March 2016, Vol. 243, No. 3

Features

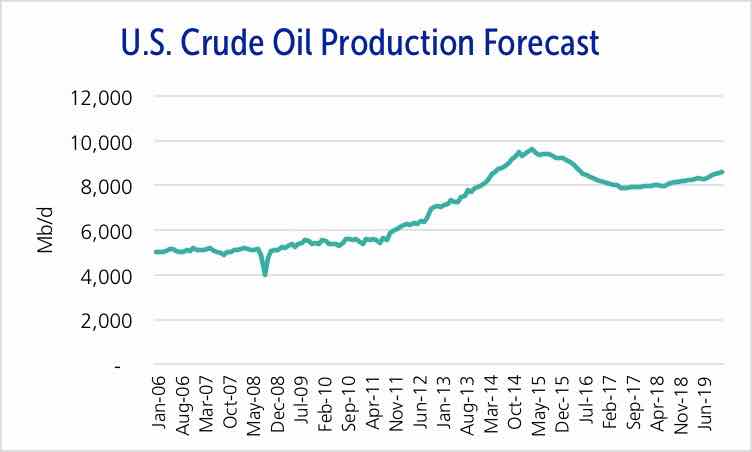

U.S. Production to Fall to 8.1 MMbpd by Year End, Researchers Say

With sustained weakness in crude prices and oil rigs at the lowest level since the economic crisis of 2008, production in the United States is set to see significant year-over-year declines.

U.S. production for the year peaked at 9.6 MMbpd in April and declined to 9.2 MMbpd by December. Industry research group Genscape expects these declines to continue into 2016 with production falling to 8.1 MMbpd by the end of 2016 – a 740 MMbpd year-over-year decline from 2015.

In the last two weeks of 2015, total rig counts dropped 75 rigs, and Genscape’s 2016 North American Crude Oil Production Forecast shows rigs continuing to fall through mid-2016. Currently, 695 rigs are drilling wells in the United States, which is the lowest level since at least 2006.

Genscape expects 386 rigs will be dropped over the next six months, hitting a bottom of 384 active rigs in July. Once the rig cutting is complete, the Lower 48 rig fleet will have lost 82% of its active fleet compared to October 2014.

With oil prices closing at about $36 on Jan. 8, the economics of nearly every play, even the premier plays, are being challenged by this low-price environment. Although, Genscape analysts do not foresee significant shut-ins, there will still be incremental retrenchment in drilling activity.

The only area in which Genscape expects year-over-year growth in 2016 is the Gulf of Mexico (GoM), up 41 MMbpd year-over-year, mostly as a result of new projects that are scheduled to come online. These projects were commissioned when prices were higher. Due to the large amounts of capital sunk into them, the projects will come online despite of the lower price environment.

Of the big three shale plays, the Permian Basin will fare better than the North Dakota and South Texas regions, according to analysts. The Permian is only expected to decline by 30 MMbpd year-over-year in 2016, compared to declines of 175 MMbpd year-over-year in North Dakota and 266 MMbpd year-over-year in South Texas.

Though some areas will benefit from both well and rig efficiencies, the outright level of drilling anticipated in 2016 will not be enough to forestall further production declines.

Canadian Crude Production to Grow Despite Prices

While sustained sub-$40/bbl prices have caused significant cutbacks in drilling programs through 2015 and early 2016, it Genscape expects heavy oil production from oil sands projects will continue to expand, resulting in net growth for Canadian supply of 125 MMbpd in 2016.

Such sizable growth is in line with company comments concerning the largest oil sands projects that are either on track to reach or are currently ramping up to nameplate capacity. Large-scale projects such as Husky’s Sunrise, ConocoPhillips’ Surmont, and Cenovus’ Christina Lake and Foster Creek are pushing ever-increasing volumes to market.

Though Genscape expects material growth in oil sands production, bitumen production leads its growth expectations, adding another 237 MMbpd of bitumen supply in 2016 and 216 MMbpd in 2017.

Despite this rapid growth in oil sands and bitumen production, the forecast is very bearish on non-bitumen drilling activity in the coming year. Non-bitumen oil rigs will average just 26 rigs in 2016, about a third of the 76-rig average the previous year.

Comments from Precision Drilling’s third-quarter conference call support this view:

“…We believe we will see 2016 Canadian E&P drilling budgets reduced anywhere in the range of 30% to 50% from 2015 levels or more … we should expect the industry’s weakest winter drilling season since late 1990s…”

On top of this contrast of drastically lower conventional drilling and increasing heavy supply, there will be waning activity at the major oil sands upgraders, as a heavy slate of maintenance scheduled in the first half of 2016 will temporarily reduce synthetic crude oil supply in April through July.

Notably, Genscape analysts expect maintenance at the Suncor, Shell, Syncrude and CNRL upgraders in the spring and early summer. These events, along with the coker tie-in at the Horizon upgrader planned for the second half of 2016, will lead to a moderate growth rate of 22 MMbpd for synthetic oil production in 2016.

With increasing oil sands and bitumen production, and tempered non-bitumen drilling activity and upgrader maintenance, Canadian supply will make for an interesting 2016.

By Jodi Quinnell, Oil Product Manager, and Carl Evans, Senior Crude Oil Analyst, Genscape

Comments