September 2015, Vol. 242, No. 9

Features

Pragmatic Approach to Understand Indian Natural Gas Market

A Pragmatic Approach to Understand Indian Natural Gas Market

Historically, India has relied on coal to generate power, liquid fuels as feedstock and oil for its transport sector. But for environmental reasons India needs to focus on cleaner fuels. Natural gas has emerged as the fuel of choice for many industries in India owing to its environmental benefits and higher economic efficiency. However, India’s natural gas market is seeing a supply deficit due to its low domestic production.

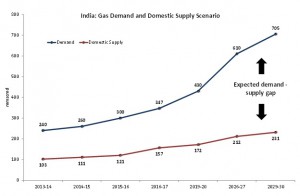

The demand and supply gap is increasing, and there is no reason it will stop. MarketsandMarkets expect that the demand for natural gas will reach about 705 MMscm/d by 2029-30, up from about 260 MMscm/d in 2014-15.

Demand for natural gas has risen significantly due to demand from the fertilizer and power sector which cumulatively accounted for over 60% of gas consumption in 2014. The demand is also driven by growing usage in the city gas distribution (CGD) sector and industrial sectors such as refining and petrochemicals. Rising concerns on carbon emission have also contributed to the demand for natural gas in the country.

Viability of India’s Gas Pipeline Options

India has been mulling several transnational gas pipelines, onshore or offshore — over the past two decades to meet the rising demand of natural gas, mainly from new power generation projects, fertilizer plants, and industrial users. But, till now none of the projects becomes a reality.

Over the years, several routes for gas pipelines have been proposed such as the Iran-Pakistan-India (IPI) Pipeline, Oman-India Deep Sea Pipeline and the most talked about Turkmenistan-Afghanistan-Pakistan-India (TAPI) Pipeline. However, all these projects were limited to the drawing board except for TAPI, which made some progress this year. The 1,735-km pipeline will run from Turkmenistan to India via Afghanistan and Pakistan.

The pipeline’s designed capacity is 33 Bcm annually. Investments are estimated at $7 billion. The multibillion-dollar TAPI project could be off to a year-end start, as the legal framework is expected to be in place by September, followed by the announcement of the consortium. However, TAPI pipeline faces an uncertain future with the recent oil price fall, ambiguity regarding transit via Afghanistan, and an increase in the estimated project cost.

Although energy companies such as Total, Chevron and ExxonMobiI have shown interest in financing and running the pipeline project and have been shortlisted for the contract, however, no company or consortium has stepped forward to take the necessary lead to manage the finance, design, construction and operation of the pipeline.

Critically, the oil and gas giants with the capacity to support TAPI have told the Turkmenistan government they will need exploration rights in country’s onshore gas fields, mainly Dauletabad, to make the project economically attractive. Turkmenistan so far will only consent to offshore exploration. This bottleneck has made any deal impossible.

The IPI pipeline was envisaged to link the South Pars gas field in Iran with India via Pakistan. The total length of the proposed pipeline is 2,700 km, costing $7.5 billion (current cost may be much higher) to transport 20-100 Bcm/y. Initially, this project was planned to link Iran and Pakistan; India later joined as a partner but withdrew, citing geopolitical and security reasons and the U.S. and EU sanctions on Iran.

Another project is the Oman-India Deep Sea pipeline which South Asia Gas Enterprise (SAGE) and Fox Petroleum claimed to be the most promising option. The project intends to transport over 200 Bcm to India over 20 years. The pipeline would be 1,300 km, laid at a depth of 3,400 meters below the seabed. It will connect the Middle East compression station near Oman with the receiving terminal near Gujarat. The estimated cost of this project is $4-5 billion and can be executed in about five years.

Geographically, the Oman-India Pipeline is comparatively more feasible because India is close to the sources of natural gas in the Middle East and the undersea distance is less than 1,300 km, if connected to Gujarat coast only.

Another reason in favor of this project is the landed cost at Oman Point, which will be lesser by $1.5-2/MMBtu as compared to LNG imports. It should be noted this project will overcome the security issue of IPI and TAPI projects.

However, Oman does not have large gas reserves compared to Iran and Turkmenistan. Oman has 0.7 Tcm of gas reserves with reserves to production ratio of 24 years. Hence, it makes no sense to build an infrastructure which will be stranded soon if Iran is not taken into consideration.

