August 2018, Vol. 245, No. 8

Features

How the Historic Energy Reform Transformed Mexico’s Oil Fortunes

By Maria Cortez, Senior Research Manager, Wood Mackenzie

Five years ago, few would have predicted that Mexico would be capable of overhauling its oil and gas sector, much less through a downturn. Yet since the constitutional reform of 2013, Mexico has dramatically revivified its upstream sector.

Recognizing the challenge of attracting capital post-2014, the government set about providing competitive fiscal terms that would work for investors. Nine licensing rounds have resulted in the award of more than 100 blocks. Among these were some of the highest profile tenders held globally in the last two years, second only to Brazil.

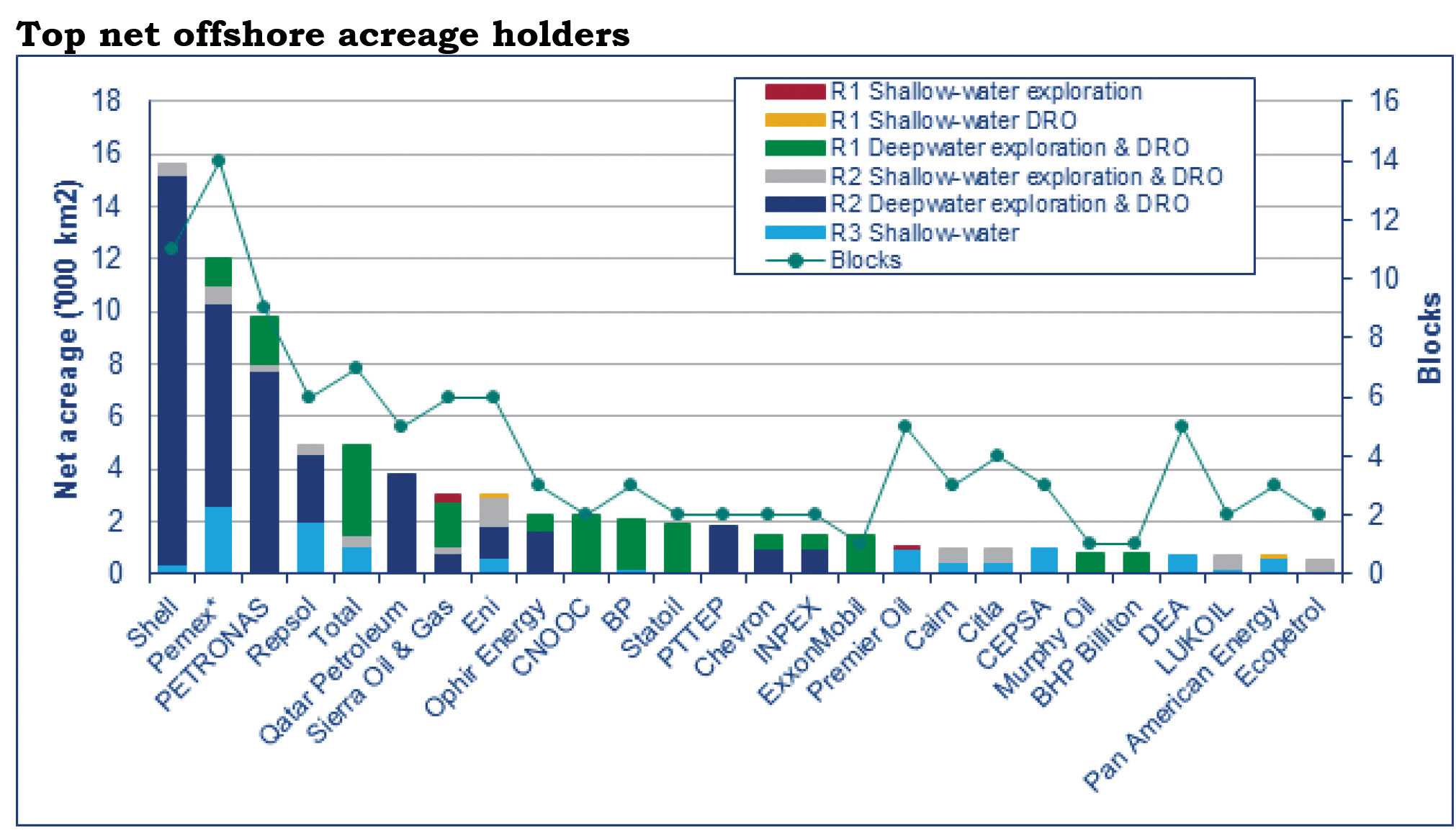

Driven by Mexico’s attractive geological potential, dozens of E&Ps, ranging from supermajors and foreign NOCs to regional independents and new local operators, are now present and hold substantial acreage in what was previously Pemex’s private playground. The flourishing of a diverse upstream landscape brings financial and technical expertise, as well as different skillsets.

