October 2015, Vol. 242, No. 10

Features

Is Gas Storage Up for the Challenge?

What’s in your storage cavern?

It’s that time of the year when the natural gas industry takes stock of its supplies that it attempts to match with consumption and demand. Thanks to burgeoning production from the Marcellus Shale, consumers have had little problem accessing natural gas despite two colder than normal winters.

The question has always been, when do you need to begin storing your natural gas? Is the product priced too high to store for later usage, or is it so low that it’s best to put it in the ground now in hopes of seeing higher prices when weather dictates there will be in high demand?

The Energy Information Administration (EIA) reports that the natural gas storage injection season passed the halfway mark in mid-July with inventories totaling 2,912 Bcf on July 31 – that’s 23% higher than a year earlier and 2% higher than the previous five-year average (2010-14). EIA projects inventories will end October at 3,867 Bcf, which would be the second-highest October level on record and surpassing the five-year average by a wide margin.

Year-over-year strength in production has boosted storage injections this summer, despite warmer temperatures, which have increased natural gas use in the power sector to serve air conditioning demand, the EIA said in its most recent review.

EIA Perspective

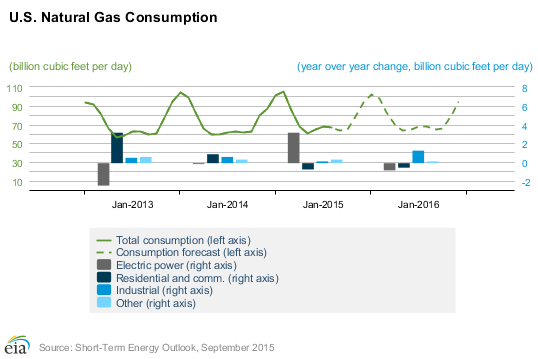

EIA’s forecast of U.S. total natural gas consumption averages 76.5 Bcf/d in both 2015 and 2016, compared with 73.5 Bcf/d in 2014. EIA projects natural gas consumption in the power sector to increase by 13.9% in 2015 and then decrease by 3.4% in 2016. Relatively low natural gas prices support increased use of natural gas for electricity generation in 2015.

Industrial sector consumption increases by 2.3% in 2015 and by 5% in 2016, as new industrial projects, particularly in the fertilizer and chemicals sectors, come online later this year and next year, and as industrial consumers continue to take advantage of low natural gas prices. Natural gas consumption in the residential and commercial sectors is projected to decline in 2015 and 2016.

EIA expects marketed natural gas production will increase by 4 Bcf/d (5.4%) and by 1.8 Bcf/d (2.3%) in 2015 and 2016, respectively. Despite data showing month-over-month production declines in May and June, natural gas production remains higher than year-ago levels.

EIA expects moderate growth through 2016, with increases in the Lower 48 states expected to more than offset long-term production declines in the Gulf of Mexico. Increases in drilling efficiency will continue to support growing natural gas production in the forecast despite relatively low natural gas prices. Most of the growth is expected to come from the Marcellus Shale, as the backlog of uncompleted wells is reduced and as new pipelines come online to deliver Marcellus natural gas to markets in the Northeast.

Increases in domestic natural gas production are expected to reduce demand for natural gas imports from Canada and support growth in exports to Mexico. EIA expects natural gas exports to Mexico, particularly from the Eagle Ford Shale in South Texas, to increase because of growing demand from Mexico’s electric power sector, coupled with flat Mexican natural gas production. EIA projects LNG gross exports will increase to an average of 0.79 Bcf/d in 2016, with the startup of a major LNG liquefaction plant in the Lower 48 states.

For a more complete understanding of the gas storage market, P&GJ spoke with two well-known storage executives, John M. Hopper, managing director, Nexus Energy Logistics LLC, and Jeff Foutch, EVP/chief commercial officer, Peregrine Midstream Partners LLC.

P&GJ: Storage has traditionally been seen as a hedging tool for the gas market; in your view, has the conventional role of the gas storage market changed?

Hopper: No. Storage is still very much used as an effective hedging tool. That said, in certain markets – like the gas-fired electric power generation market – gas storage also is used as an operational tool. It’s a place to put gas during the off-peak in the power market and a place to get gas from during the peaks in the power market – which is still a form of hedging. I suppose (it’s just more operationally driven than pure financially driven). Any gas buyer for a gas-fired power plant will tell you that it’s very difficult, if not impossible, to buy gas on an hourly basis or get rid of gas (sell it) on that basis. Storage is really the only economically viable option for doing that.

