December 2023, Vol. 250, No. 12

Features

RNG Outlook Offers Mixed Message for Midstream

By Richard Nemec, Contributing Editor, North America

(P&GJ) – In mid-2023, the international management consulting firm Boston Consulting Group (BCG) issued an assessment of renewable natural gas (RNG) that offered a mixed message.

While concluding that, in these upcoming climate change response decades, RNG will play a “critical role in decarbonization,” BCG consultants also alleged that biofuel gas supplies are currently under-developed with a “nascent and fragmented market.”

Additionally, from a strictly midstream perspective, the build-out for RNG expansion has been concentrated on the production end, along with construction of more gathering pipelines. The interstate and intrastate distribution and transmission infrastructure is already in place, with the extensive U.S. gas pipeline network.

A quartet of BCG authors in the June-released white paper, “Is RNG Poised for Future Growth or Doomed to Decline?” seemed to hedge their bets, although they did offer recommendations for actions on the oil and natural gas sector’s part and utilities that focus on more partnerships with the budding RNG developer/producers.

BCG’s authors — Houston-based managing directors Ilshat Haris and Laura Borland, along with Anusha Paliwal and Gonzalo Caballeria — indicate that RNG is one of several technologies that the United States should rely on, in pursuing a path toward decarbonization. They see natural gas playing a “material role” in the global energy mix through the decades of 2040-50.

Increasingly, they said, gas will come from organic waste streams, rather than traditional fossil fuel production, the BCG report emphasizes. The consultants’ conclusion is that RNG can help reduce greenhouse gas (GHG) emissions in four ways: cutting electric generation emissions, reducing fossil fuel use, replacing chemical fertilizers with bio-based products and enabling the production of synthetic fuels that depend on biogenic CO2.

“The BCG report rightly notes the critical role of RNG in decarbonizing gas utilities and providing different consumer groups with low-carbon solutions,” said the American Gas Association’s (AGA) Richard Meyer. “AGA supports the market growth of RNG, and the BCG report (and others) points to significant potential for market growth in this area in the coming decade and points to a need to expand the availability of RNG supplies to the market.

Also, last summer, another international consulting giant, Wood MacKenzie (WoodMac), issued an assessment of RNG, “North American RNG State of the Market,” noting it currently accounts for only 0.5% of the North American natural gas sector but can reach 3% penetration by 2050. A 3% level would equate to 4 Bcfd of RNG in North American gas supplies.

“There are opportunities for new policy framework to drive more activity in the sector, but we will also need to see voluntary efforts as well, particularly from the industrial sector, as more firms commit to low-carbon initiatives,” said Natalia Patterson, a senior research analyst at WoodMac. “The growth in the industrial sector would have the potential to dwarf traditional RNG demand in the transportation sector.”

Acknowledging that a ton of work still needs to be done over the coming years, officials at the California-based RNG Coalition indicate the BCG and WoodMac reports are encouraging, by virtue of two respected global analytical organizations, a vision for ten-fold or more of growth over the next 17 years for RNG.

They laud BCG for noting the security advantages that RNG can bring, which may be taken for granted in North America — amidst the current wealth of energy supplies — but is certainly part of the reason Europe is all-in on RNG and projecting a twelve-fold increase in its share of the European Union energy market by 2030, hitting 1.23 Tcf (35 Bcm) annually.

“When push comes to shove, global governments are likely to continue encouraging capture and production of every available molecule of RNG as a sensible means of supply diversification,” said Dylan Chase, a Sacramento, California-based RNG Coalition spokesperson, who also expressed encouragement from the WoodMac assessment.

As for the assertions of under-development and fragmentation of the RNG market, Chase said “people are quick to supply adjectives to our industry, but we think the numbers [or metrics] speak for themselves. Tenfold growth over the past decade, 300 and counting operational RNG production facilities, overwhelming penetration of the compressed natural gas [CNG for vehicles] market and resounding strong carbon intensity scores, compared to other clean fuels, are all part of the story.”

