October 2022, Vol. 249, No. 10

Projects

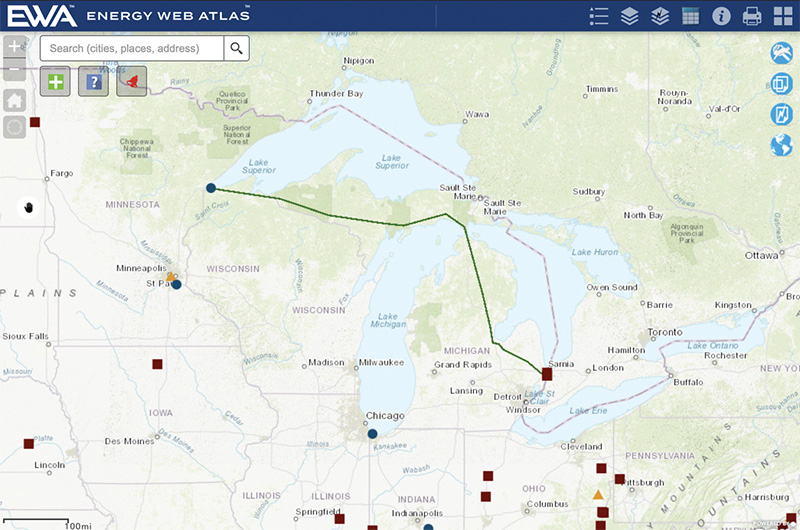

Enbridge Line 5 Pipeline Dispute Headed to Federal Court

Enbridge Line 5 Pipeline Dispute Headed to Federal Court

A state lawsuit designed to stop Enbridge from operating the Line 5 oil pipeline beneath the Straits of Mackinac in the Great Lakes will be heard in federal court, a judge ruled.

The Canadian pipeline operator has been involved in a lengthy dispute with the state over the 4-mile (6.4-km) section of the aging pipeline, which ships 540,000 bpd of crude and refined products from Superior, Wisconsin, to Sarnia, Ontario.

Enbridge ignored and order that the pipeline be shut down by May 2021. The lawsuit was originally filed in state court in June 2019 by the Michigan Attorney General’s Office, prompting Enbridge to argue that federal court was the jurisdiction.

“The state’s attempts shut down this critical energy infrastructure raises important federal questions of interstate commerce, exclusive federal jurisdiction over pipeline safety and the serious ramifications for energy security and foreign affairs if the State and the U.S. government were to defy an international treaty with Canada that has been in place since 1977,” Enbridge spokeswoman Gina Sutherland said in written remarks.

A 1977 pipeline treaty governs the free flow of oil between Canada and the United States, and last year Ottawa warned shutting down Line 5 could sour relations with Washington.

Cheniere to Form JV to Construct 43-Mile Gas Pipeline in Texas

Cheniere Energy will form a joint venture with units of Whistler Pipeline to construct the ADCC natural gas pipeline, WhiteWater Midstream LLC said.

The 42-inch ADCC pipeline is expected to extend about 43 miles from Whistler’s terminus to Cheniere’s Corpus Christi liquefaction facility in Texas.

The pipeline can transport up to 1.7 Bcf/d of natural gas, expandable to 2.5 Bcf/d, and is expected to be in service in 2024, pending regulatory approvals.

Cheniere in June gave the financial go-ahead to an $8 billion expansion of its Corpus Christi plant and signaled further expansions could be in store.

The development comes against the backdrop of strong demand for LNG as Europe loses access to Russian gas.

Whistler Pipeline is owned by a consortium including MPLX LP, WhiteWater and a JV between Stonepeak and West Texas Gas.

TotalEnergies Moving Forward on Gas Pipeline in Argentina

TotalEnergies approved the final investment decision for the Fenix gas development, located 37 miles (60 km) off the coast of Tierra del Fuego in southern Argentina.

The Fenix field will be developed through three horizontal wells, drilled from a new unmanned platform in 229 ft (70 meters)water depth. The gas will be transported through a 21-mile (35-km) pipeline to the TotalEnergies-operated Véga Pleyade platform and treated onshore at the Rio Cullen and Cañadon Alfa plants, also operated by the company.

