January 2021, Vol. 248, No. 1

Features

Global Pipeline Construction Outlook 2021

By Michael Reed, Editor-in-Chief

To say 2020 has been a volatile year would not even begin to describe what midstream and other energy sectors have endured over the better part of the past 12 months.

The year, which began with optimism running high for new pipeline projects, quickly descended into an abyss of price declines, cancellations and COVID-19-related delays that had many wondering if their companies and jobs would survive, let alone return to anything resembling “business as usual.”

That said, the industry has survived, albeit a little warily after briefly seeing oil futures plunge to an unheard price of zero, and by most accounts there appears to be a light appearing at the end of the tunnel.

In fact, in a recent analysis, Morgan Stanley went so far as to upgrade the 2021 outlook for midstream as “attractive,” in the wake of post-pandemic re-openings and the sector’s “self-help” measures.

“Midstream stocks have been catalyzed by the prospect of a divided Congress (expectation of more benign tax and energy policy changes), coupled with the COVID-19 vaccine progress,” Morgan Stanley said in its 2021 MPLSs & Midstream Energy Infrastructure Outlook. “We see support for a sustained rally in midstream.”

Other analysts agree, saying, in general, midstream should disproportionately recover as people return to more normal activities as the pandemic is brought under control and refined product demand recovers.

Overall, the pipeline business appears to be relatively stable, all things considered, certainly in comparison to other energy sectors, such as exploration and production, which are more directly affected by volatility and oil and gas prices.

Many midstream stocks have returned to early March, pre-coronavirus levels, led out of the gate by such major players in North America as Williams, Kinder, Enbridge and TC Energy. In another promising sign, some smaller companies such as Targa and Plain All American did even better than the larger companies.

That said, U.S. midstream companies reduced planned crude pipeline capacity expansions by more than 1.4 MMbpd through deferrals or scale-backs in the wake of the collapse in oil prices and effects to the COVID-19 pandemic. The bulk of these postponements involve projects that had been expected to be in service by the end of 2020.

The following is a summary of some notable pipeline activity taking place across key global regions. Keep in mind, much of the downward trend, compared to 2020, reflects delays brought about by the pandemic.

