Tellurian Files for FERC Review of Permian Global Access Pipeline

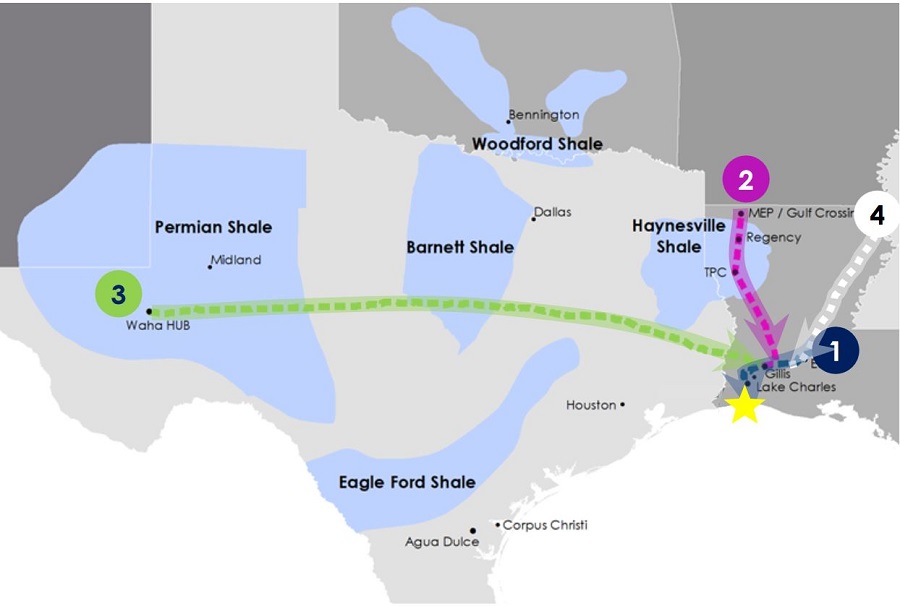

HOUSTON (P&GJ) — Tellurian has asked the Federal Energy Regulatory Commission (FERC) to initiate a review of its proposed Permian Global Access Pipeline (PGAP) following an oversubscribed open season for the 625-mile natural gas project from West Texas to Southeast Louisiana's growing LNG export market.

In its 12-page FERC request to initiate pre-filing review of PGAP, Tellurian emphasized the economic and environmental benefits the 2.3 Bcf/d, 42-inch pipeline would provide as an outlet for stranded natural gas associated with Permian Basin oil production.

"Of critical importance to the Permian Basin, all of Texas and Louisiana and globally, PGAP will facilitate the reduction of venting and flaring of natural gas and will continue to foster the displacement of burning fuel oil and coal for fuel via fuel switching to natural gas," the filing said.

Natural gas production from the Permian region is expected to exceed 16 BCF/d, at a minimum, by 2023 to 2025, the company said, while growth of the petrochemical, industrial and LNG export industries in the Southwest Louisiana-East Texas region are expected to increase natural gas demand in the area by approximately 14 BCF/d by 2025.

PGAP construction could begin as early as 2021, and the project could begin service by late 2023-early 2024. To meet that timeline, Tellurian anticipates receiving FERC approval for use of the pre-filing process in September 2019, according to the filing.

PGAP is one of three proposed pipelines that would comprise the estimated $7.3 billion Tellurian Pipeline Network, which is integral to its planned $15.2 billion Driftwood LNG export project near Lake Charles.

The pipeline network also includes the proposed Haynesville Global Access Pipeline (HGAP) and the Driftwood Pipeline. The 96-mile, 48-inch Driftwood Pipeline would provide 4 Bcf/d transport from Gillis to the Driftwood LNG facility.

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- Tallgrass to Build New Permian-to-Rockies Pipeline, Targets 2028 Startup with 2.4 Bcf Capacity

- TC Energy Approves $900 Million Northwoods Pipeline Expansion for U.S. Midwest

- A Systematic Approach To Ensuring Pipeline Integrity

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- Enbridge Adds Turboexpanders at Pipeline Sites to Power Data Centers in Canada, Pennsylvania

- Great Basin Gas Expansion Draws Strong Shipper Demand in Northern Nevada

- Cheniere Seeks FERC Approval to Expand Sabine Pass LNG Facility

Comments