December 2021, Vol. 248, No. 12

Features

Carbon+Intel: New Dawn of Carbon Capture, Transportation and Storage

By Jeff Lee, principal consultant, Kronos Management

With ever-sharpening focus from investors, shareholders and government on climate issues, oil and gas companies around the world are increasingly on the defensive to justify their businesses and adjust their operations to reduce carbon footprint and cut greenhouse gases.

Some argue that instead of resisting this macroeconomic shift, oil and gas companies should adjust their business model to capture the entire value chain by selling carbon fuel and capturing/storing waste carbon, merging “Big Oil” with “Big Sink.”

There is an array of green initiatives on the menu, from solar, wind, geothermal, battery, to hydrogen. One area of decarbonization technologies, carbon capture, (use), and storage (CCS or CCUS), is particularly suited for operators because of their vast expertise in managing large and complex infrastructure, industrial gas treating, pipelines and reservoir management.

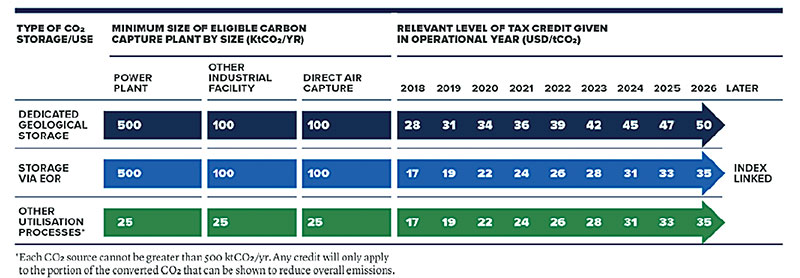

It is an understated component critical to achieving net-zero emissions goals. With governments beginning to price carbon and offer incentives or disincentives ranging from emissions credits, tradeable certificates, carbon tax, grants and penalties to encourage CCS development, a viable revenue model is taking shape and a large addressable market is emerging. (Figure 2)

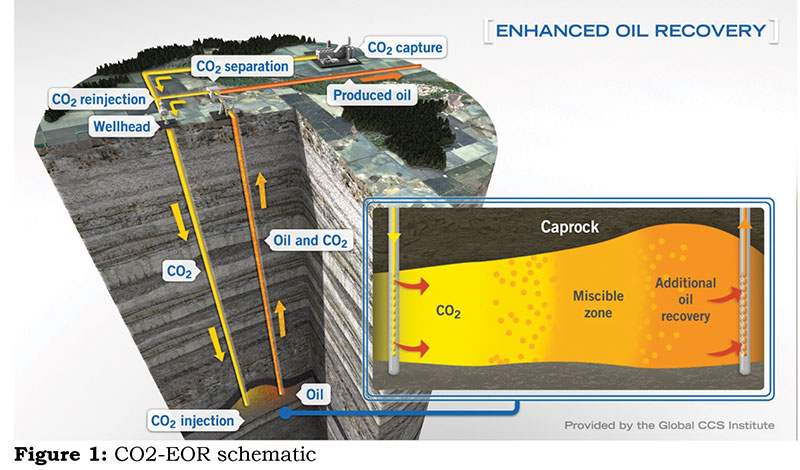

Historically, oil and gas companies have used carbon dioxide (CO2) for enhanced oil recovery (EOR). Decades of data have shown that high-pressure CO2, which acts like a lubricant, can coax out as much oil as primary production methods. Figure 1 is an overview of a CO2-EOR operation. Oxy, Shell, Exxon, Kinder Morgan CO2 and Denbury are active in that space.

This movement all started by drilling for naturally occurring CO2, but the trend is now shifting toward anthropogenic (man-made) CO2 captured from industrial sources. Oxy Low Carbon Ventures have even partnered with a Canadian firm to deploy direct air capture from the atmosphere.

Exxon, under recent shareholder pressure, has committed $3 billion for low-emissions energy solutions and CCS through 2025. CCUS used to be dominated by producers but in recent years it is attracting midstreamers with tariffs in mind.

Wolf Midstream operates the Alberta Carbon Trunk Link transporting captured CO2 from refineries and fertilizer plants. Valero and BlackRock announced plans in March 2021 to develop industrial-scale CO2 pipeline systems to match sources and sinks in the Midwest.

