November 2018

Features

The Well Hasn’t Run Dry for Midstream Opportunities

By Kevin Petak, Vice President, Natural Gas and Liquids Markets, ICF, and Julio Manik, Technical Specialist, ICF

An Interstate Natural Gas Association of American (INGAA) Foundation midstream infrastructure report, recently completed by ICF, projects nearly $800 billion will be invested in new oil and gas infrastructure between 2018 and 2035, terrific news for a wide range of stakeholders who could benefit from future activity.

Opportunities lie ahead for midstream developers, investors and energy consumers, but as the lion’s share of these investments is poised to unfold over the next decade; the true victors will be those who develop strategies to harness the potential now.

Projected Wealth in Midstream Investment

Several factors should increase oil and gas supply and foster infrastructure development. Notably, the North American unconventional resource base (shale and tight oil and gas) is enormous, with vast quantities of relatively low-cost oil and gas remaining to be developed.

The application of technology is continuing to reduce well drilling and completion costs and enhance well productivity. Thus, the unit cost of oil and gas production continues to decline.

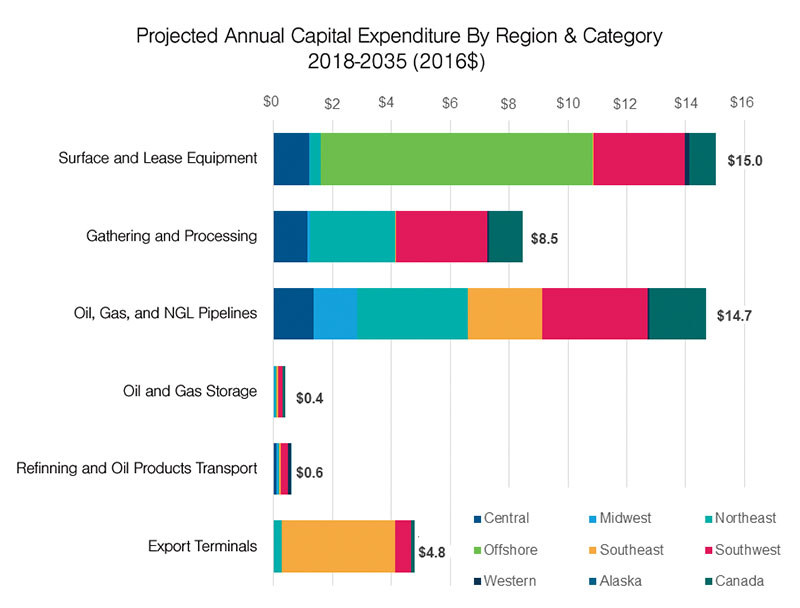

ICF projects:

- $417 billion of investment in new gas infrastructure

- $321 billion of investment in new oil infrastructure

- $53 billion of investment in new natural gas liquids (NGL) infrastructure

Overall, investment in new oil and gas infrastructure will total $791 billion from 2018 through 2035, averaging $44 billion per year.

Drilling Down

The ongoing splurge in midstream spending of nearly $50 billion per year will continue to create many investment opportunities.