North America

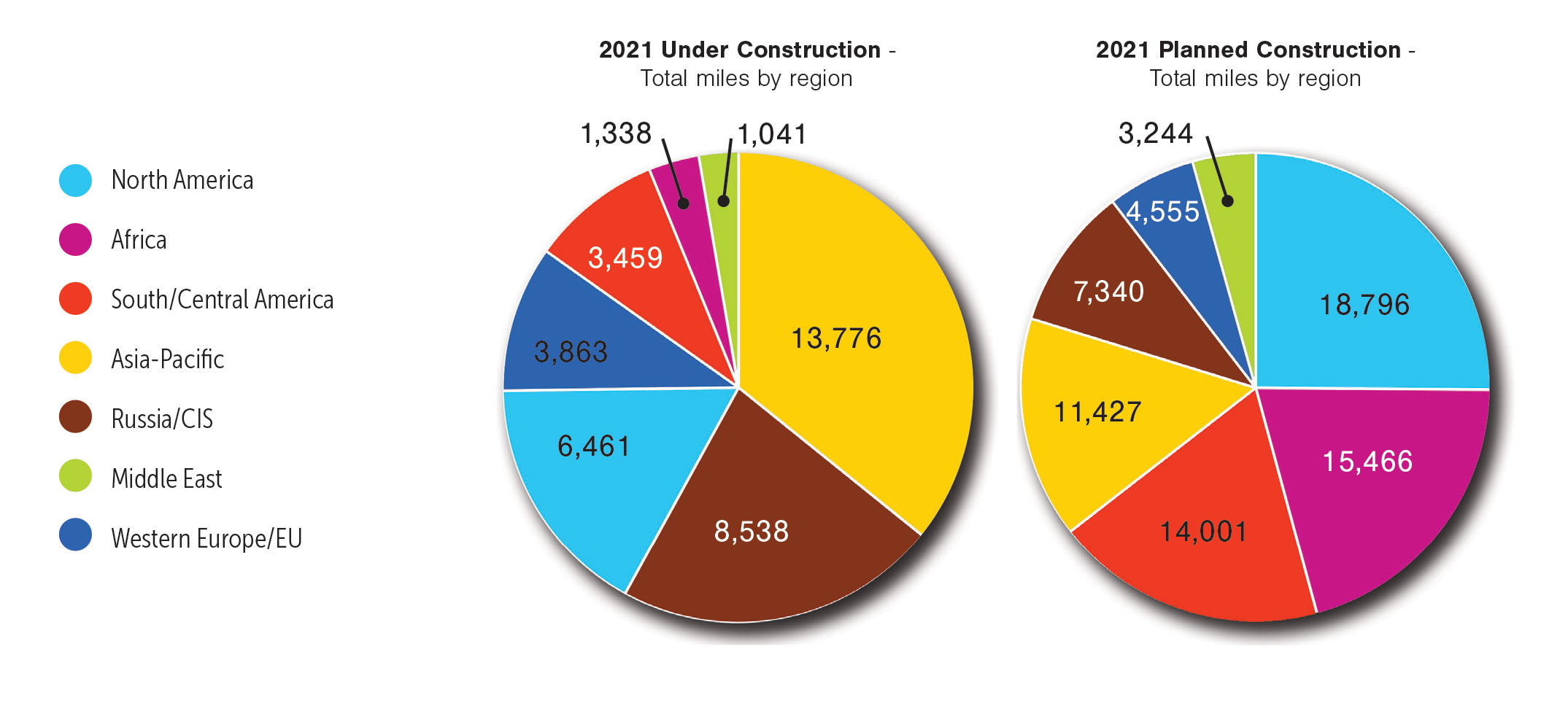

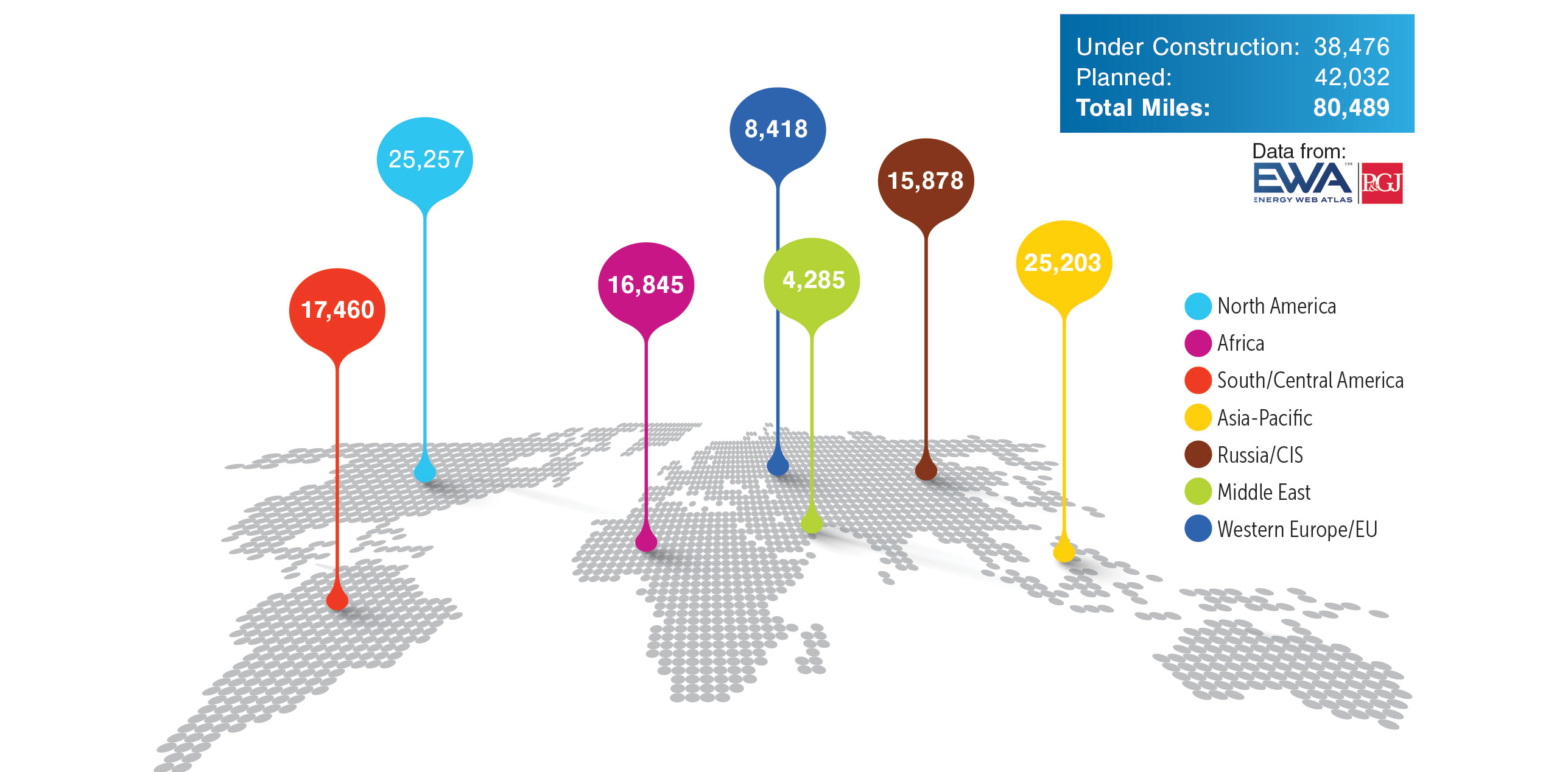

Pipeline Miles Under Construction: 6,461

Pipeline Miles Planned: 18,796

Total: 25,276

Regionally, growth is expected to continue in the Gulf Coast for midstream, at least through 2025. This should increase investment, particularly when the COVID-19 adjustments taken by the sector are factored into consideration by financial institutions.

Additionally, the Permian Basin and Bakken Shale areas will still provide good opportunities for midstream companies in 2021.

With the 2.1-Bcf/d (59 MMcm/d) Permian Highway Pipeline going fully online in early 2021, and the 2-Bcf/d (57 MMcm/d) Whistler Pipeline still expected to go in-service in the third quarter, the results could play a key role in energizing midstream in that region.

Permian producers should see significantly improved options with this eastbound expansion to the still burgeoning Texas Gulf Coast, where shipping at hubs remains reasonably attractive and should attract additional midstream projects.

Meanwhile, in the second-largest field in the United States, Bakken producers still face pressure to delay bringing back much of the 500,000 bpd of their curbed output, following a court ruling in July that jeopardizes the operation of Energy Transfer LP’s Dakota Access Pipeline (DAPL), which ships most of the region’s oil.

An appeals court has allowed DAPL to continue operating for now, but the threat of closure makes reversing cutbacks and drilling new wells too risky, executives and analysts say.

DAPL links Bakken producers to Midwest and Gulf of Mexico customers, accounting for about 40% of the volumes transported to those regions. Rail transport, which is $3 to $6 a barrel more expensive, is expected to expand if the pipeline closes.

