October 2024, Vol. 251, No. 10

Features

India Sets $67 Billion Goal to Expand Gas Pipeline Network by 9,630 Miles

By Eugene Gerden, P&GJ International Correspondent

(P&GJ) — India is rapidly moving toward implementation of its ambitious target for almost doubling of its gas pipelines network in years to come that will be achieved by planned construction of several major gas pipelines and expansion of already existing infrastructure.

Since the beginning of 2023, the Indian energy sector has experiencing a renaissance, thanks to huge supplies of cheap Russian oil, which has been re-directed by Russia from West, making the country, along with China, one of the major beneficiaries of the war in Ukraine.

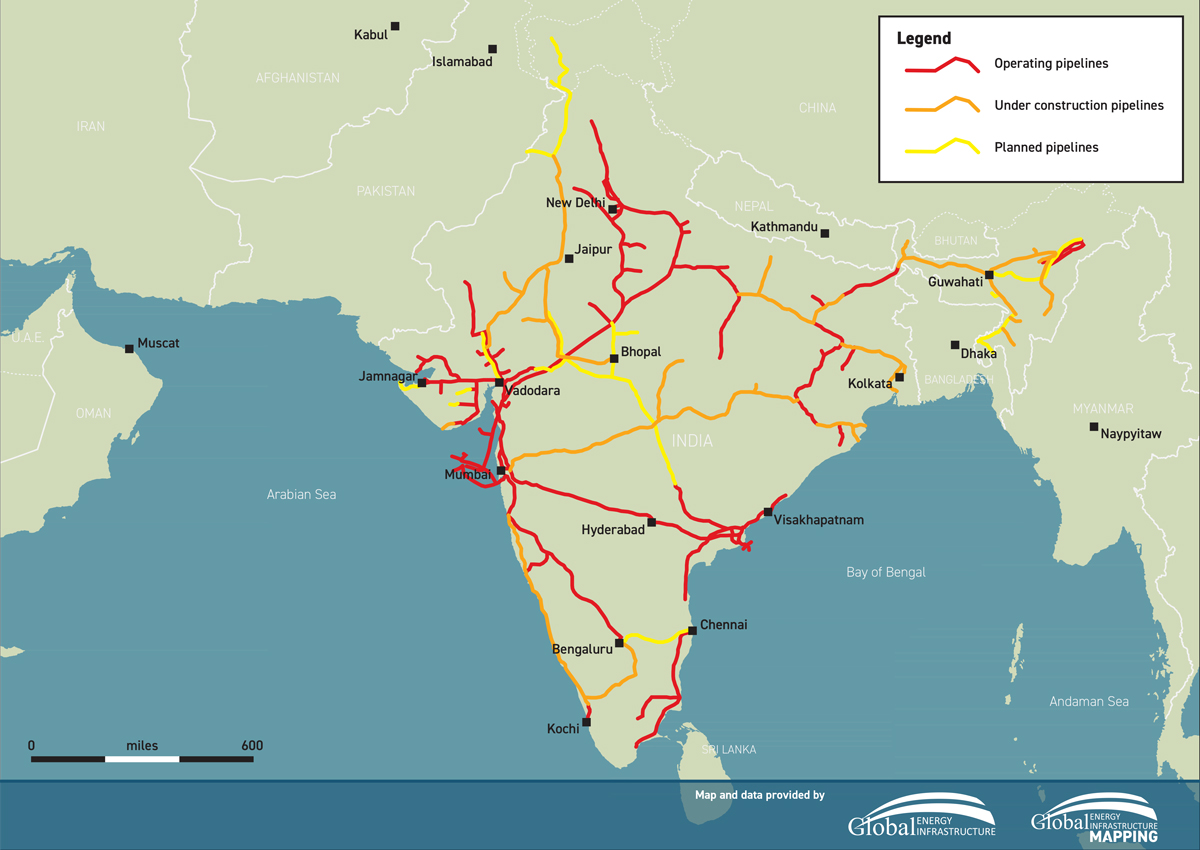

According to Pipeline & Gas Journal data, India currently has 13,331 miles of pipeline projects planned or under construction, with major gasification efforts taking place in the country’s northeast and northwest. Pipelines are also increasingly reaching out from the coasts to central India.

According to predictions of the Indian Ministry of Finance, this year the Indian economics is expected to grow by 7.5%, that will make it the world’s third-largest and the world’s fastest growing economy.

Such impressive economic results provide an opportunity to the government to pay more attention for the development of its energy industry, particularly gas sector and creates conditions for implementation of an important goal to ensure gas coverage to all households of the country, including those which live in its less developed central part, which does not have access to sea.

According to earlier statements of Prime Minister Narendra Modi, as part of these plans, the government is ready to invest at least $67 billion in the next five to six years in the development of domestic natural gas sector.

That will allow to increase the share of natural gas from the current 6% to 15% in the overall energy structure of the country and to reduce imports, which still account for 50% in the overall volume of gas consumption in the country The state also plans is also to provide incentives for domestic households for more active use gas for their needs.

It is expected, a significant part of these funds will be invested in the development of gas pipelines’ infrastructure of the country, paying a particular focus to those states, which have less developed pipelines infrastructure at present.

According to Indian Ministry of Petroleum and Natural Gas, at present the length of the country’s gas pipeline network is estimated at 14,290 miles (23,000 km), however, as part of state plans is to build another 9,630 miles (15,500 km) of pipelines in years to come, that will ensure stable gas supplies in almost each part of the country.