Coalition’s Confidence

Chase said the coalition leaders are confident they are on the right path, integrating resources and industrial know-how with growing policy support to eventually displace what he calls “meaningful volumes” of fossil fuels.

“With the right amount of policy support, a lot of hard work, and a dash of luck, we’re hopeful this will not be the last time we multiply our growth trajectory within a short time frame.”

At the state level, clean heat standards (CHS) and renewable gas standards have a major role to play in RNG being an important decarbonization tool, according to Coalition officials like Chase.

CHS programs usually establish percentages for renewable energy sources, which must be used in building heating/cooling systems that use RNG, geothermal heat pumps or other renewable sources. The standards in turn establish a “sense of urgency,” promoting more action in the renewable space, Chase said. RNG advocates are tracking such standards in a number of states, including California, Colorado, Minnesota, New Hampshire and Vermont.

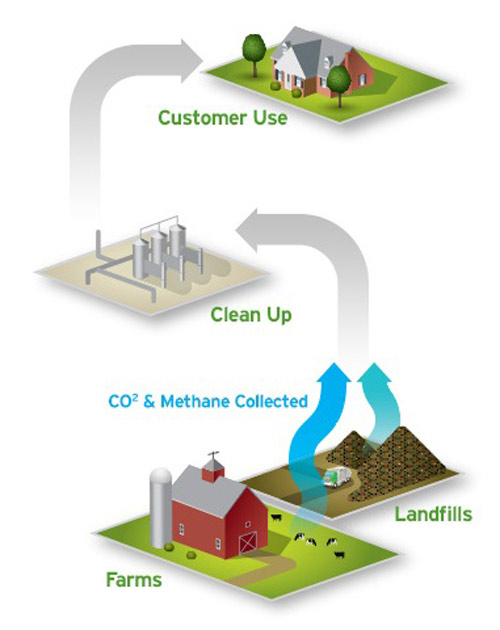

Advocates call RNG’s compatibility with existing infrastructure a “core strength.” Chase added that pipelines should be “exceedingly modest,” compared to the historic U.S. pipeline build-outs of the past, according to Chase. “Once biogas is captured, it simply requires some straightforward cleanup and processing to be ready for distribution to customers.”

AGA Study

The AGA Foundation, in assessing renewable sources of natural gas, acknowledged that RNG now costs more than traditional geologic supplies. However, it anticipates that, as the market for the renewable supplies matures, production volumes increase and long-term contracts emerge, “the opportunities for cost declines” will be significant by 2040. As a GHG emissions reduction tool, the cost of RNG is competitive now, according to analytical work that the global consulting firm ICF did earlier for the AGA Foundation, and which served as a baseline for the more recent BCG report.

“RNG could reduce emissions from natural gas by 95% in the residential sector,” ICF research analysts note, calculating that the RNG carbon abatement costs range between $55-$300/metric ton (mmt) of CO2.

According to AGA’s study, “Net-Zero Emissions Opportunities for Gas Utilities,” the inclusion of natural gas, advanced fuels and “our world class infrastructure” can develop opportunities to slash emissions, unleash greater innovation and enhance energy reliability.

“With its low-to-negative life-cycle carbon footprint, RNG has great potential to continue driving down emissions and helping meet the nation’s environmental goals,” the AGA study notes.

The study advocates an “all pathways” approach incorporating a significant expansion of RNG and hydrogen production and consumption. This envisions large amounts of renewable and low-carbon electricity and gases, as well as negative emissions technologies, to meet an economy-wide 2050 net-zero target. As in the power sector, rapid and widespread adoption of renewable, low-carbon and negative emissions resources will be essential to the gas sector achieving net-zero emissions, according to the AGA study.

“Once biogas is captured, it simply requires some straightforward cleanup and processing to be ready for distribution to customers.”

– Dylan Chase, RNG Coalition spokesperson, commenting on the “exceedingly modest” need for pipeline build-outs

Early in 2023, AGA wrote, U.S. Environmental Protection Administration (EPA) head Michael Regan was being urged that new federal renewable fuel standards (RFS) make room for future development of RNG and biogas, with AGA stressing that natural gas currently provides a third of the nation’s energy and is working to greatly reduce its GHG emissions.