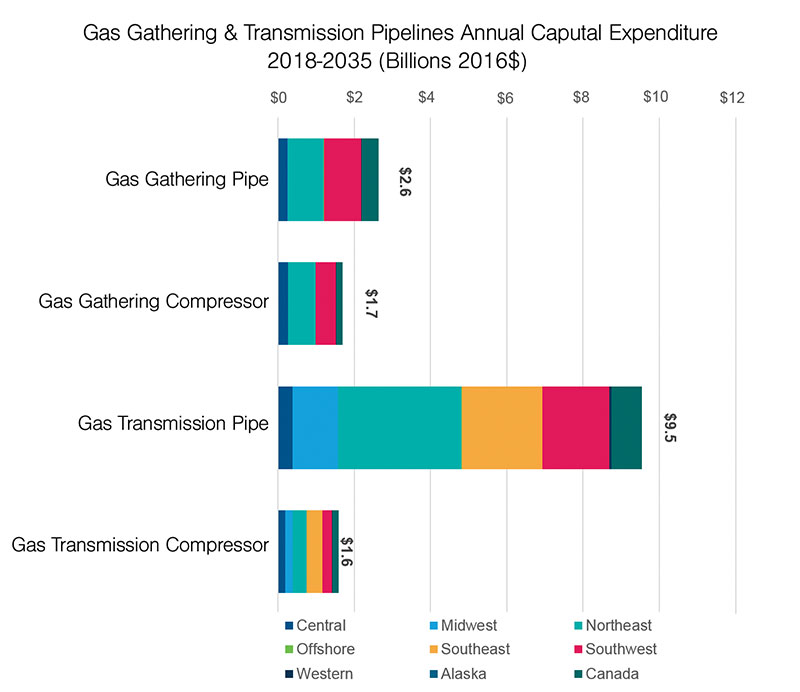

Roughly 35% of the total spending, with average annual capital expenditures (capex) of about $16 billion, is projected for natural gas gathering and transmission pipeline:

- New natural gas transmission pipeline: $11 billion annually for a total of $200 billion through 2035.

- New gas gathering pipeline: $4 billion annually for a total of about $80 billion through 2035.

There are significant upside and risk for natural gas pipeline development, depending on market evolution and project approvals. Private equity firms looking to gain a foothold in midstream development would be well advised to fully investigate which projects offer the strongest opportunities for growth, as well as to fully understand uncertainties and risks.

With that in mind, there is little doubt that there are many potential roadblocks in the midstream space, including opposition that stalls projects; new regulations that promote other forms of energy to the detriment of oil and gas; and a growing interest by policymakers to decarbonize the U.S. economy.

40 Bcf/d Growth

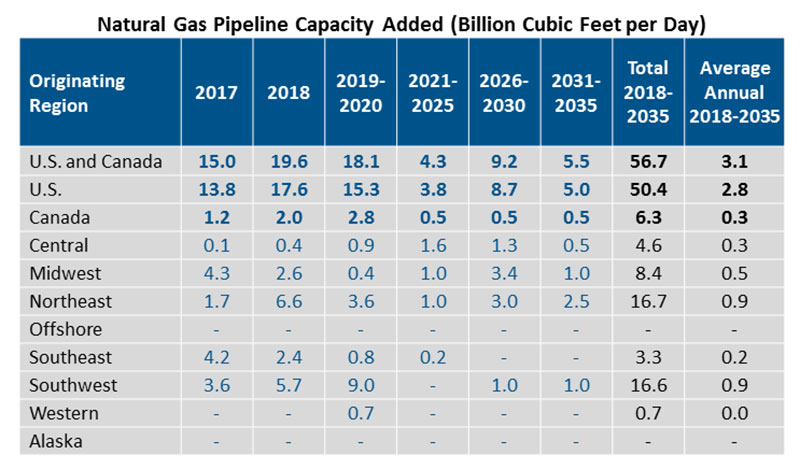

The report projects significant growth of gas production – up to 130 Bcf/d by 2035 or 40 Bcf/d of growth – spurred by an increased resource base and accelerated technological advancements that yield lower gas prices, and thus, greater market growth. This growing supply, both from gas and oil wells, results in the need for new natural gas gathering and pipeline transmission capability.