Unfortunately, the midcontinent regions, the Marcellus and Utica, along with the SCOOP/STACK basin, will not fare as well. After scaling back by about 20% in 2020, based on Gulf Energy Information’s Energy Web Atlas, in part due to regulatory challenges posed to pipeline projects to the East Coast, much of the new year will likely consist on recovery efforts.

Overall, it is difficult to estimate how spending in North America during 2021 will compare to 2020 – which was, hopefully, a year unlike any other we will ever experience. It is fair to say mid-2021 will be better than mid-2020.

Additionally, there will be increased regulatory risk to projects and social opposition that, over the past few years, has increased its targeting to include banking institutions that finance pipeline projects. The related delays increase costs due to delays and court battles.

A few, though certainly not all-inclusive, examples include the Northeast Supply Enhancement (NESE) postponed by Williams in May after a key permit was rejected, and delays to Mountain Valley Pipeline, which once again faces legal opposition in Virginia due to concerns about sedimentation and blasting that they say impact threatened and endangered species.

In the ongoing saga of the Keystone XL pipeline, there was some encouraging news about the project’s prospects for 2021, though challenges remain, along with the possibility that President-elect Joe Biden will scrap an essential permit.

Six U.S. union construction companies were awarded about $1.6 billion in contracts recently to build portions of the Keystone XL pipeline. The project’s owner, TC Energy, expects the work to get underway in 2021.