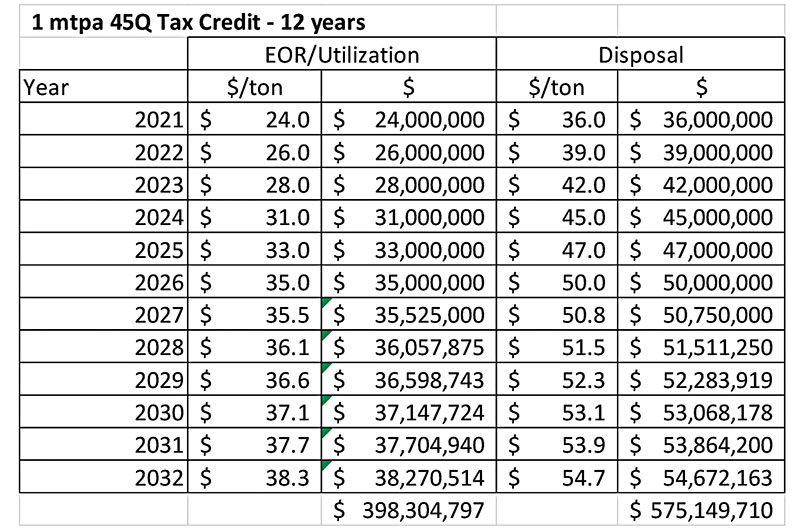

In the U.S., the 2018 bipartisan passing of 45Q, a reformed federal carbon oxide (CO and CO2) sequestration tax credit, has brought about much interest among project developers in oil and gas, and industrial sectors. It places values on carbon oxide at $50/ton for geologic storage or $35/ton for EOR/utilization, according to a progressive schedule indexed to inflation, provided the project commences by Jan. 1, 2024.

The ability of project developers to transfer the credit allows for tax equity investors to participate, increasing the appeal of CCS. In addition, this credit can be combined with other state and local incentives such as the $200/ton Low Carbon Fuel Standard in California where applicable. The minimum storage thresholds are fairly low to qualify.

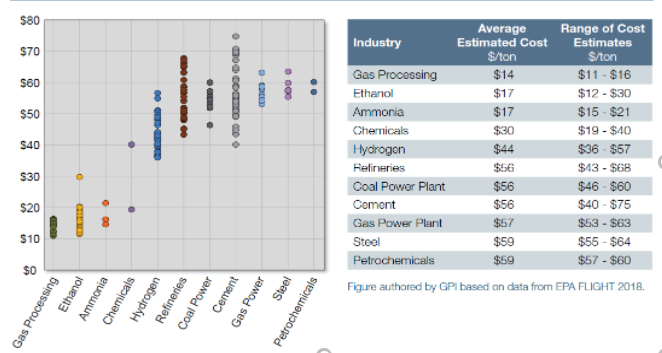

However, the economic viability of projects is highly dependent on the sources since the concentration of captured CO2 can play an important role. According to recent data from GCCSI, an advocacy group, the capture cost from ethanol, chemical and natural gas processing plants ranges in the teens; coal power plants and refineries can range in the $40s to $60s per ton; steel and cement plants can fall in the $60s to $70s/ton range. With the incremental oil revenue from EOR at a lift ratio of 0.5-to-1.5-ton CO2/bbl oil, many projects appear feasible with the tax credit. (Figure 2)

CO2 captured can be used or sequestered in a variety of ways, such as fuel production and injection into concrete. Most take significant energy input and emit more CO2 than is sequestered. Currently, the most economic CCUS subset is EOR, which requires CO2 capture equipment at the emission source, typically process/flue gas from a gas processing plant, chemical plant, power plant or other industrial facilities. The methods of CO2 capture are primarily solvents (physical, chemical) or membranes.

The CO2 concentration in the gas stream varies across industrial sectors, and it is the key factor in optimizing capture efficiency. In most cases, there are even several process gas streams at the same facility, but only some are economical to recover. The lowest cost capture option is often liquid solvent/regeneration that is tried-and-true in the gas processing industry, e.g., amine.