It is expected Iran will be freed from almost all economic and financial sanctions within the next six months, and India should kick start the IPI pipeline talk that had been in the doldrums. The IPI pipeline faces a serious problem of security as it passes through an area where the Taliban has a stronghold. The TAPI pipeline faces double the risk as it passes through Afghanistan and Pakistan.

In Afghanistan, the TAPI pipeline passes through Kandahar, which is considered to be the spiritual home of the Taliban. In a nutshell, the TAPI pipeline traversing Afghanistan and Pakistan is riskier than IPI, which has only to cross Pakistan.

TAPI and IPI pipelines are not feasible options due to the aforementioned reasons.

The Oman-India Deep Sea pipeline, however, seems a promising alternative, but in reality, it will remain a dream inside a pipe. Since India’s domestic production of natural gas has not been increasing and a cross-border pipeline is not on the cards anytime soon, importing LNG is the only feasible option to meet the rising natural gas demand in the country and an expensive one.

With a delivered price of $12.33/MMBtu, it is not easy for the fertilizer and power sectors to absorb such high-priced LNG. We are already in a low-oil price scenario; had it been a high oil price scenario, it would be next to impossible to feed the fertilizer and power sectors with LNG as it is oil-linked. Over the past five years, there has been an increase in LNG imports. India imports about 13.7 million tons of LNG, which accounts for about 33% of the total supply. Future LNG imports will depend on the expansion program of LNG terminals in India and the international spot price for LNG.

If the gray situation of low domestic gas production is allowed to continue, India will have no option but to import more LNG as the fuel source for its fertilizer and gas-based power plants. In view of the prevailing situation of gas production and supply and the price-sensitive nature of the fertilizer and power sectors, the government is promulgating gas-price pooling options to meet the sector’s gas shortage.

With the gas pooling mechanism, the price of gas supplied to fertilizer and power plants could settle close to $7.50-9/MMBtu including transportation cost. However, pooling of gas entails multiple risks. With high-priced LNG pooled with low-priced domestic gas, LNG negotiators could enter into unattractive contracts. It would be critical to ensure that this does not become a political issue.

What Does the Future Hold?

The cross-border gas pipelines from Turkmenistan and Iran are essential projects in Pakistan’s energy calculus. In the case of India, the TAPI and IPI pipelines are not realistic alternatives for multiple reasons: Pakistan’s precarious security situation and lack of an agreement that guarantees protection to the supply and alternatives in case of disruption are some of them. Hence, it is not the cross-border pipeline gas but LNG that will play a crucial role in meeting India’s energy demand in the future.

Gas pooling to the extent of domestic gas availability would benefit the fertilizer and power sectors and would also result in saving in subsidy outgo. The gas-pooling mechanism seems to be a worthwhile option for reviving India’s ailing fertilizer and gas-based power sector and can be implemented through collaborative efforts from all stakeholders. Gas pooling can only serve as a short-term solution for today’s concerns. The need is for more proactive government policies that will make every effort to find ways of attracting more public and private players to the sector and increase the country’s gas production.

Global natural gas markets have already felt some impact from the slide in oil prices. But those markets will be affected to a much greater degree if oil prices remain in the $50-60/bbl range for an extended period of time, given the interaction that exists between the two fuels. LNG capacity will increase by almost 50% by 2020, due to a huge number of LNG trains coming online in Australia and the United States.

LNG prices are expected to remain under pressure, given the increase in supply and decrease in demand. U.S. LNG has an advantage over the other LNG suppliers, since U.S. natural gas prices at $3-4/MMBtu are much lower than gas prices elsewhere. However, transportation cost of U.S. LNG to India is much higher and nullifies some of the advantages. Major LNG suppliers like Qatar and Australia have much lower transportation costs to India.

It is a price war but also a waiting game. Oversupply of LNG in the market and lower prices represent a real challenge to the industry, but that doesn’t mean the future is all gloom. What the future holds for India is the sufficient quantity of LNG from different countries, both the hub and oil-indexed.

Author: Priyank Srivastava works as a senior analyst specializing in oil and gas for MarketsandMarkets, a full-service market research and consulting firm. He has written high-level, strategically analyzed full-length reports on issues impacting the oil and gas industry.

Sources: Vision 2030, Natural Gas Infrastructure in India and MarketsandMarkets Analysis.

Priyank Srivastava

Comments