Foutch: Storage is still a hedging tool. The supply demand balance is still very seasonal, and we need the deliverability during peak demand, but the summer winter spreads are more compressed due to the huge amount of gas hitting the market, so storage it is not as lucrative as before.

I see more summer peaking priced into the market as we shift to more gas-fired electric generation away from coal. So it is seeing an increased role in providing operational flexibility to meet dual peaks and more gas-fired generation. Also, as pipeline flows change due to the development of new supply basins, it is seeing increased use as a put option for supplies.

P&GJ: What concerns do you have as we approach the next winter season? What factors will drive the market?

Hopper: I still believe that if we have a cold enough winter in the heavily populated market areas, then we are going to see price spikes just like we saw during the 2013-14 winter. I don’t care how much shale gas reserves are out there in the ground. The fact is that if it gets cold enough, there simply isn’t enough combined deliverability from flowing gas wells (shale and conventional wells) plus withdrawals from storage facilities to satisfy peak winter demand. We saw that very clearly during the 2013-14 winter and nothing has happened to really change that dynamic since then.

Foutch: There is not much concern about getting enough gas in storage this season; the main factor driving the market this winter will be the weather. Unless we see a pronounced reduction in supplies, we could see a large basis drop in the fall as mild weather sets in and gas tries to find a home while storage is near full.

P&GJ: How did the storage sector handle last winter? Were there any specific challenges or problems that operators faced?

Hopper: As far as I am aware, the gas storage industry handled last winter just fine. Of course, it wasn’t all that cold comparatively speaking – and certainly not as cold as it was the winter before.

Foutch: After having survived the polar vortex of the previous winter, it seemed that everyone was ready to handle anything. The only challenge was getting enough gas back into storage for the 2014-2015 winter after stocks were drawn down so low from the 2014 polar vortex winter.

P&GJ: How has the storage business kept pace with the natural gas boom? Do we have enough storage to accommodate production, and in your view, how much more do we need?

Hopper: That’s a very good question. The market has been signaling for some time that we have enough gas storage capacity already – or at least enough perceived gas supply in the aggregate – available to satisfy peak winter demand. As a result, seasonal storage spreads are (and for the last several years have been) pretty thin – which signals that we have enough winter gas supply and don’t need any more gas supply deliverability from storage. But again, I draw your attention to the winter of 2013-14, which suggests the contrary.

The challenge for the gas storage market is that the rest of the energy market effectively is saying “Yeah, we were short deliverability for a month or so in one winter out of the last five, but that just isn’t enough of an economic incentive to build (or contract for) more gas storage capacity.” I think that’s pretty short-sighted but I suppose my view is a bit biased.

Foutch: In answer to your first question it really hasn’t. Storage may not have keep pace to store enough gas since summer/winter spreads have collapsed in the past few years and very little new storage has been added. There have been some expansions of existing storage where it makes sense to serve the local market for supply or demand. But there have also been projects canceled or abandoned, potentially offsetting the expansions. We will need storage in places where it has not traditionally been located due to changes in pipeline flows and new demand centers due to electric generation buildout, new exports and new industrial load.

P&GJ: Do we have, and are we constructing, enough storage facilities where they are needed most, particularly as the Marcellus and Utica shales remain strong? What are the challenges involved in developing storage reservoirs up north?

Hopper: It would be hard for me to get very excited about building more gas storage capacity in the Northeast. The Marcellus and Utica shales are going gangbusters up there and drilling continues despite relatively low gas prices. So there is lots of gas up there. And there aren’t that many viable sites left for developing gas storage in the Northeast, even if the case could be made that the market needs or wants more storage capacity there. I think there are better places to develop gas storage capacity.

Foutch: Answering your first question, the market evidently doesn’t think so. The greatest challenge is the market does not justify the cost of developing new storage pretty much anywhere at this time.

P&GJ: So, will the Gulf Coast region, with its salt facilities, continue to be the center of the storage business?

Hopper: That also is a very interesting question. It remains to be seen whether the Henry Hub continues to be a focal point for gas aggregation and distribution – or even as the settlement point for the NYMEX gas futures contract. There has been a lot of chatter in the industry about that recently. Of course, LNG very well could and likely will have an impact on all of that. On balance, I’d say that as more sources of gas demand come on line in the next couple of years in the Gulf Coast area (petrochemical plants, etc.) and LNG liquefaction in the Gulf Coast also comes on line, the role of gas storage in the Gulf Coast region will become more important than it already is today.