Additionally, even as the pandemic-driven collapse subsides, there will likely be consolidation between larger diversified companies and smaller midstream operations. This is in addition to outright sales, such as the recent Devon Energy acquisition of Permian Basin peer WPX Energy for $2.56 billion and CenterPoint Energy’s sale of Miller Pipeline and Minnesota Limited to PowerTeam Services for $850 million. There will also be more mergers like the Husky Energy–Cenovus Energy agreement that created Canada’s No. 3 oil and gas producer.

In Canada, which became the largest source of U.S. energy imports and the second-largest destination for U.S. energy exports behind only Mexico, production declines and payroll reductions largely mirrored those of the United States.

On a favorable note, Canada’s Supreme Court made rulings in 2020 benefiting pipeline construction projects, including one that ended seven years of legal challenges to the Trans Mountain pipeline expansion. Now under construction, that project will triple the capacity of the 67-year-old pipeline from Alberta to the British Columbia coast. Completion is planned for late 2022.

The Keystone XL and Line 3 pipelines would increase pipeline access for Canada, but Alberta producers would still be limited to refiners in the U.S. Midwest and Gulf Coast. The Trans Mountain expansion, however, could allow producers to access markets in California and Asia.

Western Canadian oil producers have suffered from a shortage of export capacity from the region for much of the past decade, and the pandemic heightened problems, necessitating the shutdown of 1.2 MMbpd.

Currently, there is about 700,000 bpd of surplus oil pipeline capacity out of Western Canada, based on comments by midstream firm Enbridge’s CEO Al Monaco during the company’s first-quarter 2020 earnings call.

Construction has restarted on Coastal GasLink pipeline in the west, which will move gas from northeast British Columbia to the Pacific Coast, where the Royal Dutch Shell-led liquified natural gas (LNG) Canada export facility is under construction.

Michels Canada won the contract from TC Energy to construct 162 miles (260 km) of the Keystone XL Pipeline Project in Alberta, Canada, which is expected to be completed in the spring of 2022.

The company will be directly responsible for hiring a projected 1,000 workers each year over the two-year construction period, between Oyen and Hardisty, Alberta, with special emphasis placed on hiring locally and giving priority to qualified local and indigenous businesses.

South & Central America

Pipeline Miles Under Construction: 3,459

Pipeline Miles Planned: 14,001

Total: 17,460

The midstream sector in South America has been hit particularly hard by low prices and weak demand brought on by COVID-19 shutdowns and declining demand. Several projects have been pushed back until at least 2022, and some may never be built.

Analysts report that pipeline companies in the region, as a rule, have been reducing capex by as much as one-third and slashing workforce totals, with an eye toward rebounding in late 2021.

As was the case to start the year, the large countries of the region, particularly Brazil, Mexico and Argentina, which have been large producers and large importers of natural gas, each still face their own infrastructure challenges to meet domestic demand.

Mexico continues to need more gas pipelines for electricity generation but was at least able to open the Texas-Tuxpan gas pipeline to meet the growing demand in the central and south-southeast regions of the country.

Additionally, there was growing pre-pandemic interest in cross-border pipeline projects. There are currently 16 of these in the region: seven between Argentina and Chile; three between Bolivia and Argentina; two each between Argentina and Uruguay, with one connecting Bolivia with Brazil; one between Argentina and Brazil; and another between Colombia and Venezuela.

Setbacks aside, Mexico’s energy administrator Sener expects two gas pipelines, totaling 760 miles (1,224 km), will be delivered by the middle of 2021. The first, the 280-mile (452-km) La Laguna-Aguascalientes, commissioned by the Federal Electricity Commission (CFE), will have a capacity of 1.29 Bcf/d (37 MMcm/d).

The second is in the final phase of construction – the South Texas-Tuxpan South submarine pipeline – covering 480 miles (772 km), with a capacity of 2.6 Bcf/d (74 MMcm/d).

The 381-mile (614-km) Samalayuca-Sasabe gas pipeline, also under construction, has a capacity of 472 MMcf/d (13 Bcm/d). The 232-mile (374-km) Villa de Reyes-Aguascaliente-Guadalajara with a capacity of 886 MMcf/d (25 Bcm/d) is under construction as well.

Asia Pacific

Pipeline Miles Under Construction: 13,776

Pipeline Miles Planned: 11,427

Total: 25,203

China remains the dominant force behind the region’s energy industry as the nation continues to work toward restructuring its state-owned energy assets and focus on natural gas as a power source.