“The EPA’s RFS Program could further advance the development of low-carbon gas resources,” AGA told EPA’s Regan. “The biogas industry has grown significantly since 2014, when CNG and liquefied natural gas [LNG] derived from biogas first qualified as cellulosic fuels under the RFS. Since that time, biogas-derived CNG and LNG have grown to comprise the majority of all cellulosic biofuel gallons produced — more than 95% of the annual volume standards set by EPA.

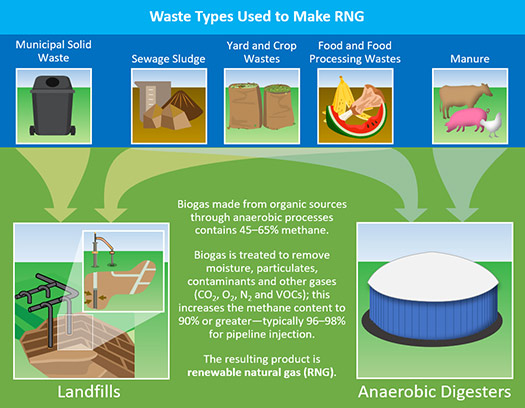

Enabled by the RFS, the market has supported the development of biogas systems that serve as organic waste recycling infrastructure. Anerobic digesters and landfills convert byproducts from wastewater treatment facilities, farms and industrial food facilities into renewable energy.

Pipeline Quality

“Today, the U.S. has over 2,300 sites producing biogas in all 50 states. Nearly 300 of these sites produce RNG that has been processed to meet pipeline gas quality standards. That represented a 47% increase in 2021,” according to AGA.

In June, the EPA established a final RFS rule — establishing renewable volume obligations (RVO) for 2023, 2024 and 2025 — that has some positive aspects for RNG, but it didn’t go far enough from the perspective of advocates at the RNG Coalition.

Economists have summarized the action as raising the floor for demand in the biomass-based diesel and advanced biofuel sector, but as long as they lag behind capacity, the action will not incentivize continued growth in a sector that has made a substantial contribution to corn and soybean demand for American farmers, as well as to the overall sustainability of U.S. energy supplies.

“The rule further reduces this floor through the removal of a 250-million-gallon supplemental conventional fuel requirement for 2023–2025, leading to lower corn demand and the implications that come from that,” according to the American Farm Bureau Federation economist Bernt Nelson.

“On the whole, we found the EPA’s latest rulemaking to be very promising for our industry, with tremendous growth rates forecast for RNG under the program’s cellulosic category,” said the RNG Coalition’s Chase. “That said, there were a few missed opportunities, including environmental renewable identification numbers (eRIN), which we continue to advocate for with the agency.”

EPA’s action established biofuel volume requirements and associated percentage standards for cellulosic biofuel, biomass-based diesel (BBD), advanced biofuel and total renewable fuel over the next three years. The rule also responds to a court remand of the 2016 annual rule, by establishing a supplemental volume requirement of 250 million gallons of renewable fuel for 2023.

As evidenced in some late September meetings held in New York City, RNG has taken on more of a global profile in recent years, spearheaded by cooperative GHG protocol work between the World Resources Institute (WRI) and the World Business Council for Sustainable Development. The U.S.-based RNG Coalition is now part of that worldwide dialogue.

The U.S, coalition met with the WRI’s director of the GHG Protocol and representatives of the European Biogas Association (EBA) to discuss how to ramp up the continuing growth in RNG production and use. They identified various future opportunities for global collaboration. The goal is a closer, firmer link between GHG emissions reduction efforts and the use of RNG.

Noting that the New York meetings were both productive and positive, WRI Protocol Director Pankaj Bhatia said WRI plans to remove remaining obstacles to biomethane, under its Land Sector and Removable Guidance program.

“We are working to ensure that existing best practices are incorporated in any future guidance on GHG Protocol, so that RNG transactions are carried out with the highest level of integrity and confidence,” Bhatia said.