Foutch: Salt is cheap to expand on a relative basis so incremental demand can be met where there is salt. The issue will be how do you meet new demand where there are no existing facilities and the summer winter spreads/volatility don’t justify new build in either salt or reservoir storage.

P&GJ: EIA projects inventories will close the injection season Oct. 31 at 3,867 Bcf, the second-highest end-of-October. Is this due to the current low price environment for natural gas? What does this mean for the storage market? Will this be a buyer’s market?

Hopper: Well, I think it means that there’s still a lot of gas supply out there looking for a home, and storage is always a welcoming place for gas to go when there isn’t enough demand out there to burn it all up.

Foutch: It is due to low price, and we do need more storage. As for a buyer’s market, well, you either take a low price for your gas or you try to buy storage and hedge it forward, but you are not going to pay more for storage than the market will let you make on it, unless you have operational or security of supply issues. But the storage contracting rates in this market will not justify new build. We are kind of at a standoff.

P&GJ: Are we seeing new owners/investors emerging to acquire or build storage assets?

Hopper: Yes – at least on the acquisition side. Brookfield has been quite acquisitive in the gas storage market over the last couple of years. They obviously have a point of view (which I happen to share) that gas storage capacity is relatively cheap right now (perhaps even below replacement cost) and that it will become more valuable in the future as more sources of gas demand come on line (and maybe even gas-directed drilling slows down a bit!). Other than that, I have not seen much new investor interest in gas storage, simply because of the market’s perception that we have enough gas supply during the winter to meet peak demand – but I’ve already pontificated on what I think about the fallacy of that premise.

Foutch: There are some parties acquiring assets that are suffering from a contracting rate perspective, because they can be acquired far below the cost to develop. The only new storage to be built will have to be at a cost that is low enough to produce a return at these current low storage contract rates. That may get easier to do since development costs are coming down due to the oil price collapse.

P&GJ: Has it become more difficult to arrange contract terms with buyers?

Hopper: It all depends on price. There is always a number at which storage capacity is going to clear the market – but even that depends on where the capacity is located and what kind of service the user wants.

Foutch: There are plenty of buyers; it is just a matter of what they will pay. Storage sellers are entering into shorter term contracts so they can take advantage of higher rates in the future. Buyers may want to lock up the space for a greater tenor for the same reasons. Many operators are selling PALs (park and loan services), just trying to maximize the intrinsic value and keeping all the optionality for themselves because they are not getting paid for a lot of extrinsic value.

P&GJ: How do you see the market for storage changing as we move closer to exporting LNG? Similarly, what changes may occur as more electric generators switch to natural gas?

Hopper: Again, an increase in the demand for natural gas could have a profound impact on the value of gas storage (much more so than any supply response, in my opinion). Certainly LNG is one potentially significant source of new gas demand. Gas-fired electric generation is another, and so are new petrochemical plants and other new industrial/manufacturing facilities as new sources of gas demand.

As these new sources of demand come on line, the need for incremental gas storage capacity (and the attendant value thereof) could certainly increase. This is especially so for highly variable sources of gas demand like gas-fired electric generation, which really need storage to properly manage their gas supply portfolios.

Foutch: It should grow in the areas being accessed for supplies to serve the LNG facilities. As far as the switch to natural gas, the answer is the same. There will be a need for storage to serve coal plant conversions where there has been little-to-no natural gas infrastructure in the past, and to serve gas-fired generation expansions.

P&GJ: Following that last question, this has been an extremely hot summer in much of the country. Has this had, or will it have, any implications for the storage operators?

Hopper: Well, there have been some weeks this summer where gas storage injections were lower than the historical norms because gas was being consumed in power plants instead of being injected into storage. As more gas-fired power generating capacity is built we will likely see more of this kind of thing happen during hot summers. And as other new sources of gas demand materialize (LNG, petrochemical, etc.) it is conceivable that filling storage capacity during the summer could become much more of a challenge than we have become accustomed to.

Foutch: It made a small dent in supplies but there is still a lot of gas hitting the market. There should be plenty of gas to fill storage for this winter.

John M. Hopper

Jeff Foutch

Comments