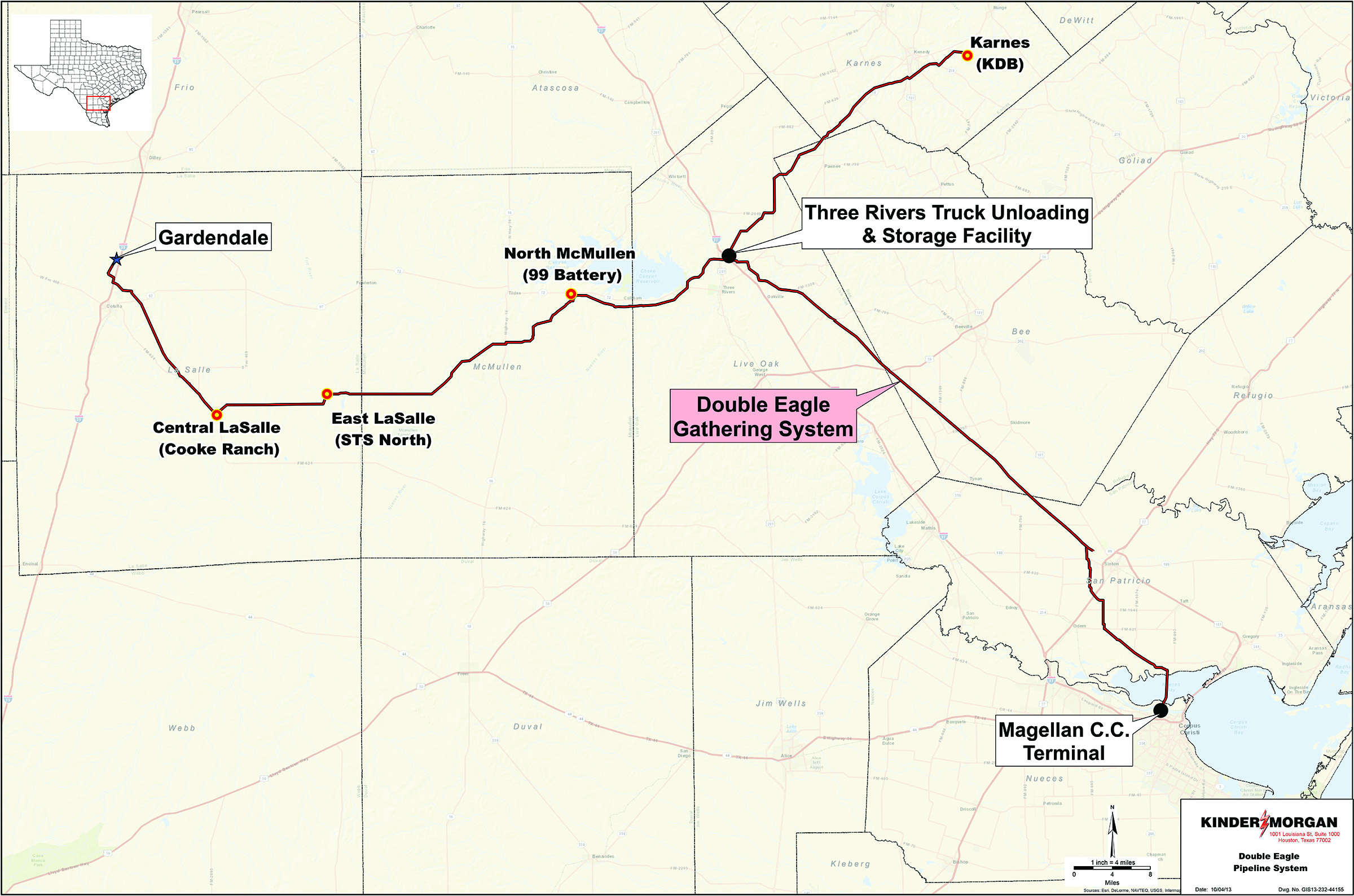

A Texas-based pipeline, it was essentially designed around their central delivery points as well as being able to receive condensate from Gardendale, which is near the far west end of the Eagle Ford play, all the way out to LaSalle County, and into the center of Orange County. From here, the pipeline basically flows to Three Rivers, where it goes into a slightly larger pipeline for delivery into a Magellan facility, which is our joint venture partner on the project, in Corpus Christi.

For the most part, the line from Three Rivers to Corpus Christi was an existing line. However, some pipe had to be added in order to extend it across Corpus Christ Ship Channel to access Magellan’s terminal. The existing line is l4 inches in diameter and the new build is a 12-inch line. The pipe for the new segment was supplied by American Steel.