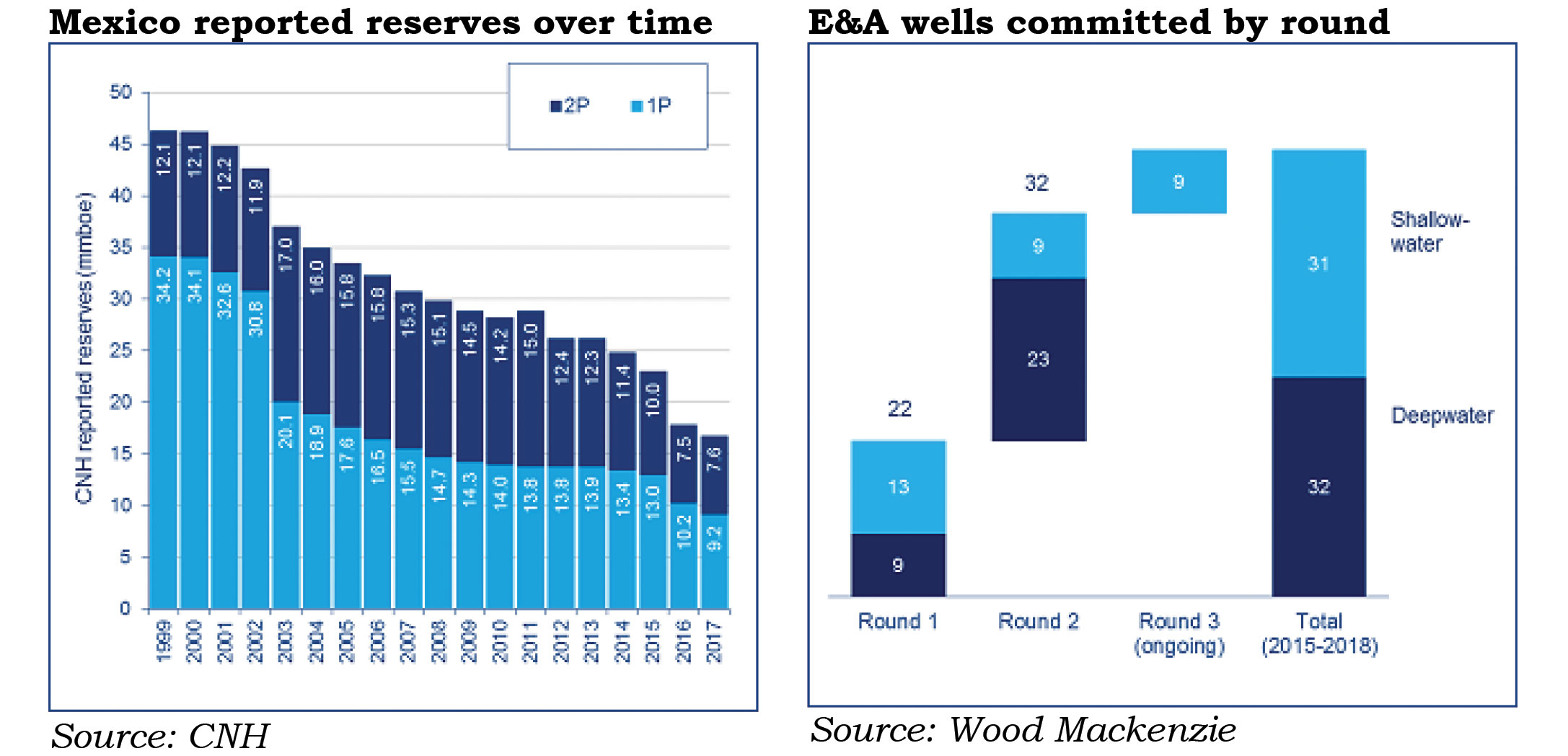

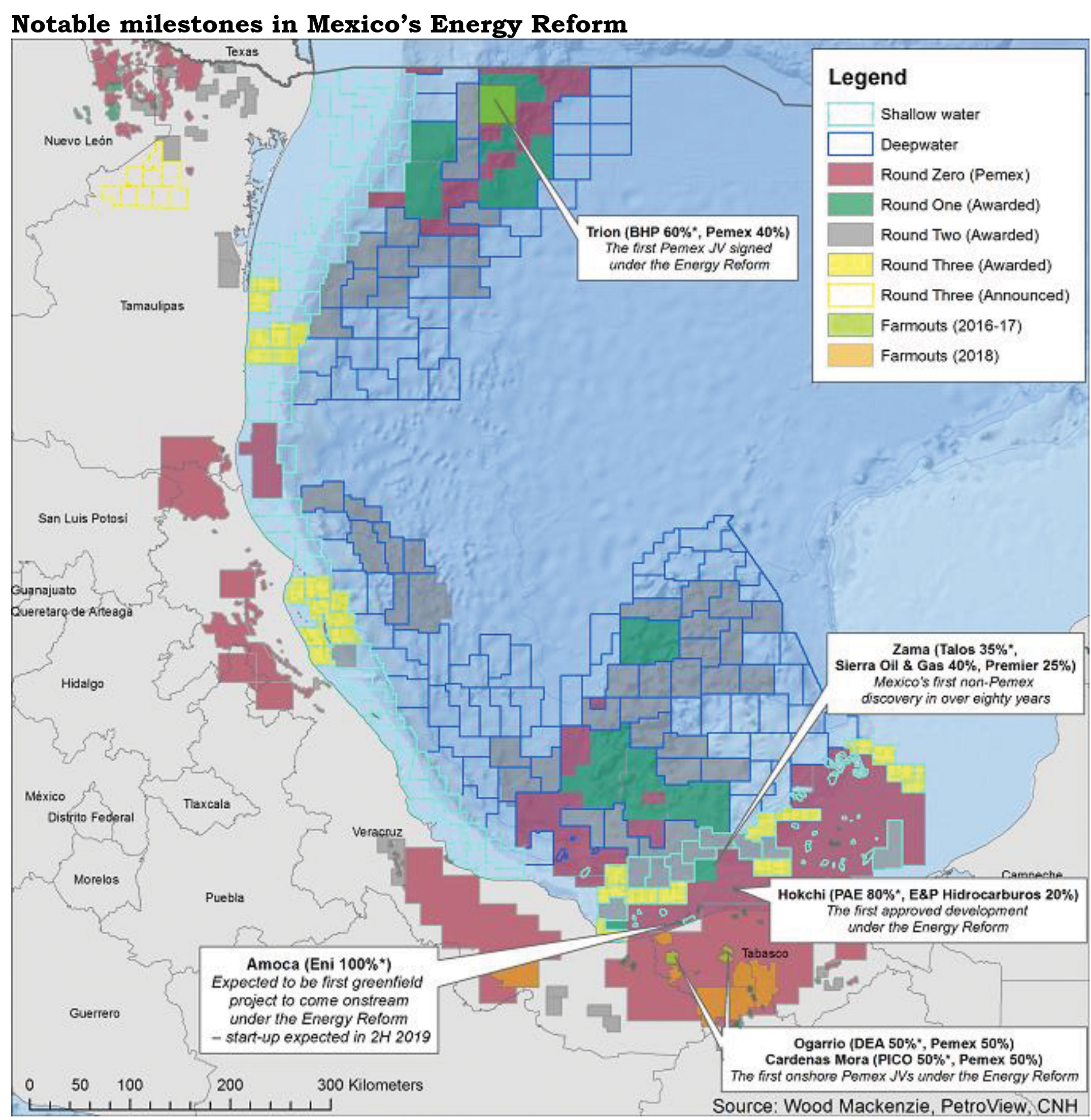

Much-needed exploration is also taking root. The first post-Energy Reform discoveries at Talos’ Zama and Eni’s Amoca are early signs of success. This year private operators added reserves for the first time ever. Over sixty exploration and appraisal well commitments will lay the groundwork needed to find the additional volumes to replace falling reserves.

The Energy Reform is on track to arrest Mexico’s precipitous production decline. Round One shallow-water developments, like Zama and Amoca, and Pemex JVs could contribute a third of Mexico’s total production by the mid-2020s.

A strong institutional framework and government backing have been foundations of the Reform’s success, but Mexico’s presidential election puts the process at a crossroads. The newly appointed government stands to reap the rewards of the Reform – production, investment and activity. But continued government support over the next six years would allow for Pemex’s reform and new developments to take shape, the necessary building blocks for Mexico to reach sustainable production growth in the long-term and increase revenue for the country.

Investor Confidence

Following the downturn, several countries stepped up efforts to reboot their upstream sectors. Twenty-two licensing rounds launched in 2017, more than four times the rounds announced in the prior year. Highly anticipated offshore rounds in Mexico and Brazil rarely disappointed. Drawing on regular participation from the industry’s most respected explorers, both countries stood out above the competition.

