November 2014, Vol. 241, No. 11

Features

Reducing Market Barriers Seen As Key To Chinas Gas Pipe Dream

China’s domestic natural gas production is expected to rise from 120 Bcm to 172 Bcm in 2018. In parallel, the nation is pressing ahead with drilling for unconventional gas and expects to reach its target output of 30 Bcm in 2020.

China imports gas from Turkmenistan, Kazakhstan, Australia, Qatar and Yemen, which accounted for almost one-third of its consumption in 2013, according to Bloomberg. The bulk of pipeline gas supplies come from Turkmenistan and are forecast to reach 40 Bcm annually by 2015 and 65 Bcm by 2020.

Kazakhstan will export gas to China in 2015 after the completion of the Beineu-Shymkent gas pipeline. Rising domestic production of natural gas, augmented by rising gas of liquid natural gas (LNG) by tanker and pipeline imports will support the “dash for gas” during which demand for gas will nearly double by 2019, according to the International Energy Agency (IEA). From 2018 gas supplies will be further boosted by imports from Siberia, following the agreement in May, between Russia’s Gazprom and the China National Petroleum Corp. (CNPC), to supply 38 Bcm a year.

Construction work on what will be one of the biggest pipelines in the world, running from the gas fields in Siberia to the border with China’s Far East, was launched by Russian President Vladimir Putin and Chinese Vice Premier, Zhang Gaoli recently. This substantial expansion in gas supply will double the share of gas in the country’s energy mix from 4% to 8% by 2017.

Underpinning the rapid expansion of supplies of gas is a massive construction boom in gas pipelines which will see a doubling in the length of the pipeline network between 2011-2016. By 2017, China will have added over 150 Bcm worth of natural gas pipeline transportation capacity, according to ChinaDaily.com.

Demand, Supply Trends

China is the world’s third-largest consumer of natural gas and the biggest potential buyer of LNG. The nation’s National Development and Reform Committee (NDRC) forecasts a 150% increase in China’s natural gas consumption, from 160 Bcm in 2013 to between 400-420 Bcm by 2020. By 2020 the gap between domestic supply and demand for gas is expected by the IEA to have reached 129 Bcm. Imports will increasingly play a more important role in coming decades.

Pipeline imports of natural gas are expected to rise by 350% from 27 Bcm to 120 Bcm in 2020 while total imports will increase 200% to 160 Bcm, an amount equal to China’s current total gas consumption.

Table 1: China’s Consumption and Production.

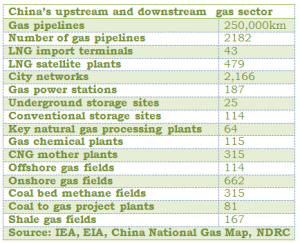

China’s main pipeline transmission grid and distribution networks have insufficient capacity to accommodate the flow of the rapidly rising supply of domestic gas to urban and industrial centers. Similarly, new sources of imports require expansion and extension of existing pipelines, as well as the construction of new pipelines. Despite the construction boom, gas pipelines will only reach 250,000 km by 2015 or about one-tenth that of North America. (Table 2).

Table 2: China’s upstream and downstream gas sector.

CNPC is China’s largest oil and gas producer, owning or operating 80% of the cross-border and cross-country and interregional natural gas pipeline network. Fitch, the credit rating agency, predicts CNPC will continue to be a major investor and initiator of pipeline construction. Pipeline construction in China serves five distinct functions:

• To deliver imported gas from central Asia and Russia via the west-to-east strategic pipelines to the major cities on the east coast, including Shanghai.

• To deliver gas to 1,890-plus city gas franchises through the interprovincial gas pipeline network.

• To provide domestic distribution and overcome congestion points by building up a nationwide distribution grid.

• To link the nine existing and five planned LNG import terminals, with a regasification capacity of about 35 MTPA, to the national gas grid.

• To transport domestically produced natural and shale gas, tight gas and coal bed methane.

Gas Pipelines

The key motivation for the gas pipeline construction boom remains the need to attain energy security by reducing overdependence on key suppliers by adding both new sources of supply and new routes. Equally important is the need to satisfy rising demand for power derived from the urbanization boom and population increase, as well as continued industrial expansion.

Increasingly important in the coming years will be the government’s determination to reduce coal use to combat chronic and serious air pollution. These factors underpin the furious pace of construction, which is a source of amazement to western eyes. In mid-August, the west section of China’s third west-to-east gas pipeline was completed as work started on the major stage of the China-to-Central Asia Pipeline D in Tajikistan.

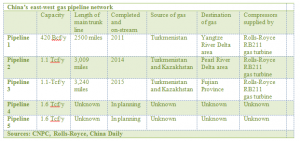

China has built some impressive pipelines, including the East-West pipeline that links central Asian gas fields with major cities along the coast, such as Hong Kong, Shanghai and Beijing. This pipeline network has grown from delivering just 420 Bcf/y in 2011 to over 2.5 Tcf/y in 2014, and next year capacity along this 3,000-mile pipeline network will increase by another 1 Tcf/y (See Table 3 and Figure 1).

Table 3

China’s east-west gas pipeline network

Another vital recently completed project is the Myanmar gas pipeline, delivering gas from Myanmar offshore gas fields and the Middle East to southern Chinese customers. This and the soon-to-be-completed parallel oil pipeline not only provide a new supply route, but also bypass the Straits of Malacca with its constant threat of piracy and interruptions.

Construction of the East Siberian-China gas pipeline has begun. It will carry gas from eastern Siberian fields to the Manchurian grid. The $75 billion, 2,000-km pipeline is expected to delivery 38 Bcm in 2018 but is facing an embargo on access to western technology, such as the Rolls-Royce RB 211 gas turbines needed to push the gas along the pipeline.

Keys To Future

The top three domestic oil and gas companies are being urged to accelerate the pace of construction on their natural gas infrastructure projects, including pipelines and LNG-receiving terminals, in order to boost gas supplies. However, according to Reuters, despite recent price increases averaging 15% for non-residential users in summer 2013, domestic gas prices remain 30% below world gas prices – a considerable commercial disincentive for new investment and a financial strain on state-owned corporations.

Indeed, CNPC is said to have invested $49 billion in new pipeline capacity between 2010-2013. At least as much is required now, leading state-owned energy companies to look for external sources of finance. PetroChina, the biggest company by market value in China, is considering opening up pipeline, exploration and refining units to private investors and has begun disposing of assets valued at $6.3 billion, according to Bloomberg.

Private sector investment is being encouraged and has been successful as seen in the popularity of CNPC’s Petro China pipeline joint venture with an investment fund in 2013.

“This is a good example of investors’ interest and points the way toward future financing of energy infrastructure,” said Alex An of Wood Mackenzie.

In order to meet the country’s economic, energy security and environmental ambitions, structural reform such as the breakup of the country’s major energy companies, reducing market-entry barriers to private enterprise and imposing major price reforms are essential. Unless action is taken, it is unlikely China will have the gas pipeline infrastructure in place to meet its ambitious target of doubling gas consumption by 2017.

Author:

Nicolas Newman is an Oxford, UK-based journalist and broadcaster, who concentrates primarily on the global energy sector.

Comments