November 2014, Vol. 241, No. 11

Features

UGI Gets Aggressive With Pipeline Replacement Program

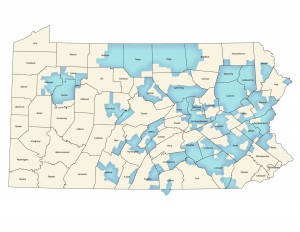

In some ways UGI Utilities is fortunate to be so far ahead of the game when it comes to infrastructure replacement. The natural gas distributor, which serves 600,000 customers in 45 eastern and central Pennsylvania counties and one county in Maryland, has about 86% of its 12,000 miles of pipeline already constructed of contemporary materials.

Still, that leaves about 1,200 miles of bare steel and 350 miles of cast-iron infrastructure to replace throughout the region’s challenging terrain, often facing brutal weather.

“All the cast-iron in our system will be replaced by February 2027, and the bare steel pipe in the UGI system will be replaced by 2041,” said Bob Krieger, UGI vice president of operations. “We are on an aggressive schedule for getting that pipe out of the ground, without question.”

The $1.2 billion replacement program, which began in February 2012, is on pace to update 65 miles of pipeline this year alone. The Pennsylvania Public Utility Commission (PUC) recently approved the company’s long-term infrastructure improvement plans and an accelerated recovery mechanism, or distribution system improvement charges (DSIC), when eligible.

Krieger, whose energy industry experience spans nearly 28 years, all at UGI, ranging from distribution operations, construction and maintenance to GIS implementation, expects his company to maintain “an aggressive schedule” for the next 14 years, spending about $85 million or more annually.

The size of the pipe being replaced varies but most are smaller diameter mains, measuring 3 to 8 inches. While UGI still has some pipe from the early 1900s to replace, Krieger said the company is “fortunate from that perspective” in that compared to other gas utilities its infrastructure is relatively new.

Fortunate or not, the Reading, PA-based natural gas supplier still faces the same logistical problems that confront any company working in congested areas such as WilkesBarre Scranton and Pennsylvania’s state capital, Harrisburg.

“I think every utility is faced with these challenges,” the Penn State University graduate said. “UGI engineering and operations personnel have had numerous meetings with Harrisburg authorities about ongoing infrastructure replacement downtown. When we are doing our work, particularly in Harrisburg, a lot of it has been done after hours to avoid congestion around the capitol. That’s not uncommon for us.”

Still, there are times that UGI closes roads or detours traffic for the safety of the public and its employees. When that happens, the company keeps residents abreast of the work being done through a suite of the communication tools and social media alerts, which provide roadwork bulletins and other advisories. UGI also employs some old standbys to get the word out: door-hangers and public meetings.

One of the best ways the company has found to keep long-range traffic and pedestrian problems to a minimum is by coordinating its work with other entities that are planning water or sewer projects.

“We’ll try to work in tune with the municipality that’s doing that work,” Krieger said. “The last thing we want is for a city to do a digging project, and then two years later UGI comes into that same area and starts replacing mains on the same streets.”

Another way disruptions are kept to a minimum involves the use of high-density polyethylene pipe that is inserted through existing main lines, thereby avoiding trenching along the length of an entire street.

“As we are doing this, we’re also converting and upgrading from what is typically a low-pressure system of cast-iron or bare steel to a medium-pressure system, which gives us additional capacity as we grow and serve additional customers,” he said.

At some locations UGI has adapted small hole technology, allowing its crews to core an 18-inch diameter hole in order to gain access for certain tasks. This eliminates much of the disturbance that would occur in the area if more conventional methods were used. The core removed from the hole can then be replaced as a permanent repair.

Additionally, UGI has tested a system that enables workers to install coil pipe of up to 500 feet in length. Installing coil pipe limits the number of joints required, saving time and labor.

“We’ve had a lot of success of late with the pipe-straightening tool that enables us to use larger diameter coil pipe,” Krieger said.

In addition to the replacement of first-generation mains, UGI plans to install excess flow valves, and replace and relocate meters, as well as installing new risers, meter bars, regulator stations and service regulators, among other appurtenances that further improve the integrity of its overall system.

Due to the volume of work UGI is undertaking, the company recently announced it will hire 100 additional field employees, incrementally. UGI is also in the process of reorganizing while adding supervisory staff, managers, engineers and training positions. The company has expanded the number of contractors it uses as well.

“As recently as this year, we introduced an ‘on-boarding’ process to better prepare the new hires as they enter the UGI workforce,” Krieger said. “The first day on the job, instead of reporting to our HR department and getting acclimated, field hires report to our training center so we can start to impart our safety culture on them immediately. We want to emphasize as they walk in the door the importance of safety.”

While safety has always been a core value at UGI, it has become even more paramount since the deadly 2011 explosion in Allentown, PA, caused by a crack in a cast-iron main. UGI has significantly increased its leak survey and detection programs, enhanced its odorization testing and monitoring, and greatly expanded safety information to customers, communities and stakeholders.

“UGI Utilities is committed to the safe and reliable delivery of energy to our customers and the many communities we serve,” said Krieger. “A core element of this commitment is to ensure we design, operate and maintain safe and reliable facilities.”

It’s a commitment UGI continues to make good on.

