January 2024, Vol. 251, No. 1

Features

Spotlight on Supply Chain: How Companies Can Avoid Uncertainty

By Nigel Elson, Associate Partner, Sayan Ganguly, Consultant Stephen Hall, Senior Partner, Christoph Kloos, Associate Partner, and Johann Raunig, Partner, McKinsey & Company

Supply-chain uncertainty is a major headache for many sectors across the world. For oil and gas companies, volatile costs and labor and material-supply uncertainties threaten everything from field operations to project delivery. Minimizing these supply-chain risks could help oil and gas firms better secure their labor and materials while cutting costs by up to 15%.

This article sets out a three-step plan that oil and gas companies could use to assess their supply-chain risk and explores risk-mitigating levers and management-mindset changes that could build resilience in the face of a supply-chain crunch.

Oil and gas companies are grappling with the business fallout of sustained global inflation, geopolitical developments in Europe and Asia, and increasing economic headwinds. Industry leaders say that of all the urgent challenges they face, supply-chain uncertainty is the most pressing. Supply-chain risks are affecting field operations and project delivery, and traditional mitigation strategies are proving inadequate.

As a result, production efficiency is dropping while operating expenditure is rising, project budgets and schedule milestones are being missed, and key suppliers are struggling to provide labor and materials on time. This catapults supply-chain security to the top of the CEO agenda as organizations must swiftly implement a nimble, comprehensive strategy to navigate this turbulent period.

The two major supply-chain security risks now are volatile costs and uncertainties around labor and material supply.

Costs Roller-Coaster

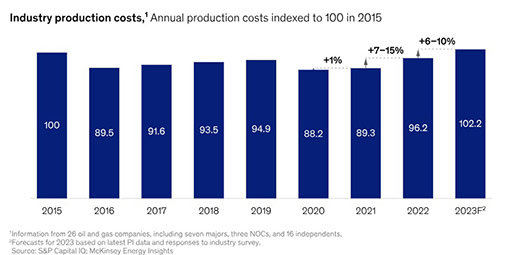

Costs in the oil and gas industry increased by 7 to 15% in 2022 (Figure 1). In 2023, a further 6 to 10% increase is expected, mainly due to labor uncertainties and raw-materials inflation. However, if the predicted global recession hits, some input cost factors could swing downward.

In addition, primary operation tasks, such as regular maintenance and inspections, are becoming more expensive as labor rates grow at more than 9% per annum. Costs for standard-use materials, such as casings and tubing steel parts, are also rising at 5% per annum.

Marine and aviation logistics have been particularly affected by spiraling prices: fuel now costs 20% more on an annual basis, and prices are set to continue rising. At the same time, rates for vessels and emergency work have soared. Inflation has also hit non-technical areas: food prices at offshore installations have risen by around 10% and underlying labor costs for catering are expected to experience similar growth, indicating that offshore premiums may return.

Operators that remember the 2010-14 oil-price boom are acutely aware of inflation’s sharp bite as they struggle to control their current operating expenditure costs. Managing cost volatility can ensure resilience in the oil and gas industry.

Vicious Supply Cycles

The oil and gas industry has faced major supply risks in labor and materials. Planned work has been delayed by strikes over pay hikes, stretched agency staffing pools, and absences as staff seek work that offers improved working conditions and pay. This has created a vicious cycle: more work is carried out under emergency conditions, which is increasingly expensive.

In many areas, the situation has been exacerbated by a heavy reliance on a small number of suppliers with few alternatives. A high staff-absence rate of 6 to 8% has been observed and anecdotal evidence shows an estimated 5 to 10% no-show rate for flights to offshore sites.

Lead times for both long-lead (12 to 18 months) and short-lead (two to six weeks) equipment have stretched, significantly impacting project-delivery schedules. Vessel and spare-parts inventories are continually dropping, causing availability challenges. In addition, the rig market has been tight, making securing a rig more difficult and unpredictable than before.

Robust safeguards against cost inflation and supply risks could allow oil and gas companies to operate in a secure environment with predictable lead times, maintain operational and capital planning to support production, and ensure a stable cost base. Organizations that are taking measures to secure their supply chain and avoid market volatility are seeing significantly less inflationary pressure, saving about 15% on costs. At the same time, securing the supply chain reduces risks in operations and project delivery while maintaining a license to operate and deliver growth.

Where to Start?

To secure the supply chain, oil and gas companies can conduct a comprehensive risk assessment to understand exposure to inflationary pressures and estimate the impact of inflation and supplier availability on future profits. Operators can then understand, manage, and mitigate supply-chain risks from external vendors by focusing on availability, inflation, and supplier risk on a category level.