With the enormous task of reversing the country’s oil production, Mexico’s Energy Reform could make no mistakes. At a time of scarce investment dollars, the country went head to head with other fiscal regimes. The hydrocarbon prospectivity was attractive, in and of itself, but Mexico needed to put forth a fiscal regime competitive enough to capitalize on the geology but balanced towards incentivizing the exploration activity the country desperately needed. Reasonable minimum bids have enabled Mexico’s terms to compete internationally, while progressive factors used in the contracts – such as price, production, R-factors, and internal rate of return (IRR) adjustment mechanisms – will maximize value for the country.

In seeking to strike the right balance, Mexico has fostered competition. Compared to the neighboring U.S. Gulf of Mexico, deepwater and shallow-water government returns remain materially higher in Mexico. The terms are tougher, but they are not punitive enough to restrict investment. Setting lower minimums for less prospective acreage has also facilitated the award of marginal blocks that may yield important finds.

Enthusiasm surrounding Mexico’s success can be measured. Its licensing award success rate in 2017 was 70%, twice the global average. In five years, the country has held nine licensing rounds and awarded more than 100 blocks. New entrants bring the financial capacity and technological expertise that Mexico needs to fully realize its hydrocarbon potential.

E&Ps Drawn

There are now over 30 E&Ps active offshore, including all the Majors, for whom the Energy Reform offers opportunities across the energy value chain. Most will be chasing giant deepwater discoveries, but the under-explored shallow waters will be a target too, particularly for Eni, which will become the first offshore IOC producer in 2019.

Leading Asian NOCs are also present. While CNOOC, Petronas and PTTEP are seeking resource to bolster long-term outlooks, they bring top-tier expertise to Mexico’s deep waters.

Independents have also joined Mexico’s offshore. Companies like BHP Billiton, Repsol, Murphy and Premier have cut back on wildcatting through the downturn. Mexico is one of the few areas in the world where giant company-making discoveries are possible, and the time was ripe for these companies to replenish their high-impact acreage portfolios.

A number of small caps backed by private equity are also participating. Onshore, a domestic E&P sector is emerging. In keeping with the size of the prize, this is predominantly the domain of the small- and micro-cap, lower-cost operators with lean management structures and rapid decision-making processes.

Drawing in new entrants in the later phases of Round Two and Round Three has been a notable vote of confidence to the government and reflects Mexico’s rich opportunity pipeline. However, the pace at which Mexico has added new entrants is at stake due to the upcoming election and to the possibility that the next president may slow the pace of licensing rounds.