P&GJ: When did you start receiving deliveries?

Lindley: We started receiving trucks loads into the system at Three Rivers in April.

P&GJ: What is the initial capacity of the pipeline and what will the peak capacity be?

Lindley: Capacity wise, it is a 100,000-bpd system at startup and as it begins delivery along the whole system it will possibly be expanded to 150,000 bpd.

P&GJ: Did you use open trench throughout the project?

Lindley: We used a combination of open trench, conventional bores, HDD and barge lay to complete the project.

P&GJ: What was the trench depth and did you have to deviate from that to accommodate permits that required deeper depths or special considerations?

Lindley: We typically placed the pipeline with 4 feet of cover. There are many areas deeper than that due to foreign line crossings, creek, railroad and road crossings, HDDs, bores, etc.

P&GJ: Can you explain the HDD work on the project?

Lindley: While there were a number of HDDs, up to 30, not all were for water crossings. The only HDDs for water were two in Nueces Bay and in the Atascosa and Frio rivers. Also, several were required for deep drainage ditches.

The HDDs were in the mainline contractor’s scope of work to complete. They hired the subcontractors to perform the drills so there were several different drilling contractors on the project.

Sunland had the most technically and environmentally challenging HDDs on the project. The longest HDD was approximately 7,800 feet. The drill went from the south side of Nueces Bay, crossed under the Corpus Christi Ship Channel and exited out into Nueces Bay.

This drill was very deep, approximately 190 feet, to avoid any future development plans for the ship channel. The HDD extended out in the bay to avoid impacts to sea grass and oyster beds per the requirements of our USACE permit.

Also out in the bay, the HDD crossed under many existing flow lines. Another major environmental challenge was that this drill went through possible contaminated soils on the south end due to the close proximity of the existing industrial areas.

To accommodate this, the contractor drove a temporary casing pipe through the zone of possible contamination to avoid spreading any contaminated soils throughout the rest of the drill path. All excavated materials and drilling mud were hauled off site to an approved disposal facility.

The second HDD on this spread was the shore approach on the north side of the bay. This HDD was approximately 7,000 feet long and was done to avoid impacts to sea grass and oyster beds.

Sunland Construction installed the Nueces Bay crossing spread, which was 4.5 miles of 16-inch pipeline. Driver Pipeline completed two spreads of 16-inch pipe lay that involved some 23 miles.

Sprint Pipeline completed the two 12-inch spreads. These were the largest, totaling 120 miles. And NVI, working with Ritter Construction, completed the conversion of the existing Goebel line from gas service over to liquid service.

P&GJ: What do you consider the most challenging aspect of the entire project?

Lindley: The Nueces Bay crossing was the most challenging portion of the Double Eagle project. The spread was a combination of technically and environmentally challenging HDDs that had to be tied together with approximately 7,000 feet of shallow water barge lay.

P&GJ: Can you briefly describe additional facilities that were constructed?

Lindley: Double Eagle constructed a new truck unloading and storage facility near Three Rivers, which began service in mid-April. This facility includes 400,000 bbls of storage tank capacity that serves as pipeline break out storage as well as a four-lane truck unloading rack.

P&GJ: What was the overall project cost?

Lindley: Approximately $145 million.

P&GJ: Did the project come in on time and budget?

Lindley: All the construction has been completed and the project is currently on time and on budget.

P&GJ: Are there other projects you might mention?

Lindley: Yes. In September, KMP completed construction of the 141-mile, 16-inch Parkway Pipeline which transports refined petroleum products from refineries in Norco, LA to an existing petroleum transportation hub in Collins, MS. Parkway, a 50-50 joint venture between Kinder Morgan and Valero Energy, has an initial capacity of 110,000 bpd with the ability to expand to over 200,000 bpd.

Also, Kinder Morgan and MarkWest Utica EMG, L.L.C., a joint venture between MarkWest Energy Partners, L.P. and The Energy and Minerals Group (EMG), have signed a letter of intent to form a midstream joint venture to pursue two critical new projects to support producers in the Utica and Marcellus shales in Ohio, Pennsylvania and West Virginia.

The first project consists of the development of a 400 MMcf/d cryogenic processing complex in Tuscarawas County, OH, utilizing an existing, 220-acre site that Kinder Morgan has under option. The second project consists of the development of an initial, 200,000-bpd, C2+ NGL pipeline that originates at the planned JV processing facilities in Ohio and transports NGLs to Gulf Coast fractionation facilities.

Comments