At production start-up, expected early 2025, Fenix will produce 70,000 boe/d (10 MMcm/d) of natural gas. This development represents an investment of $706 million.

“With first gas less than two and a half years from FID, the Fenix project will contribute to maintaining our production levels in Tierra del Fuego and securing supply to the Argentinean gas market,” said David Mendelson, senior vice president of Americas at TotalEnergies.

In April, the national authorities granted the CMA-1 concession, including Fenix, an extension for 10 years until April 2041. As a new gas project in Tierra del Fuego, the national authorities also granted Fenix the benefits provided for under Law 19640’s special tax regime.

Through its Total Austral affiliate, TotalEnergies operates the project with a 37.5% interest, in partnership with Wintershall Dea (37.5%) and Pan American Sur (25%).

TotalEnergies has been operating in Argentina since 1978, through its Total Austral affiliate, and is the country’s leading international gas producer, with some 25% of production. The company’s equity share of production averaged 81,000 boe/d in 2021.

Tellurian Completes Acquisition of Haynesville Natural Gas Assets

Tellurian subsidiary Tellurian Production closed on the acquisition of assets in the Haynesville Basin from privately held EnSight IV and EnSight Haynesville Partners.

Tellurian Production agreed to pay $132.5 million for the assets, which are comprised in part of 5,000 net acres, 45 MMcf/d (100%) of current natural gas net production, 30 gross drilling locations and 108 Bcf of natural gas proved reserves. Additionally, these assets included 44 producing wells and five wells in currently in progress.

With the closing of the EnSight acquisition, the company has current production of about 150 MMcf/d from assets in the Haynesville Basin. In addition, TPC operates 11 wells currently being drilled or completed, all of which are expected to turn to sales before the end of the year.

“By owning and operating upstream assets, a pipeline network and the Driftwood LNG terminal, Tellurian will have the ability to sell natural gas into domestic or international markets,” said Octávio Simões, Tellurian president and CEO.

The cash consideration at closing was $125.5 million, revised from the announced $125 million due to preliminary purchase price adjustments. The consideration was funded with cash on hand.

Croatia to Build $182.3 Million Gas Pipeline, Doubling Capacity

Croatia plans to invest $182.3 million (180.5 million euros) to build a new gas pipeline, which will double the capacity at its LNG terminal as part of the effort to curtain use of Russian supplies.

The new gas pipeline itself will cost $156 million (156.5 euros) and run between Zlobin and Bosiljevo in northwestern Croatia. The LNG capacity on the northern Adriatic Island of Krk will increase to 6.1 Bcm of gas annually from 2.6 Bcm.

Energy Minister Davor Filipovic announced the government has made a strategic decision to secure gas supplies but also to position itself as an energy leader in the region, state news agency Hina reported. The announcement did not include a timeline for the project.

The government will use European Union funds to finance the projects, along with allocations from state budget, he said.

France Favors Gas Terminals vs. $3 Billion in Pipeline Projects

A third gas pipeline between Spain and France would cost at least $3 billion (3.01 billion euros) and take years to complete, making it a less attractive option to address Europe’s supply worries than new terminals to receive fuel by boat, France’s energy transition ministry said.

The European Union is bracing for any further fall in gas flows from Russia, which had been the 27-nation bloc’s biggest supplier before it invaded its neighbor Ukraine in February and trade was disrupted.

According to Reuters, German Chancellor Olaf Scholz said that building a pipeline from Portugal through Spain and France to the central European states that are more reliant on Russian gas would “massively relieve the supply situation.”

Spain is the site of Europe’s largest fleet of terminals, which can receive LNG from the United States and Qatar but has limited capacity for supplies from other countries.

The French ministry said in a statement that new LNG terminals, including those that float could be located in northern and eastern Europe, particularly Germany, and be quicker and cheaper to use than a new pipeline.

US Officials Block Idaho-Wyoming Gas Pipeline Pending Review

Officials in the United States have blocked the approval of a natural gas pipeline from Idaho to Wyoming until additional environmental studies are completed.