Other emerging technologies are being developed but will need to show commercial viability. Captured gas is typically at atmospheric pressure and is compressed into a supercritical phase for transportation. Figure 3 is a snapshot of the range of estimated capture costs in the U.S.

Safe, long-term storage options are primarily oilfields that use the CO2 for EOR while sequestering the gas, or deep saline formations that have the right geologic characteristics. Many suitable reservoirs exist along the Gulf Coast and in the Permian Basin, but the Gulf Coast has the added advantage of proximity to large clusters of emission sources.

The Department of Energy, through sponsorship of Midwest Regional Carbon Initiative, has sponsored studies throughout the Midwest that covers more than one-third of the domestic CO2 point sources for suitable storage reservoirs.

Monitoring, measurement and verification (MMV) requirements in the regulatory framework in different jurisdictions are somewhat inconsistent but they usually entail insurance, leakage penalty, liability transfer to the state after a defined period of time and the establishment of financial security/trust. State laws are evolving on pore space rights and liabilities, but the concepts are not foreign to fossil fuel-producing jurisdictions.

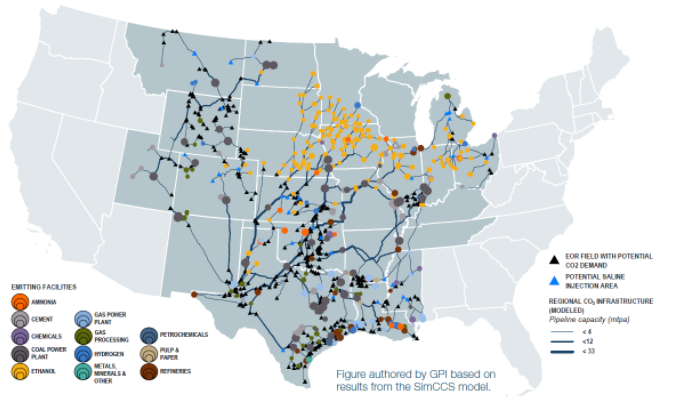

Transportation of CO2 is generally not technically complex but plays a significant part in the cost of deployment, especially when the sources and sinks are far apart. The common assumptions for tariffs are about $10/ton and EOR purchase at $20/ton for base case analysis. As with typical midstream infrastructure, aggregation of volume can bring down unit cost meaningfully for regional transportation and spur project development. To that end, Great Plains Institute performed a study with Los Alamos Lab to produce the conceptual corridors (Figure 4).

Technically, CO2 pipelines need to be designed for mitigation of ductile fracture propagation and carbonic acid corrosion, but it is readily achievable. Maintaining supercritical conditions for high density, i.e., transport efficiency, also requires the system to be designed for higher operating pressures. Another unique aspect of CO2 pipelines is asphyxiation risk in populated areas in case of an accidental release. Air dispersion modeling in the route selection process is helpful in overall risk assessment.

As a sign of the times, leveraging our experience implementing CCUS in the U.S., we are currently assisting a development bank and China’s Ministry of Ecology and Environment to develop a CCUS pilot project that aims to demonstrate the technical and economic viability of retrofitting a coal-to-chemical plant to capture, transport and sequester about 0.4 to 1.0 mtpa of high-concentration CO2 for EOR purposes. Given that China has a vast collection of coal-fired power plants and industrial facilities as well as a newly aggressive decarbonization targets by mid-century, we expect similar projects to proliferate in the decades to come.

Since industrial facilities are not familiar with oil and gas pipelines and reservoir management, it is generally difficult for them to assemble the components in a complex CCUS value chain. Producers and midstreamers are in an excellent position to capitalize their knowledge and experience to bring solutions to the emitters and take advantage of the tax credits, and potentially the global carbon offset market, while expanding their business model for a new commodity.

Climate change, ESG investment theme, social pressure and government initiatives will provide impetus for global CCS project development. We are excited about this multidecade trend and are well-positioned to help investors and project developers navigate the policy, economic and technical landscape of CCUS.

Author: Jeff Lee is the principal consultant for Kronos Management, a boutique consulting firm that caters to the oil and gas midstream sector. He has extensive experience working on CCS/CCUS project development and CO2 pipelines. He can be contacted at LeeJeff@engineer.com.

Comments