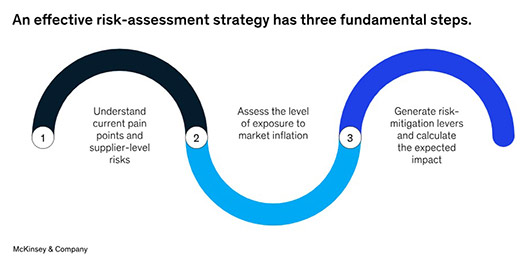

A good risk-assessment strategy has three fundamental steps: understand the current pain points and the risks at supplier level; assess the level of exposure to market inflation; and generate risk-mitigation levers to calculate the expected impact (Figure 2).

Understanding pain points and supplier-level risks involves holding workshops and engagements with function teams to establish why suppliers are not meeting expectations. Once pain points and root causes have been established, organizations can then create a category-level picture of where certain risks exist and identify whether mitigation is required.

A supplier-level risk analysis will help highlight specific risks within certain suppliers and categories. Once a clear picture emerges, a company can then analyze tier-two and three suppliers to identify connectivity and reliance throughout the supply chain. Finally, a holistic risk profile can be created by applying the above steps to different moving parts – consider commercial, operational, and execution risks to construct a complete picture.

Assessing the level of exposure to market inflation requires reviewing contracts to determine the level of exposure to market inflation, reviewing contractual mechanisms to mitigate the impact of inflation (such as risk-reward ratio, managed service options, and supplier consolidation), and comparing against a view of market inflation across key industry indices, each tailored to different categories.

Generating risk-mitigation levers and calculating the expected impact involves mitigating actions across operations and the project portfolio and assessing their expected impact on future costs. A mechanism to appropriately share risk with suppliers, linked to performance, could be established. Thereafter, contract-performance management and supplier relationship-management processes could be refined to ensure long-term sustainability.

The assessment can be carried out jointly with procurement leads and business representatives in a cross-functional task force to ensure effectiveness. The scope can be clearly defined while linking it to a timebound delivery plan and prioritizing levers based on impact and feasibility.

Shifting Gears

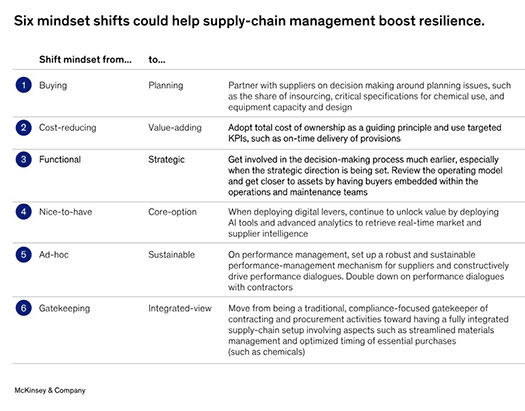

To mitigate supply-chain reliability risks, organizations could pivot away from the typical cost-reduction mindset to a robust bottom-up strategy with concrete levers informed by market intelligence, expert input and risk analysis.

To increase the probability of success, the levers would likely need to be embedded in the organization’s strategy and accompanied by accountability measures. These levers could include the quantification of potential impact for the first year and full run-rate implementation, and the use of KPIs to track performance, where relevant.

The syndication and alignment of each lever, with clear accountability lines and actionable steps on how each one should be progressed, could also help ensure success.

Implementation of the levers could go hand-in-hand with the targeted optimization of contract-performance management and supplier-relationship management across people, processes, and practices. This may help to ensure that the transformation is sustained over time.

Typical high-impact levers include early procurement in strategic projects to accelerate long purchase times by adjusting the sanctioning period, revising the approval gating process or enabling earlier budget approvals. Improving the risk-reward ratio in major contracts to incentivize performance and consolidate contract volumes could also add impact.

When it comes to staffing, enhancing offshore execution efficiency and digitizing inspection data could make the workplace more appealing. Incorporating personnel retention schemes into contracts could also help retain talent.

Supply-chain management needs to evolve from its traditional role to improve its resilience to external shocks. Six mindset shifts could help to achieve this (Exhibit 3). These mindset shifts could be accompanied by new working methods focused on agility and speed that can react quickly to external changes.

Authors: Nigel Elson is an associate partner in McKinsey’s London office, where Sayan Ganguly is a consultant and Stephen Hall is a senior partner; Christoph Kloos is an associate partner in the Munich office, and Johann Raunig is a partner in the Vienna office. The authors wish to thank Adam Davey and Paul Gargett for their contributions to the article.

(Editor’s note: This article was originally published by McKinsey & Company on March 6, 2023.)

Comments