A U.S. District Court approved an agreement reached between the U.S. Forest Service and two environmental groups that had filed a lawsuit to halt the 50-mile (80-km) Crow Creek Pipeline Project.

“This unique area that links the Northern and Southern Rocky Mountains must be protected and managed as a wildlife corridor for our endangered wildlife species,” Jason Christensen, director of Yellowstone to Uintas Connection, said in a statement to the Associated Press.

Before authorizing the project that partially crosses Forest Service land, the Forest Service agreed to complete a supplemental environmental impact statement. The completion date of the environmental study is not specified.

Wyoming-based Lower Valley Energy hopes to construct the pipeline that is planned to run from Montpelier, Idaho, to Afton, Wyoming. The Alliance for the Wild Rockies and the Yellowstone to Uintas Connection, on the other hand, argue that it will harm protected grizzly bears and other wildlife.

In a lawsuit filed in 2020, the groups claimed that an 18-mile (29-km) section of the pipeline would cut a corridor through Caribou-Targhee National Forest and create a road through six roadless areas. The 2001 Roadless Rule prohibits road construction and timber harvesting in designated roadless areas of 5,000 acres (2,000 hectares) or greater.

DCP Midstream Receives Acquisition Proposal from Phillips 66

Phillips 66 has offered to buy the public units of DCP Midstream in a deal that would place the value the pipeline operator at about $7.2 billion and enhance Phillips’ natural gas liquids assets.

According to Reuters, Canadian pipeline operator Enbridge, which owned 50% of DCP’s general partner, said it would reduce its stake in the company to 13.2% from 28.3%. The company received a $400 million in cash from Phillips 66 as part of the deal.

Enbridge would take over as operator from Phillips 66, more than doubling its stake in Grey Oak pipeline. The Grey Oak pipeline transports crude oil from West Texas to the Gulf Coast.

UGI to Develop RNG Project in Upstate New York

UGI Corp. entered into an agreement with Cayuga RNG to develop its fourth project to produce renewable natural gas (RNG) in upstate New York, the company said.

Once completed in the second half of 2024, the project will produce 150 MMcf of RNG annually for delivery to a local natural gas pipeline serving the regional distribution system. UGIES’ subsidiary, GHI Energy, will be the exclusive marketer for Cayuga RNG.

Cayuga RNG’s fourth project will be constructed at Bergen Farms and Glenview Dairy, both located in Schuyler County in upstate New York. The project will include the construction of a manure digester and gas upgrading equipment at each location.

Cayuga RNG is a joint venture of UGI Energy Services LLC (UGIES), a subsidiary of UGI, and Global Common Ventures LLC (GCV).

“We are excited to increase our portfolio of sustainable energy solutions that will deliver environmental benefits to farmers, communities and customers,” Robert F. Beard, executive vice president of natural gas at UGI, said.

Operator Oldelval to Invest $750 Million in Vaca Muerta Pipeline

Argentine oil pipeline operator Oldelval will invest $750 million to double its transport capacity from the Vaca Muerta shale formation, the country’s energy ministry said.

The 350-mile (563 km) pipeline, connecting the province of Neuquen with Salliquelo, is expected to cost $1.5 billion and require 18 months to complete construction.

Oldelval looks to double capacity to 2.5 MMcf/d (72,000 cm) per day in two years, the ministry said.

The activity around the Vaca Muerta could boost Argentina’s total oil exports to 250,000 bpd, the energy ministry estimated, adding that the region encompasses the world’s second-largest shale gas reserve and fourth-biggest for shale oil.

“This project will allow us to double our transport capacity and allow the country to generate between $4 billion and $6.5 billion,” Oldelval CEO Ricardo Hosel said in a release to the media.

The announcement came after the government approved a 10-year extension for Oldelval to operate pipelines from the Neuquen basin to Vaca Muerta until 2037.

The government also plans to begin construction of a gas pipeline linking Vaca Muerta with the capital Buenos Aires in the fourth quarter.

Comments