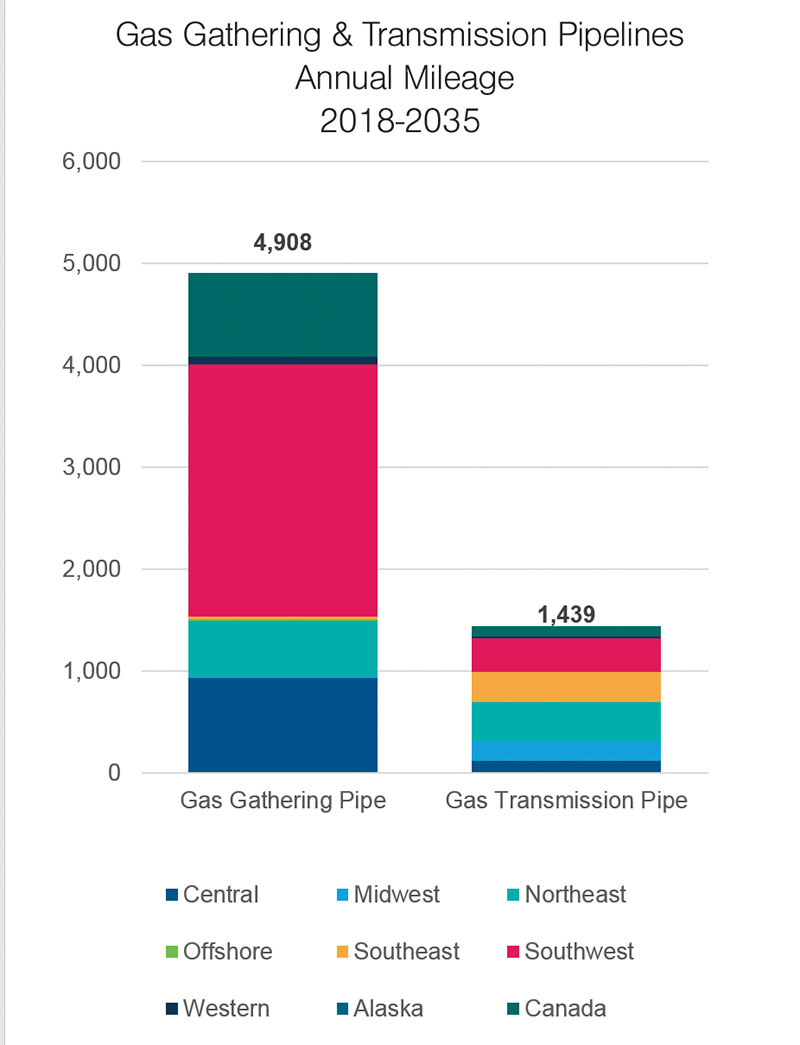

This projected growth in production will spur the $280 Billion investment in this space. Looking at where demand and production will be located, the study anticipates construction of over 1,400 miles of natural gas transmission pipeline each year, with a total of 26,000 miles through 2035. Most of the new transmission pipeline capacity will be large pipe, averaging over 30-inches in diameter.

Robust natural gas production growth requires significant new gas gathering line to connect new wells to gas processing facilities. About 4,900 miles of new gas gathering line are needed to support the growth. The size of new gathering lines will generally average 8 inches in diameter, but there is a great deal of regional variance in the estimates. Larger productivity wells in the Marcellus will require larger gas gathering lines ranging from 10-20 inches in diameter.

