January 2016, Vol. 243, No. 1

Features

Crude Oil Prices to Remain Relatively Low Through 2016, 2017

The Short-Term Energy Outlook (STEO) released on Jan. 12, which is the first STEO to include projections for 2017, forecasts Brent crude oil prices will average $40 per barrel in 2016 and $50/bbl in 2017. West Texas Intermediate (WTI) crude oil prices are expected to be $2/bbl lower than Brent in 2016 and $3/bbl lower than Brent in 2017.

EIA recognizes that there is still high uncertainty in the crude oil price outlook. For example, EIA’s forecast for the average WTI price in April 2016 is $37/bbl, while the market expects WTI prices to range from $25/bbl to $56/bbl (at the 95% confidence interval) based on the recent prices of futures and options contracts for April 2016 delivery.

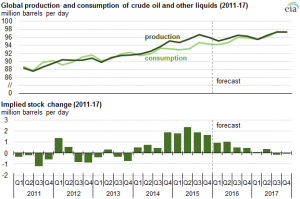

Crude oil prices are expected to remain low as supply continues to outpace demand in 2016 and more crude oil is placed into storage. EIA estimates that global oil inventories increased by 1.9 MMbpd in 2015, marking the second consecutive year of inventory builds. Inventories are forecast to rise by an additional 700,000 bpd in 2016, before the global oil market becomes relatively balanced in 2017. The first forecasted draw on global oil inventories is expected in the third quarter of 2017, marking the end of 14 consecutive quarters of inventory builds.

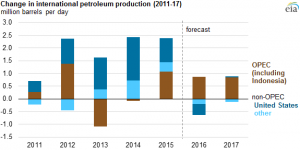

Since 2012, the United States has been the source of much of the global increase in production of petroleum and other liquids. In 2016 and 2017, however, members of the Organization of the Petroleum Exporting Countries (OPEC) are expected to account for most of production growth. EIA expects non-OPEC production to decline by 0.6 MMbpd in 2016, which would be the first decline in non-OPEC production since 2008. About two-thirds of this forecast decline in 2016 comes from the United States.

Since 2012, the United States has been the source of much of the global increase in production of petroleum and other liquids. In 2016 and 2017, however, members of the Organization of the Petroleum Exporting Countries (OPEC) are expected to account for most of production growth. EIA expects non-OPEC production to decline by 0.6 MMbpd in 2016, which would be the first decline in non-OPEC production since 2008. About two-thirds of this forecast decline in 2016 comes from the United States.

Changes in non-OPEC production are driven by changes in U.S. tight oil production, which is characterized by high decline rates and relatively short investment horizons that make it among the most price-sensitive production globally. Forecast total U.S. liquid fuels production declines by 400,000 bpd in 2016 and remains relatively flat in 2017, as low oil prices contribute to drilling rig counts falling below levels required to sustain current production rates.

OPEC crude oil production is forecast to increase by 500,000 bpd in 2016, with Iran accounting for most of that increase. Iran is expected to increase its production once international sanctions targeting its oil sector are suspended. Although uncertainty remains as to the timing of sanctions relief, EIA assumes this occurs in the first quarter of 2016. EIA’s timing reflects Iran’s progress in meeting key obligations required under the Joint Comprehensive Plan of Action, which has been faster than previously anticipated.

OPEC crude oil production is forecast to increase by 500,000 bpd in 2016, with Iran accounting for most of that increase. Iran is expected to increase its production once international sanctions targeting its oil sector are suspended. Although uncertainty remains as to the timing of sanctions relief, EIA assumes this occurs in the first quarter of 2016. EIA’s timing reflects Iran’s progress in meeting key obligations required under the Joint Comprehensive Plan of Action, which has been faster than previously anticipated.

EIA expects global consumption of petroleum and other liquid fuels to grow by 1.4 MMbpd in both 2016 and 2017. Forecast real gross domestic product (GDP) for the world, weighted by oil consumption, which increased by an estimated 2.4% in 2015, rises by 2.7% in 2016 and by 3.2% in 2017.

Principal contributor: Hannah Breul, Energy Information Administration

Comments