March 2016, Vol. 243, No. 3

Web Exclusive

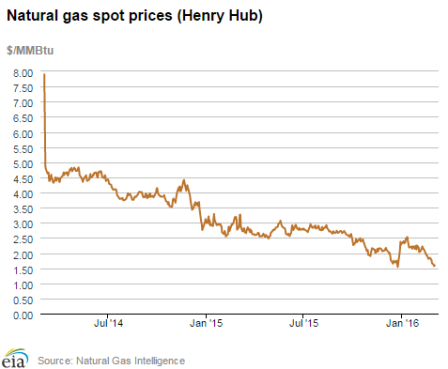

Natural Gas Prices Could Plunge Below $1 Here

Natural gas prices in the United States dropped to their lowest levels since 1998 on March 1, with Henry Hub spot prices falling to $1.57 per million Btu (MMBtu).

Low oil prices are stealing the media show, but the natural gas sector is also facing a historic downturn. Less attention is understandable for a few reasons. Natural gas markets are regional, and as such, gas is priced differently in different parts of the world (although natural gas prices have plummeted in Europe and Asia as well). Not every country is suffering from low natural gas prices in the way that oil-producing countries are reeling from cheap crude. Also, natural gas prices in the U.S. have been low for several years, so a state of abundance is not necessarily new.

Still, today’s prices are now lower than they have been in 17 years.

There are several phenomena right now that are working together to push prices low. First, production is at a historic high. Production has climbed inexorably over the past decade as drillers dotted shale basins with thousands of wells. The shrinking gas rig count and ongoing price declines have caused production to plateau since hitting a peak in September 2015, but output has not noticeably declined since then.

At the same time, just as rapidly rising storage levels for crude oil have become a drag on crude prices, so too have elevated storage levels for natural gas. The El Nino has contributed to an abnormally warm winter season in the U.S., cutting into what is typically the strongest time of year in terms of demand. Natural gas markets are seasonal, with storage build ups between spring and autumn and drawdowns in the winter.

The U.S. entered the winter heating season in November with storage levels 4.7 percent above the average for the past five years. But tepid demand due to a mild winter made the storage problem even worse. The U.S. is about to exit the winter season with storage levels 36 percent above the five-year average for this time of year (blue line on the EIA chart above).

Warm weather led to residential demand for natural gas over the past few months to average only 19 billion cubic feet per day, a 31-year low. That has all occurred while production remains near an all-time high. Gas production in December 2015 was 5.3 percent above the level from December 2014.

To recap: we have high production levels, weak demand, and record levels of storage. And this is where it gets tricky. The U.S. is heading into a season that typically sees some of the lowest natural gas demand for the year.

Spring signals the start of “injection season,” in which excess production is diverted into storage. So the record levels of storage for this time of year are about to start rising. Moreover, injection season could get a head start: a wave of warmer temperatures is sweeping over the east coast of the United States this week. New England, normally under snow at this time of year, will see temperatures above 60 degrees Fahrenheit.

All of this has contributed to a 17 percent decline in front-month natural gas deliveries since February.

But with natural gas storage already so high, there could be problems finding adequate storage, threatening further price declines. Spot prices for natural gas in the mid-Atlantic – near the vast Marcellus Shale in Pennsylvania – have dropped to just $1.21/MMBtu as of March 4. Prices could fall even further in the next few months as inventories start to rise again. In Canada, things could be even worse, with prices dropping below $1.

There are a few bullish trends that could prevent prices from crashing below current levels. Natural gas demand for electric power generation – edging out coal from the sector – continues to rise. Cheniere Energy just shipped its first LNG cargo from the U.S. as well.

But these demand-side factors may not be enough to push storage levels off their historic highs. One other negative for prices looms: natural gas producers are leaving some wells that they have already drilled uncompleted because of low prices. They could complete those wells if prices start to rise, which in turn, will cap any price rally. In short, as the trajectory for oil prices looks pretty grim in the near-term, the outlook natural gas appears to be even worse.

By Nick Cunningham, Oilprice.com

Comments