However, expansion of nuclear energy in China – as well as United Arab Emirates, Iran, Turkey and India – has led to a lowering of oil and gas demand that has helped slow construction of pipelines in China, with several projects canceled or delayed.

Some large pipelines in China remain at below-capacity levels, which was amplified by the ramifications of the coronavirus lockdowns. This was especially true of oil pipelines.

Still, to reduce dependence from Russian and African sources, China’s diversification efforts have led to pipeline projects in such locations as Myanmar and Central Asia, and massive investment, which is expected to continue.

Central Asia has an abundance of oil and natural gas deposits, and the region accounts for about 4% of global energy deposits. The oil reserves in Central Asia and along the Caspian Sea coast amount to 17-33 bpd – with more unexploited deposits.

Two main pipelines from Central Asia to China, the Central Asia-China gas pipeline and Kazakhstan-China oil pipeline, are already in operation.

The Central Asia-China Gas Pipeline (CAGP), spanning Turkmenistan, Uzbekistan and Kazakhstan, and crossing Xingjian at the border town of Horgos, transported 1.4 Tcf (40 Bcm) of natural gas when it was first built. It is connected to China’s second west-east gas pipeline, which starts from Horgos and ends in Hong Kong, stretching a total of 5,408 miles (8,704 km).

China imported about 494 Bcf (18.4 Bcm) of natural gas through its first cross-border pipeline over the last two years. Given the nation’s plan to increase gas imports from Central Asia by five times, the Central Asia-China Pipeline’s capacity will expand up to 1.9-2.1 Tcf (55-60 Bcm) of gas per year.

Upon the possible addition of what is now known as “Line D,” the Central Asia-China Gas Pipeline will have an annual deliverability of 3 Tcf (85 Bcm), the largest gas transmission system in Central Asia.

The second of these pipelines, the Kazakhstan-China Oil Pipeline, is China’s first direct oil import pipeline that allows oil import from Central Asia. This pipeline flows from the Caspian shoreline, on Kazakhstan’s side, to China’s Xinjiang. The pipeline is jointly owned by China National Petroleum Corporation (CNPC) and the Kazakh state-owned oil company KazMunayGas.

Africa

Pipeline Miles Under Construction: 1,338

Pipeline Miles Planned: 15,466

Total: 16,854

A slow approvals system and frequent governmental flip-flops on projects has been at the crux of what has slowed development in the region for years, and 2020 was no exception.

Abu Dhabi National Oil Company (ADNOC) said in June that a consortium of investors agreed to bring $10.1 billion in foreign direct investment for natural gas pipeline assets valued at $20.7 billion. Under the agreement, ADNOC will lease its interest in assets to ADNOC Gas Pipelines for 20 years in return for a volume-based tariff subject to a floor and a cap.

Nigeria National Petroleum Corporation (NNPC) started construction of the biggest natural gas pipeline in the country’s history – a $2.8 billion, 384-mile (614-km) project from Ajaokuta to Kano. The 40-inch (1,016-mm) line will transport 3.5 MMscf/d (98,882 cm/d) from multiple gathering projects in southern Nigeria, resulting in the establishment of a connecting network between its eastern, western and northern regions.

Tanzania and Kenya are constructing a 345-mile (558-km) gas pipeline between Tanzania’s Dar es Salaam and Tanga and on to Kenya’s coastal city of Mombasa. The project, which is being developed under a contract by China Petroleum Technology and Development Corp., will meet the estimated gas demand of 50 MMscf/d (1 MMcm/d) in the two countries. Demand is projected to rise to 150 MMscf/d (4 MMcm/d) by 2035.

Additionally, Uganda discovered an estimated 6 billion barrels of oil in the Albertine rift basin in 2006, but production has been repeatedly snagged by disagreements with foreign oil companies over taxes and development strategy. The government now projects production will begin in early 2022.

In December, landlocked Uganda granted environmental approval for a $3.5 billion pipeline to export crude oil from western fields to the Indian Ocean coast in Tanzania. If built, the 900-mile (1,445-km) pipeline will run from fields co-owned by France’s Total and China’s CNOOC and would cross sensitive ecological systems including wildlife-rich areas, rivers and swampland that are catchments for Lake Victoria.