With the nationwide push to replace aging infrastructure creating a huge demand for skill and technical labor, UGI has taken steps to ensure that enough skilled laborers are available to fill positions in its aggressive replacement program. This includes talking with educational institutions about the type of expertise it and others in the industry will need in coming years.

“We’ve also recruited a number of military veterans and reservists. These individuals possess leadership skills they’ve developed while serving our country,” Krieger said. “We take great pride in going to local military job fairs.”

Beyond the replacement program, the increasing use of natural gas in the region has kept UGI busy with the company adding 40,000 residential and commercial customers who have converted from fuel oil in the past four years.

“That (conversions) is something UGI has been very successful at even before Marcellus,” said Krieger, a western Pennsylvania native. “That’s especially significant, given the tougher economic times we’ve had.”

Still, UGI estimates 70% of the gas in the company’s pipelines comes directly or indirectly from the Marcellus; as a result, prices are 30-40% lower now than in 2008.

To assist with the cost of converting to natural gas, UGI launched the Growth Extension Tariff (GET) pilot program, which allows customers to pay a monthly surcharge over a 10-year period, thereby avoiding the significant up-front cost.

The typical GET gas customer will be able to use a portion of the savings generated from converting to natural gas to offset the surcharge. The program, approved by the state PUC last February, is being funded by UGI for $75 million over the next five years.

“It’s really a win for customers,” Krieger said. “They are going to see lower bills based on the current price vs. oil.”

UGI Utilities, a wholly owned subsidiary of UGI Corp., based in Valley Forge, PA., saw dramatic growth during the middle part of the last decade. In 2006, the company bought the gas operations of PG Energy Inc. from Southern Union for $580 million, adding 158,000 customers to its operations in Pennsylvania, including the cities of Scranton, Wilkes-Barre and Williamsport. Two years later, UGI acquired the gas operations of Pennsylvania Power & Light (PPL) for $268 million and working capital, adding 76,000 customers in the state.

Study: UGI Tops East Region For Customer Satisfaction

Even though the nation faced more harsh weather and increased gas bills this past winter, customer satisfaction with residential gas utilities improved for a third consecutive year, according to a J.D. Power study.

For a second straight year, UGI found itself sitting at the top of the ratings among large utilities in the East region.

“Achieving this honor for the second straight year is a testament to our employees’ commitment to our customers and to the communities we serve,” said UGI President and CEO Robert F. Beard. “Every UGI employee contributed to this accomplishment. We will continue to strive to maintain the highest level of customer service in the years ahead.”

The 2014 Gas Utility Residential Customer Satisfaction Study, in its 13th year, measures residential customer satisfaction with gas utility companies across six factors: billing and payment, price, corporate citizenship, communications, customer service and field service.

Key Findings

• Communication from gas utilities informing customers about efforts to keep energy costs low is a key driver of satisfaction.

• Payments made online at a utility’s website are the most satisfying to customers, compared with all other payment types.

• While 51% of customers have an online account at their utility’s website, up from 48% in 2013, only three in 10 customers receive their monthly bill electronically.

• More gas customers are taking action to save energy – 18% vs.13% in 2013.

• Corporate citizenship satisfaction is up significantly, driven primarily by utility efforts to maintain a safe gas system.

“Natural gas utilities have offset the negatives by improving engagement with their customers,” said Andrew Heath, director of the energy practice at J.D. Power. “That engagement isn’t just about the bill and responding to customer service questions. It’s also about effective communication and demonstrating leadership in the local community.”

Study Rankings

The study ranks large and midsize utility companies in four geographic regions: East, Midwest, South and West. Companies in the midsize utility segment serve between 125,000 and 399,999 residential customers, and companies in the large utility segment serve 400,000 or more residential customers.

East Region – Among large utilities, UGI ranks highest with a score of 662 (on a 1,000-point scale) for a second consecutive year. Following in the segment rankings are New Jersey Natural Gas (653) and National Fuel Gas (646).

In the midsize utility segment, Columbia Gas of Pennsylvania ranks highest (641), followed by NSTAR (631) and Rochester Gas & Electric (630).

Midwest Region – DTE Energy ranks highest among large utilities with a score of 676. Consumers Energy ranks second (666) and MidAmerican Energy ranks third (664).

Among midsize utilities in the Midwest, Madison Gas & Electric ranks highest with a score of 662. Alliant Energy ranks second (648), followed by Louisville Gas & Electric (645).

South Region – Oklahoma Natural Gas ranks highest in the large utility segment for a third consecutive year with a score of 676. CenterPoint Energy-South ranks second (665) and Texas Gas Service ranks third (663).

Among midsize utilities, TECO Peoples Gas ranks highest with a score of 680 for a second consecutive year. Following in the rankings are South Carolina Electric & Gas (663) and Virginia Natural Gas (658).

West Region – NW Natural ranks highest for a second consecutive year with a score of 678. Following are Southern California Gas Company (670) and Southwest Gas (661).

Among midsize utilities, Colorado Springs Utilities ranks highest with a score of 669. Cascade Natural Gas ranks second (660), followed by Intermountain Gas Company (658).

The study is based on more than 69,800 responses from residential customers of 83 gas utilities between September 2013 and July 2014.

Comments