Of these, a particular attention will be paid for building of pipelines infrastructure in rural areas of India, which still account most of its part. Currently building of up to 870 miles (1,400-km) of pipelines is underway with an estimated cost of about $21 billion. In comparison, according to data of Global Energy Monitor, in case of China, these figures are estimated at about 10,560 miles (17,000 km).

In general, as part of state plans, all Indian states and provinces are expected to be connected by a trunk national pipeline network by 2027.

Implementation of these plans will be carried out as part of the existing Nation One Gas Grid scheme, which is aimed at developing natural gas infrastructure in the country with the aim to make it one of the most developed in the entire Asian region.

Most of independent analysts expect India has good chances to achieve its ambitious goals. According to a recent research conducted by experts of GlobalData agency, India will dominate the number of pipeline projects that are expected to start operations in Asia during 2024-2028, with about 43% share of the region’s total projects by 2028. Most of these projects involve building new gas pipelines.

Overall, according to data from the India’s oil and gas regulator Petroleum and Natural Gas Regulatory Board, more than 30 various projects, which involve building of new gas pipelines are currently implemented within the country.

One of the biggest of such projects is the 1,180-mile (1,900-km) Jagdishpur-Haldia Phase II pipeline, which is being built by state-owned Gas Authority of India Limited (GAIL), would be the largest upcoming gas pipeline in the country by 2028. The new pipeline is part of the major Jagdishpur-Haldia-Bokaro-Dhamra Natural Gas Pipeline (JHBDPL), intended to connect the eastern part of the country with the National Gas Grid. It starts in Uttar Pradesh (North India) and ends in West Bengal (India) and will have the overall length of more than 3500km.

The pipeline will be further extended to connect the North-eastern region of India up to Guwahati, Assam, through a 452-mile (729-km) Barauni-Guwahati Gas Pipeline. Total investments in these projects are estimated at $1.8 billion, about 40% of which are provided by the Indian government in the form of a grant.

In the meantime, Mehsana–Bhatinda is another major gas pipeline, which is currently built in India with a length of 1,139-mile (1,834 km). It will be operated by the local GSPL India Gasnet Ltd, a subsidiary of Gujarat State Petronet Ltd, a manufacturer and distributor of gas, hot water supply, steam and fuels. The pipeline, which should connect Western India with northwestern part up to the border with Pakistan was initially scheduled for commissioning in June 2021 but was delayed due to the second wave of Covid-19 in India.

Finally, India expects investment of about $4.95 billion (410 billion rupees) from companies to build natural gas pipeline infrastructure in its northeastern states and northern federal territories of Kashmir and Ladakh.

According to Indian Oil Minister Hardeep Singh Puri, the envisaged natural gas infrastructure development in northeastern states would also lead to better use of domestic gas being produced in the region. That will allow some supply to go to toward small industries, automobiles and households in five northeastern states: Nagaland, Manipur, Meghalya, Sikkim and Arunachal Pradesh, as well as the northern union territories of Kashmir and Ladakh.

In general, the India’s gas pipelines’ infrastructure should be expanded by 6,213 miles (10,000 km) to 20,505 miles (33,000-km) within the next four to five years, making it one of the largest in Asia.

At the same time, in addition to building of new pipelines, part of state plans calls for paying more attention to upgrades and modernization of the existing infrastructure, especially since a significant part of it was built in the early 2000s and is in acute need of repair.

In addition to gas, as part of the plans of Indian government is expanding of the domestic oil pipelines network by building of new infrastructure. According to Indian Infrastructure magazine, India has more than 6,200 miles (10,000 km) of crude oil pipelines, with a total capacity of over 150 mtpa, and it is expected these figures will be significantly increased in years to come.

According to a recent study of Global Energy Monitor, India is constructing 742 miles (1,630 km) of oil transmission pipelines currently, ranking second globally in the pipelines under construction category.

Among the major projects are the 742-mile (1,630-km) Paradip Numaligarh Crude Pipeline (that will connect two Indian major eastern states Odisha and Assam) and (1,194-km) New Mundra–Panipat Oil Pipeline, which will connect the Indian most Western state Gujarat and its northern part in the state of Haryana.

Both pipelines will be among the longest oil pipelines in the world after their commissioning. Overall, according to India Infrastructure Research, at least 15 oil pipeline projects are currently implemented within the country. Most of those are operated by such local majors as Indian Oil Corporation Limited (IOCL) and Hindustan Petroleum Corporation Limited (HPCL).

The development of oil pipelines’ network is important for India, as, according to earlier predictions of the International Energy Agency, India’s oil demand is expected to increase by almost 50 percent in 2030.

In addition to domestic projects, India is currently involved in the number of international projects, which involve building of new both gas and oil pipelines to supply hydrocarbons to neighboring states.

An example is India-Bangladesh Friendship Pipeline (IBFP), the pipeline, which was designed to transport diesel from India to Bangladesh. Implementation of the project, however, was suspended due to political instability in Bangladesh.

The pipeline was set to be extended, before violent protests erupted in Bangladesh several weeks ago, prompting then Prime Minister Sheikh Hasina to resign and flee to India.

Inaugurated in March 2023, the pipeline connects Siliguri in West Bengal, India, to Parbatipur in Dinajpur district, Bangladesh. With a capacity of 1 mtpa, the pipeline currently supplies diesel to seven districts in northern Bangladesh.

In addition, India also still has plans to construct pipeline connecting the country to Myanmar and Bangladesh to counter China's growing dominance in the region. The project is considered as important, as Myanmar's natural gas reserves are estimated to be 22.5 Tcf as of 2023, with China and Thailand among its major importers of LNG.

That will be also part of ambitious plans of Indian government to make the North-east Asian region a hub for oil and gas transit to other Asian states in years to come and to compete with China.

Comments