June 2012 Vol. 239 No. 6

Features

Midstream Developers Busy Building Pipelines

Midstream development companies have spent hundreds of millions of dollars in developing the pipeline needed to move the products produced in the Eagle Ford Shale region to the refineries and processing plants located in close areas.

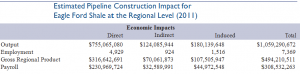

Based on the information available from surveying these companies, an estimated $755.1 million was spent in 2011 on this pipeline development and construction. These construction activities resulted in close to $1.1 billion in total output impact and more than $494 million in total gross regional product impact. These activities also supported approximately 7,400 full-time jobs. The impact of midstream development will likely have a limited lifespan once the new supporting pipeline infrastructure is built out.

NuStar Energy has been involved with the Eagle Ford Shale since the very beginning of its production, and was the first company to move Eagle Ford crude oil through pipeline.

“The reason we’ve been an early mover on this,” said Curt Anastasio, president and CEO of NuStar Energy L.P., “is because we had a critical mass of excess pipelines being underutilized in South Texas that can be filled up with the Eagle Ford liquids production.”

Anastasio also noted that NuStar is aggressively expanding its South Texas pipeline network to further increase the delivery of Eagle Ford crude from the field to South Texas refineries where it can be processed, or to South Texas ports where it can then be moved to other markets for refining. As one of the primary midstream providers in the Eagle Ford Shale region, NuStar Energy provides midstream services, including infrastructure, pipeline, storage tanks, breakout facilities, and blending facilities.

“This is the biggest onshore oil and gas play in the country and it’s right on our door step in San Antonio,” said Anastasio. “This is all made in America – this is American technology to develop American natural resources benefiting American jobs. So it’s a tremendous story, not just for our region but for the country.”

The Eagle Ford activity is having a major economic impact in San Antonio. “San Antonio is the hub for the Eagle Ford development,” said Anastasio. “Houston is still the center of the oil and gas industry in the United States. But what San Antonio has done is attract Houston and Oklahoma companies to open important offices and facilities in San Antonio because we are strategically located and we have the largest and most diverse workforce available to fill the jobs that they are going to have available.”

One of the most vital issues for the Eagle Ford Shale area is sustainability. Communities must plan to take into consideration that the shale activity will not be around forever and plan accordingly. The real challenge will be using this economic impact to promote long-term growth in South Texas.

“I think the Eagle Ford is only positive. It’s positive for our region, our state, and even for the country,” said Anastasio.

“All of this wealth creation needs to be invested wisely in things that are of sustainable value to the communities. Whether it be preserving our water resources, improving education, improving infrastructure, whatever it may be that the local authorities decide. It is important that we not squander this golden opportunity that nature has given us.

“That’s part of the responsibility of everyone working in this. If you’re called upon by local or regional authorities to help plan long term economic benefit to the region then people need to step up and be a part of that. It’s not about making money in the short term; it’s about making sure we protect the long term value of this event,” said Anastasio.

NuStar has experienced significant growth over the past few years, and has been building a new headquarters in San Antonio to help accommodate its expanded workforce. The company is investing $100 million in a 300,000-square-foot new facility in northwest San Antonio. This state-of-the-art location has created construction jobs and is set to be in operation by the third quarter.

Comments