Russia & CIS

Pipeline Miles Under Construction: 8,538

Pipeline Miles Planned: 7,340

Total: 15,878

The biggest news for the region continues to revolve around the politically charged Nord Stream 2 gas pipeline. As of late-December, Russia had resumed construction of the 765-mile (1,230-km) pipeline to Germany, laying pipes after a one-year hiatus prompted by U.S. sanctions, according to the pipeline operator.

Swiss-Dutch company Allseas suspended its work in December 2019 following the threat of sanctions from Washington, D.C., leaving Russia to find other resources to construct the project, which is designed to double the 1.9-Tcf (55-Bcm) annual gas capacity of the existing Nord Stream pipeline.

The two pipelines, which bypass Ukraine, will have the capacity to pump more than half of Russia’s total gas exports to Europe. Rows between Moscow and Kyiv over gas supplies led to the interruption of Russian flows to Europe in previous decades.

Russia also agreed with frequent foe Belarus to a deal on gas prices for 2021, easing tensions between the two former Soviet countries. The price this year was $127 per 6,290 US bbl (1,000 cubic meters).

Separately, operations have started on the middle portion of the 685-mile (1,110-km) China-Russia East natural gas pipeline, allowing natural gas from the Power of Siberia system in Russia to be transmitted to the smog-prone Beijing-Tianjin-Hebei region in northern China.

Middle East

Pipeline Miles Under Construction: 1,041

Pipeline Miles Planned: 3,244

Total: 4,285

Even after the pandemic was in full swing, United Arab Emirates and Israel discussed joining forces on energy-related opportunities, including natural gas exports to Europe, and signed an agreement on Sept. 15 to establish diplomatic relations in the wake of what Israel’s Energy Minister Yuval Steinitz called a “historic opportunity.”

In addition to exports to Europe, the two nations’ talks pointed toward the possibility of linked power grids.

Separately, Egypt, Israel, Greece, Cyprus, Italy and Jordan signed a charter to form the East Mediterranean Gas Forum (EMGF), which establishes a united front by the rivals of Turkey, a nation that has been locked in a dispute with European Union (EU) members Cyprus and Greece over drilling rights in the region.

Israel is significantly increasing the amount of natural gas it plans to export via the EMED Pipeline to Egypt, based on data from Israeli energy companies. Partners in Israel’s Leviathan and Tamar offshore gas fields agreed to sell $15 billion worth of gas to a customer in Egypt under the deal.

Texas-based Noble Energy, Israel’s Delek Drilling and Ratio Oil own Leviathan. Noble, Delek Drilling, Isramco and Tamar Petroleum are leading partners in the Tamar field. Noble and Delek Drilling have also partnered with Egyptian East Gas Co. in a venture called EMED, which bought the subsea EMG pipeline to carry the gas.

Additionally, Greece, Cyprus and Israel are pushing toward building a 1,180-mile (1,900-km) subsea pipeline to carry natural gas from the eastern Mediterranean’s rapidly developing gas fields to Europe.

Although Turkey opposes the project, the countries aim to reach a final investment decision by 2022 and have the pipeline completed by 2025 to help Europe diversify its energy resources.

Western Europe/EU

Pipeline Miles Under Construction: 3,863

Pipeline Miles Planned: 4,555

Total: 8,418

Europe remains a key battleground for global natural gas and LNG market share, and has shown a serious commitment to hydrogen gas pipeline networks in an ongoing push to clean energy.

Over the next decade, Germany plans to create the longest hydrogen transmission pipeline network in the world. In 2020, the German Federal Government assigned $10 billion, under its National Hydrogen Strategy policy, toward kick-starting an expansion of electrolysis capacity for large-scale hydrogen production.

The planned nationwide hydrogen 3,666-mile (5,900-km) pipeline network is designed for large-scale transmission of hydrogen throughout Germany and should be completed by 2030.

Meanwhile, developers of the Trans Adriatic Pipeline (TAP) have started feasibility studies on blending hydrogen with the natural gas the pipeline will bring in from Azerbaijan, TAP said.

TAP is the final leg of a $40 billion project named the Southern Gas Corridor, which will carry 353 Bcf (10 Bcm) of gas per year from the giant Shah Deniz field into Europe. The pipeline, already commercially operative, is set to start pumping its first gas into Italy at the end of 2020.

Comments