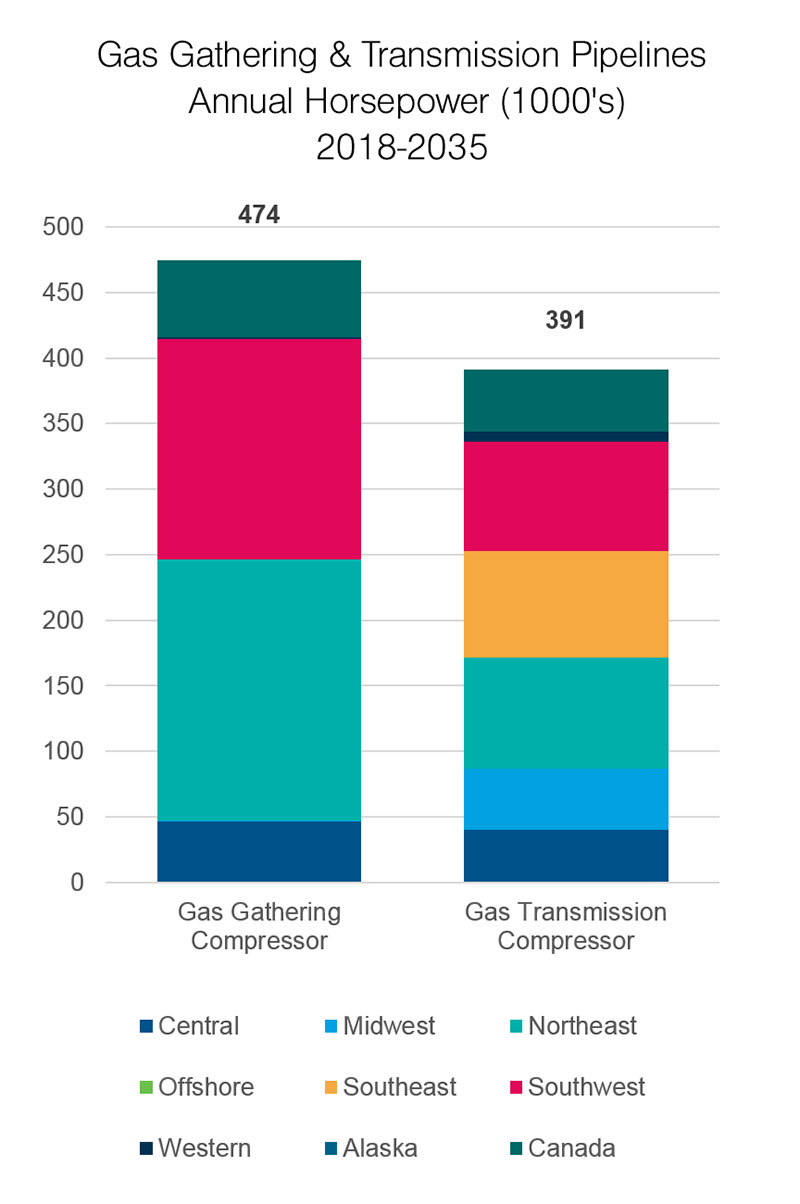

With so many new miles of pipeline, the industry will need to see 865,000 horsepower (hp) of new compression implemented annually. The study estimates 391,000 hp of compression added each year for new gas transmission pipeline, or a total of 7 million hp of over the course of the projection. To support the gas gathering process, the study estimates 474,000 hp of compression additions each year, or a total of 8.5 million through 2035. Most gathering lines will feature modularized skid-mounted units that can be easily added or removed over time.

Where Do You Build It?

Companies that own and operate infrastructure need to know where to build. They must also understand how midstream values will be impacted. Knowing where and how to best position new assets – and knowing how much capacity is needed – requires a firm understanding of markets. It is important to understand key drivers of and risks associated with new oil and gas infrastructure.

There are many companies that stand to gain – or lose– from new infrastructure. With nearly 60 BcF/d of new gas transport capability set to go in place over the next 15 years, shifts in gas transport will be very significant.

Those who come out on top will have a clear understanding of all of the nuances unique to the supply and demand mechanisms of the midstream industry. They will also have clear insights into the broader energy landscape and future for hydrocarbons. Companies receptive to competitive positioning based on analysis of the entire energy industry will leave others behind.

Changing Landscape

Understanding the implications of new policies is key – particularly those aimed at preserving nuclear and coal generation in the power sector and others aimed at electrification. Such policies could have adverse impacts on oil and gas use and very negative implications for midstream infrastructure. Knowing which assets hold up best under adverse conditions and which companies’ resources and assets will weather aggressive carbon policies is of utmost importance.

Ultimately, opportunities are building for a myriad of market participants. Resiliency, portfolio diversification, and flexibility to adapt to changing market conditions and regulations are all important factors to consider in this brave new world of investment. P&GJ

Authors: Kevin Petak is a vice president in Natural Gas and Liquids Markets for ICF. He is an expert in gas market analysis and supporting strategic planning, with almost 35 years of experience in the energy industry. Petak has directed gas market modeling work for the National Petroleum Council, America’s Natural Gas Alliance, the American Gas Foundation, and the Interstate Natural Gas Association of America.

Julio Manik is a technical specialist at ICF, with 20 years of experience in the areas of energy modeling, engineering economic, and reservoir engineering. He is the lead analyst on projects related to hydrocarbon supply curves, oil and gas drilling and production, gas pipeline-supply-demand modeling, midstream infrastructure analysis, economic impact analysis, and issues related to reservoir simulation, multiphase flow in pipeline and fluid PVT.

Comments