January 2015, Vol. 242, No. 1

Features

Black & Veatch Sees Growth Likely As Drilling Slows Down

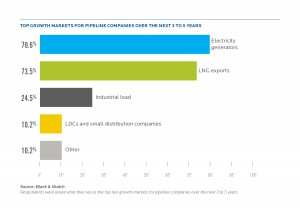

Declining crude oil prices will likely lead to reduced production, but consultants at Black & Veatch expect natural gas to meet increasing demands, particularly as new projects begin to come online in the near future.

“I suspect the optimism has been dampened a little by the softening of oil prices,” Peter Abt, managing director of Black & Veatch management consulting, told P&GJ. “However, the companies are prudent in modifying their capital budgets, and will the make the necessary adjustments.”

Currently this translates primarily into the slowing of some drilling-related activity among independents, particularly those that are heavily leveraged, he said. Companies with stronger balance sheets are expected to focus on drilling prospects that allow them to maintain their levels of production.

“You’ll see a slowdown in the overall growth in oil production over the next 18- to 24-month period that will moderate overall production growth, but I still think we will see some growth,” said Abt.

Majors, meanwhile, are expected to slow down considerably less with current levels of activity among oil sands producers predicted to show moderate growth. Still, Abt cautioned if prices fall below $65, some plays would become “uneconomical,” with the end result being “a rather sharp decline at that level.”

If oil production should go through a sustained period of low prices – two to four years – the market for related construction of infrastructure will also weaken. At the moment, though, there are several projects about to be built or permitted, he said.

“There are many megaprojects under development related to increased demand for natural gas in the United States, not the least of which has been prompted by the growing industrial demand,” Abt said.

Many of those projects are located along the Gulf Coast, including ethelyne crackers, methanol plants and several nitrogen facilities. Also, there is the NET Mexico pipeline, running from the Eagle Ford Shale south into Mexico, which will ship 2.1 Bcf/d. In all, Black & Veatch projects Mexico will increase its demand between 4-6 Bcf/d over the next five to 10 years.

Another real demand opportunity, Abt said, relates to liquefied natural gas (LNG) export facilities with four under construction: Sabine Pass (targeted for completion by early 2017), Cheniere, Freeport and Cove Point LNG. Several others are under development with new demand projections of between 8-12 Bcf/d over the next five to 10 years.

“A lot of these projects have firm commitments,” Abt said. “Those parties recognize there is a price risk, but despite that they are committed to these long-term opportunities.”

Abt said he sees the Department of Energy’s (DOE) decision to require companies seeking permits to export LNG to countries without free-trade agreements with the United States to first gain final environmental statements as a blessing for the industry. This eliminates the handing out of permits on a first-come, first-served basis.

“By changing the rule, that was a game-changer,” he said. “To prosecute a FERC application costs a developer between $25-65 million. That separates want-to-be projects from those that have the financial wherewithal and balance sheets to run through the entire process.”

That move alone, in his opinion, cuts the list of projects with a realistic chance of going forward roughly in half, to about 12. Since LNG exports will not become significant until 2018 or 2019, this represents a commitment of 20 years and beyond.

Natural Gas Prices

With about 2 Bcf/d of U.S. natural gas awaiting interconnection to pipelines, Black & Veatch doesn’t see the decline in oil prices as having much effect on prices in the near term, particularly since much of that supply should come online within the next six to eight months.

“As long as we have oil-directed drilling in the Permian Basin, the Eagle Ford, the Bakken and the Marcellus, which we expect to happen in the $75 price range [per barrel], there will still be plenty of natural gas to meet demands,” Abt said.

If, however, natural gas prices were to rise to the $5 or $5.50/MMbtu level for a sustained period, drilling rigs will refocus on dry gas plays because many locations in the Haynesville, the dry Marcellus and the dry Eagle Ford become profitable at those levels.

Abt, who has focused on natural gas and electric power generation during his 30-plus years in the energy sector, said the U.S. transition to natural gas remains strong under its own power, while much of the growing renewable energy activity is driven by economic subsidies and state mandates on renewable performance standards.

Even where renewables have made inroads, natural gas generation is still needed as a standby source of capacity on days when “the wind doesn’t blow or the sun isn’t shining,” he said. In addition, part of the Clean Power Plan as proposed by the Environmental Protection Agency (EPA) calls for state guidelines requiring average utilization of natural gas power plants to reach 70% of capacity, substantially higher than today’s levels.

Also weighing in favor of the natural gas industry is the interest shown by long-distance trucking companies in converting fleets to LNG and by short-haul delivery services in switching to compressed natural gas (CNG). This is in addition to the potential for LNG as fuel for maritime and rail fuel.

“It’s kind of a chicken-and-egg process that we are dealing with,” Abt said. “If you are going to be able to convince a fleet owner to convert, the economics have to work.”

Nonetheless, one barrier to the positive movement on the natural gas front – cited by 71.4% of Black & Veatch survey respondents – continues to be concern over construction delays caused by opposition groups. While some opponents of new pipelines oppose particular routes, others including the Sierra Club oppose further development of any fossil fuel-based energy.

“This whole [permit approval] process isn’t easy. There are obstacles placed in front of every developer each step of the way,” Abt said.

Political Climate

Despite the political gridlock on the federal level that many observers expect to intensify following the midterm elections, Abt said he sees some areas in which the administration and Congress might work together.

One is the Keystone XL Pipeline, which he said can be lauded by both sides as a means to create jobs, while also providing the safest way to transport product from the Canadian oil sands – product that will be developed even if the pipeline fails to gain approval.

“I’m not sure the president will approve Keystone, and I’m not sure if he doesn’t, the Senate can get 67 votes to override a veto, but I think the opportunity is there,” Abt said.

Even without the Keystone XL Pipeline, there are several projects in various stages of development that would boost oil sands production. Among these are Enbridge’s Southern Access Extension, which would move oil into the Midwest via a 165-mile pipe to a hub in Patoka, IL. Additionally, TransCanada may convert 1,865 miles of its Mainline natural gas pipeline to move oil from Hardisty, Alberta and Saskatchewan as far east as St John, New Brunswick on the eastern coast.

“Keystone is important and it’s become kind of the bellwether in terms of the overall state of the industry,” Abt said, “but I don’t think people should just look at that in a vacuum.”

Another area of potential agreement is the lifting of the ban on oil exports.

“Our refineries are not built to process the tremendous amount of lighter oil that is being produced now,” Abt said. “We’ve already seen some tremendous movement with respect to condensate exports.”

Abt, however, does not expect whatever level of cooperation that transpires on Capitol Hill to extend to the Clean Air initiatives or the president’s recent greenhouse emissions agreement with China, which doesn’t require congressional approval but could face efforts to roll back its guidelines.

The China Factor

On the horizon, Black & Veatch anticipates China becoming a great market opportunity for natural gas and LNG exports as its standard of living and demand for energy continue to grow unabated.

“The demand for natural gas there is real,” Abt said. “The deal with the Russians, assuming it ever comes to fruition [about 3.5 Bcf/d] is a drop in the bucket compared to the demand they are going to have in the next 15-20 years.”

China is expected to continue developing its upstream resources and pursue shale development. However, the varieties of geological conditions, along with the lack of infrastructure – including roads for rigs and other equipment – have caused more problems than China initially expected. Additionally, the unexpected outcry of the Chinese people over poor air quality caused by coal-fired energy generation has prompted an even greater demand for natural gas.

By Michael Reed, Managing Editor

Comments