November 2020, Vol. 247, No. 11

Features

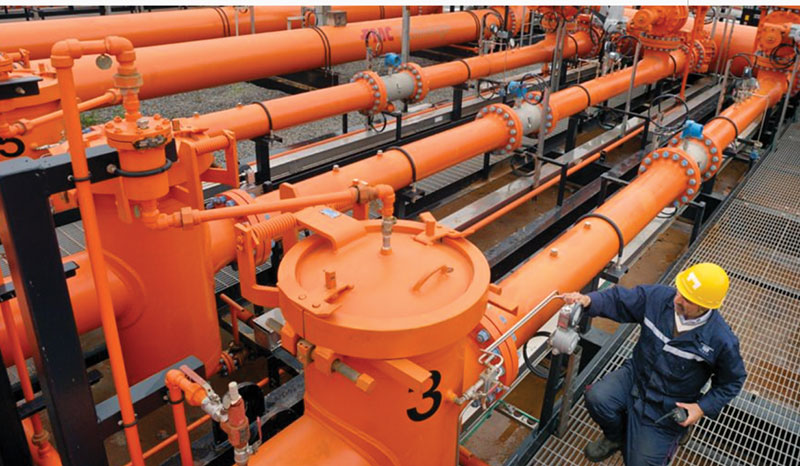

Sonatrach to Expand Pipeline Network in New Contracts

By Shem Oirere, Africa Correspondent

Algeria’s national integrated oil and gas company Sonatrach’s short- to medium-term investment strategy has moved a notch higher after it signed contracts with six companies for construction of midstream, upstream and downstream projects, including 435 miles (700 km) of collection and export pipelines linked to natural gas fields in the country’s southwest region.

Sonatrach, which previously approved a $44 billion investment in the exploration and production projects for the 2018 to 2022 period, said in early September it has picked four of its subsidiaries, ENGCB, SARPI, ENGTP and ENAC, and two other Algerian firms, Kanaghaz and Cosider, for work valued at $519 million.

If completed, these projects will ramp up gas production capacity by an additional 389 MMcf/d (11 MMcm/d) by the end of 2022.

Cosider signed a contract for the enhancement of detection and extinguishing systems and firefighting networks of the regional transportation systems in the Arzew Zone within the natural gas-rich southwest Algeria.

According to Cosider, the first contract involves the development of the southwestern fields of Hassi Ba Hamou and Reg Mouaded, Hassi Tidjerane and Hassi Tidjerane Ouest, Tinerkouk and Tinerkouk Ouest in the Adrar area, through the construction of an 18-inch (457-mm) gas shipping line.

Consider says the second contract involves bringing the “detection/ extinguishing systems and fire protection networks of the Regional Direction of Transportation of Hydrocarbons’ (RTO’s) transport facilities (Arzew area) into compliance.”

The company said two contracts will support Algeria national companies by giving them priority in carrying out the contracts and, hence, reduce the amount of foreign exchange transferred to foreign-owned project developers. The two contracts are worth $128 million.

ENAC, on the other hand, has been contracted to supply, install and commission new cathodic protection systems for the 298-mile (485-km) Hassi R’Mel-Arzew gas pipeline. This 24-inch (610-mm) pipeline was developed in 2007 by Italian oilfield services company Saipem over a 26-month period to serve the western transport region.

Sonatrach, the largest company in Africa with 154 subsidiaries, said it also signed a contract with its subsidiary SARPI/SAFIR Group for the development of the western oil fields of Touat in Blocks 352A and 353A, which will encompass the second phase. The fields, which are operated by Groupement TouatGaz (GTG), a joint venture of Neptune Energy Touat (65%) and Sonatrach (35%), are to supply the Adrar refinery at the rate of 6,000 bpd of oil by the end of 2022.

The first phase of the Touat gas development, which is located more than 870 miles (1,400 km) southwest of Algeria’s capital, Algiers, was completed in September 2019. The project entailed gas production and processing facilities, several wells and 93 miles (150 km) of gas gathering systems.

The facilities are to be connected to the 472-mile (760-km), 48-inch (1,219-mm) GR-5 gas pipeline that conveys natural gas to the national gas distributing center of Hassi R’Mel from where the commodity is dispatched to local and international consumers.

Additionally, the GR-5 pipeline has a 200-mile (320-km) loop of 48 inches that was installed in the first phase. It is set for further extension under the second phase. The loops link the pipeline to the new gas fields of Hassi Mouina, Nord and Hassi Ba Hamou.

Under phase two of the Touat gas project, GTG intends to develop eight more gas fields to achieve a targeted production plateau of 450 MMscf/d.

Currently, Sonatrach operates 2,423 miles (3,900 km) of crude oil pipeline out of the entire Algerian oil and gas pipeline network of 37 pipelines, totaling 12,193 miles (19,623 km) for the transportation of gas, oil and condensate. The pipelines serve the Hassi R’Meil gas hub and the Hassi Messaoud oil hub.

Among the largest Sonatrach pipelines are the international gas export lines: the 1,025-mile (1,650-km) Enrico Mattei (GEM), connecting Algeria with Italy through Tunisia with a capacity of 1,340 Bcf/year (38 Bcm/year); the 325-mile (523-km) Pedro Duran Farrell pipeline (GPDF), linking Algeria to Spain via Morocco that transports 390 Bcf/year (11 Bcm/year) and is the second-largest Sonatrach export gas pipeline.

Sonatrach also owns the 125-mile (201-km) Medgaz pipeline connecting Algeria and Spain through the Mediterranean Sea with a capacity of 280 Bcf/year (8 Bcm/year).

With Sonatrach on track to implement the ambitious SH2030 strategy, which was launched in 2018 to transform the company into one of the leading global oil and gas producers, more oil and gas pipeline projects are likely to emerge to support Algeria’s target of achieving a million tons of oil equivalent (200 mtoe) of primary production by the end of 2022.

Within the same period Sonatrach plans to achieve commercial output of between 155 mtoe and 160 mtoe and stabilize export volumes at 100 mtoe. Currently, the company produces an estimated 192 mtoe, including 63% of natural gas, 26% of crude oil, 6% condensate and 5% of liquefied petroleum gas (LPG).

Furthermore, a reliable oil and gas pipeline network would be needed to gather and transmit the anticipated doubling of drilling productivity by Sonatrach to six wells per year per rig at development level and four at exploration level according to the SH2030 plan.

Meanwhile, in the short-to-medium period, Sonatrach projects an additional 2 mtoe annually on existing fields by “optimizing the performance of wells and deployment of relevant enhanced oil recovery/improved oil recovery technologies” in the company’s oil and gas fields to achieve an increase in recovery rates by 2040.

It is Sonatrach’s dream to generate an additional $67 billion in revenues by the end of 2030, out of which 50% would be reinvested in its upstream, midstream and downstream operations according to the SH2030 strategy.

At least 54 mtoe of the current production is consumed locally, while 109 mtoe is shipped to international markets.

Comments