Exploration Activity

Exploration is essential if the country is to start rebuilding its resource base and turning around its production trajectory. Pemex’s legacy offshore activity has delivered some of the largest shallow-water discoveries ever made. Yet it has also left the NOC little impetus to explore deeper or riskier plays. This has resulted in year-on-year proven reserve declines. Pemex’s drastic budget cuts in 2015 further deepened declines.

Sixty-three E&A wells have been committed over the next four years as part of the licensing rounds. Wood Mackenzie estimates these wells could yield up to 20 discoveries, assuming most wells are exploration and success rates are around 30% – the global average for frontier plays. Exploration drilling could grow to 200 exploration wells by 2035 and deliver 10 Bboe in new resources.

Exploration activity is already bearing fruit. Round One winners wasted no time testing their acreage, with Eni drilling the first post-Reform well at Amoca, which also discovered additional, deeper oil. Talos’ Zama (600 MMbbl of commercial reserves) well was the first pure wildcat offshore Mexico by anyone other than Pemex in almost 80 years. The well struck oil in Upper Miocene sandstone reservoirs, yielding one of the largest shallow-water finds globally in the last two decades.

Future exploration is also likely to center on clastic play types, resembling the traditional target in the US Gulf of Mexico. Limited deepwater drilling in Mexico has left many play types unexplored. Mexico will benefit from the transfer of geological play knowledge developed across the border. The potential here is already evident through the Zama discovery.

End of Decline

Fields coming onstream thanks to the Energy Reform will halt two decades of declining production by the early-2020s. Leading the charge are four shallow water assets awarded during Round One in the heart of Mexico’s traditional producing heartland, the Salinas Sureste basin: Hokchi, Ichalkil-Pokoch, the Amoca complex, and Zama. Pemex laid the groundwork with the Hokchi, Ichalkil-Pokoch and Amoca-Mizton-Tecoalli discoveries before the Reform, but which the NOC could not exploit.

All areas were won under relatively aggressive PSC bids, but low development costs still make for attractive economics that will speed up first oil. The fields will all be in production by the early 2020s, contributing over a billion barrels of production to Mexico through the 2030s.

Deepwater also faced neglect at the expense of Pemex’s carbonate crown jewels. Billions of barrels await discovery, with the Trion JV as a foretaste of projects to come. BHP won the right to partner with Pemex in the DRO’s development in the Perdido Area, where we anticipate over 300 MMbbl of production to start flowing by the mid-2020s.

Future deepwater discoveries will take longer to come online and hold the key to pushing Mexico’s production back to sustained growth into the next decade. In the meantime, Mexico’s treasury will get relief from faster-turnaround production in shallow water fields.

Reform Crossroads

It will take years for the benefits of this presidential administration’s Reform to fully bear fruit. The changes underway may be imperiled by future administrations before the benefits materialize. However, the level of interest in recent rounds suggests that companies remain committed to Mexico despite near-term political uncertainty.

Andres Manuel Lopez Obrador (AMLO) of the left-of-center Morena party recently won the presidential election convincingly. The candidate had run two times before, staunchly opposing energy reform. This time his platform attempted to reassure the international financial community by committing to fiscal prudence, but he will likely revisit Mexico’s current energy policy. For example, he may move away from an ambitious licensing schedule and seek to review existing E&P contracts for any signs of impropriety.

An AMLO win would most assuredly tap the breaks of licensing rounds and may also slow development timelines via the permitting and regulatory agencies. Despite this, we believe the emergence of a strong secondary market for the more than 100 blocks awarded could sustain interest in Mexico in the years ahead. Strong government backing by the this administration will help Mexico reach sustainable production growth faster and increase revenue for the country earlier. P&GJ

Author: Maria Cortez is a senior research manager on Wood Mackenzie’s Upstream Latin America team. She manages a team of research and data analysts across the region. Cortez graduated from Texas State University, where she earned a bachelor’s degree in applied sociology and master’s in international relations.

Comments