June 2019, Vol. 246, No. 6

Features

Major Restructuring of Middle East Gas Exports

By Nicholas Newman, Contributing Editor

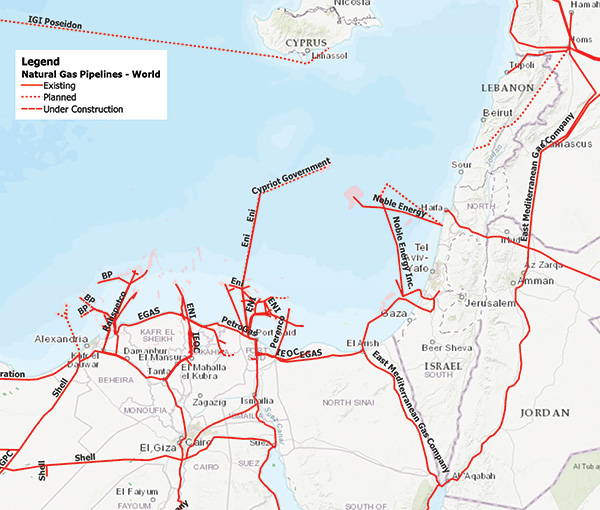

In the Eastern Mediterranean, large discoveries of natural gas have been found off the coast of Israel and Egypt earlier in the decade. This together with increased demand for gas across the region are now reshaping both production and market demand, requiring construction of a series of new pipelines and LNG import and export facilities.

Consequently, in the short term, Egypt could become an important regional gas hub. However, the most far reaching potential development has now been agreed by the Greek, Italian and Cypriot governments with Israel, to lay a pipeline connecting offshore gas fields in Cypriot and Israeli waters with Europe. If built, The East Mediterranean Gas Pipeline (EMG) will start about 105 miles off Cyprus’s southern coast and stretch for 1,350 miles to Otranto, Italy, via Crete and the Greek mainland.

Meanwhile, in the Gulf region, senior government officials are considering plans to build an integrated regional gas network to supply and trade gas amongst member states including the UAE, Saudi Arabia, Oman, Bahrain and Kuwait but not, for the moment gas-rich Qatar.

Exports to Egypt

In the coming months, piped gas from Israel’s offshore Tamar and Leviathan fields, jointly operated by US based Noble and Israeli based Delek, will be transmitted to Egyptian cities along the Nile including Cairo, Alexandria and Luxor. This offshore gas will pass through the Israeli domestic pipeline network to the cross-border interconnector known as the East Mediterranean Gas (EMG) pipeline, before joining the Egyptian domestic pipeline network at El Arish in Sinai.

Noble anticipates initial exports to Egypt of 350 Bcf/d (10 MMcm/d) or just over half of the EMG pipeline’s design capacity of 7 Bcm annually – or 19 MMcm/d. This means there will be spare capacity for Israel to make use of one of Egypt’s underutilized LNG export facilities at either Damietta or Idku.

A spate of major gas discoveries this decade, of which the Eni-operated 850 billion cubic meter mega offshore Zohr field is the most spectacular, ensure that Egypt’s burgeoning demand for gas can be met from domestic supplies and any surplus can be exported from existing LNG export facilities at Damietta and Idku.

Rising domestic supplies of gas, especially from the 2.7bcf/d Zohr field, alongside development of Cyprus’s offshore Aphrodite gas field, due to come on-stream in the next few years, could allow Egyptian LNG exports to reach some 16 Bcm a year and transform Egypt into the region’s gas hub. To support such ambitions, Egypt has signed a provisional deal to receive gas from the planned development of the Cypriot mega-gas offshore field Aphrodite.

This year marks the return of Egypt’s self-sufficiency in gas and becoming a net exporter, at least for the time being, but in the longer-term Egypt’s ability to export gas will be constrained by rising gas power generation to meet rapid population growth and industrial needs. Any surplus would probably only be available during the winter months for in summer, Egyptian demand for air conditioning peaks.

Jordan

Gas-hungry Jordan will be a recipient of both Israeli and Egyptian gas. Hala Zawati, Jordanian Minister of Energy, estimates demand for gas at around 350 million cubic feet per day. Israel’s Leviathan gas is due to reach Amman by 2020 on completion of a 40-mile pipeline starting at Jordan’s border with Israel going north across Mafraq province to the capital, Amman.

Since September, last year, Jordan has imported natural gas from Egypt and hopes to reduce its imports of LNG, which are more expensive. In the medium term, Jordan is also considering reinstating its plans for a pipeline linking Iraqi gas fields with Jordanian cities, plans that were interrupted by the recent troubles.

Lebanon

Lying to the north of Israel, gas-hungry Lebanon is preparing to replace piped gas purchases from Egypt with LNG imports as early as 2020, by way of three floating storage and re-gasification units, (FSRUs). News reports from Lebanon and international shipping publications values the contract to build the three FSRUs at about $1.2 billion. They will be moored close to existing power plants at Beddawi, near Tripoli; Selaata, north of Beirut; and Zahrani, which is close to Tyre.

Other countries are also evaluating FSRU projects including, Cyprus, Israel, Greece and Turkey. Greece has proposed a second FSRU terminal – Aegean LNG in Kavala Bay – to enable exports from its Aphrodite field while Turkey is looking to increase capacity by two thirds at the Marmara Ereglisi and EgeGaz Aliaga terminals.

The Gulf States are home to a fifth of global natural gas reserves and account for nearly 12% of the world’s natural gas production. Between them, these oil-rich states of Saudi Arabia, UAE, Kuwait, Bahrain and Oman produce 11,801 Bcm of associated gas. However, these states face surging demand for their heavily subsidized power from rapid population increase and industrial expansion.

These realities underpin the Gulf Cooperation Council (GCC) ambitious plan to construct a pipeline network for the region linking Oman, Saudi Arabia, Kuwait, Bahrain and the UAE in the first instance with future extensions perhaps to Iraq, Jordan and Egypt.

The GCCs plan would enable surplus gas to be traded between member states in the same way that surplus electricity is traded throughout the region. A regional market in gas would encourage further development and increase production of petrochemicals, fertilizers and plastic as well as providing gas for injection into mature wells to increase production in the oilfields.

Gulf LNG Projects

To reduce dependence on a single pipeline or source of gas, countries in the region are looking towards imports of LNG, whose price is falling as exports expand from Qatar, Australia and the US.

The Middle East region is well placed to purchase distressed or unwanted LNG cargo at bargain prices especially with the development of a spot market in LNG and flexible trading.

A case in point is Bahrain, which plans to begin imports of LNG purchased on the spot market as early as February or March, through its new LNG terminal in order to create a market for gas in preparation for exploiting its recent natural gas finds. Similarly, Sharjah, of the UAE plans to import LNG from 2020 when its import facility is completed.

In sum, for the region’s gas exporters, on the one hand exports of LNG though costlier to transport, offer greater market flexibility and security than piped supplies. For gas importers, if local political tensions are resolved, piped natural gas is a very price competitive solution but LNG could still have a role in topping up supplies. P&GJ

Comments