RNG Coalition founder and CFO David Cox said the WRI collaboration is constructive, calling it “a market-based approach to environmental attributes that is a proven catalyst for growth that ensures renewable gases contribute positively to our clean energy now and in the future.”

As 2023 wound to a close, the U.S. coalition was focused on California’s ongoing attempts to update its nationally recognized low carbon fuel standard. Coalition members are concerned that the state agency does not have a complete understanding of the role biogas can play.

“CARB has proposed ending avoided methane credits, which is the lever that recognizes the impact of RNG on removing fugitive methane emissions from dairy farms in the state by 2040,” said the Chase, who contends this would remove a “significant driver” from California’s long-term emissions reduction goals.

He added that the coalition members plan to continue emphasizing to CARB the life-cycle benefits of dairy and other forms of what he called “waste-derived” RNG.

Responsibly sourced or certified natural gas (eNG) is part of the debate about net-zero gas supplies, but the RNG Coalition does not take a stand on these options, noting that “responsible operations and careful emissions monitoring” of the nation’s gas system need to be routine within all operations.

“We focus on displacing fossil natural gas, and we view RNG as the most obvious near-term lever our society should lean on to clean up the U.S. gas system,” Chase said.

Gas producer/marketers, through their Washington, D.C.-based Natural Gas Supply Association (NGSA), track developments related to RNG, but they aren’t experts on that clean fuel option, according to NGSA and Center for LNG spokesperson Daphne Magnuson.

“We recognize that natural gas, like other fuels, must continue to reduce its carbon footprint over time, to fulfill its role as a building block of the net-zero emissions future,” Magnuson said.

“The timeline for developing the ‘natural gas of the future’ hinges on important policymaker support to stimulate investment in scaling-up these approaches, as well as transparency and collaboration among government, business and customer stakeholders,” he said. “Most importantly, these technologies and practices require clear permitting processes for infrastructure required for lower-emission gas products, hydrogen and CO2 pipelines.”

Nationally, RNG is produced from four primary feedstock sources: landfills, agriculture waste or dairy (manure), wastewater, and organic food waste. Each has distinct characteristics, including supply volume potential, carbon intensity (CI), production economics, and risk profiles. While carbon intensity varies by feedstock source and project, RNG produced from agricultural waste has, on average, the lowest CI score (negative 341 gCO2/MJ). It is followed by RNG produced from organic waste with negative 22 gCO2/MJ, wastewater in the +27 gCO2/MJ range, and lastly landfill with +55 gCO2/MJ1.

Technologically, anaerobic digestion (AD) and thermal gasification are the two primary RNG production technologies. AD is likely to be the focus for this decade given its high techno-economic maturity, according to BCG analysts. Targeted end-uses for RNG to decarbonize fossil natural gas include transportation, electricity generation, gas distribution, and commercial and industrial processes.

“RNG will be an attractive decarbonization option particularly as natural gas continues to play an important role in the short and medium term, according BCG’s report. “This will remain true until alternative fuels like hydrogen become cost competitive and can overcome limitations around pipeline blending limits and high transport and retrofit costs.”

Assuming continued transition in the energy sector and supportive regulations, the WoodMac study projects RNG production capacity to increase tenfold by 2050 as part of its long-term gas supply outlook. In 2022, major energy companies invested at least $8 billion in RNG merger/acquisition (M&A) deals.

“Going forward, the outlook for RNG will be supported by financial incentives and support from national, local and voluntary programs,” according to WoodMac analysts, who characterized their report as a comprehensive analysis of the North America RNG market.

More than half of RNG production is estimated to be consumed as fuel for natural gas vehicles, according to WoodMac’s Patterson. Landfills make up the largest portion of the capacity by feedstock through methane emissions, but animal waste projects are on the rise, followed by food waste and wastewater treatment projects.

Richard Nemec is P&GJ’s long-time contributing editor based in Los Angeles. He can be reached at: rnemeec@ca.rr.com

Comments