EIA Expects U.S. Natural Gas Consumption to Decline Through 2022

By U.S. Energy Information Administration

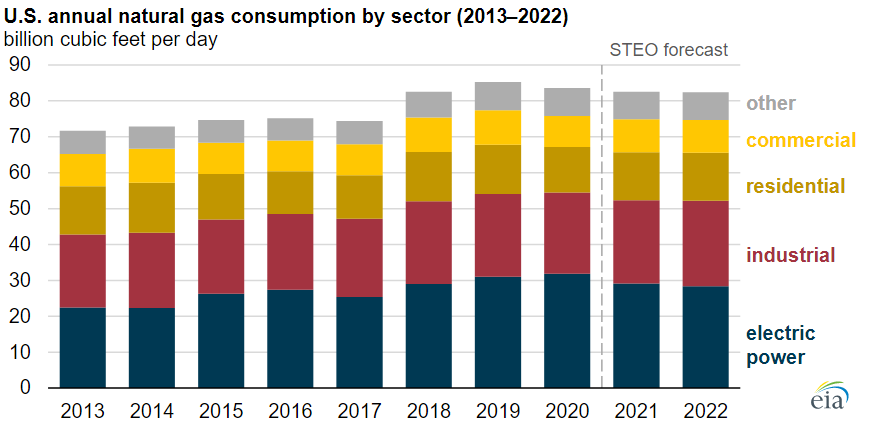

In EIA’s September Short-Term Energy Outlook, we expect U.S. consumption of natural gas to decline in 2021 and 2022 from 2020 levels. We forecast that consumption of natural gas will decline in all end-use sectors in the United States except in the industrial sector and for other non-sector-specific uses (lease and plant fuel, pipeline and distribution use, and vehicle use).

The largest decline will occur in the electric power sector. We expect total U.S. consumption of natural gas to average 82.5 billion cubic feet per day (Bcf/d) in 2021, down 0.7 Bcf/d from 2020. We expect U.S. natural gas consumption in 2022 to increase slightly from 2021 as increasing consumption in the industrial sector offsets declining consumption in the electric power sector, but still remains lower than the 2020 level, the outlook indicates.

In the United States, natural gas prices influence natural gas consumption in the electric power sector. When natural gas prices are high, generators typically switch from natural gas to lower-cost coal as the source for power generation. Higher prices at Henry Hub, the U.S. natural gas benchmark, during the first half of 2021 resulted in less natural gas consumption in the electric power sector than during the first half of 2020. We expect the Henry Hub price to average $3.63 per million British thermal units (MMBtu) in 2021, or $1.60/MMBtu more than the 2020 average. Therefore, we expect 2.7 Bcf/d, or 8.3%, less consumption of natural gas in the U.S. electric power sector in 2021. We expect another small, 0.7 Bcf/d, decline in electric power sector consumption of natural gas in 2022 as forecast Henry Hub prices remain elevated at $3.47/MMBtu and as natural gas faces more competition from renewable sources of electricity generation.

We expect natural gas consumption in the U.S. industrial sector to increase in 2022 to 23.8 Bcf/d from an average of 23.2 Bcf/d in 2021. Natural gas consumed by the industrial sector is dependent on the level of industrial activity, which we measure in the STEO using a natural gas-weighted industrial consumption index. This index reflects the growth of manufacturing subsectors and their relative importance to U.S. natural gas consumption. We expect that the index will increase 5.8% in 2021 from 2020 levels and another 5.8% in 2022 from 2021 levels, reflecting continuing post-pandemic economic growth.

Related News

Related News

- 1,000-Mile Pipeline Exit Plan by Hope Gas Alarms West Virginia Producers

- Valero Plans to Shut California Refinery, Takes $1.1 Billion Hit

- Greenpeace Ordered to Pay $667 Million to Energy Transfer Over Dakota Access Pipeline Protests

- Three Killed, Two Injured in Accident at LNG Construction Site in Texas

- Enbridge Plans $2 Billion Upgrade for North America’s Largest Crude Pipeline

- New Alternatives for Noise Reduction in Gas Pipelines

- Missouri Loses Control Over 1.5 Million-Mile Gas Pipeline Network as Feds Step In

- Enbridge Plans $2 Billion Upgrade for North America’s Largest Crude Pipeline

- South Dakota Governor Signs Bill Banning Eminent Domain for Carbon Pipeline

- Woodside May Delay Final Investment Decision on Louisiana LNG to Q2, CEO Says

Comments