November 2016, Vol. 243, No. 11

Features

Pipeline Leak Detection Expected to See Muted Growth Through 2020

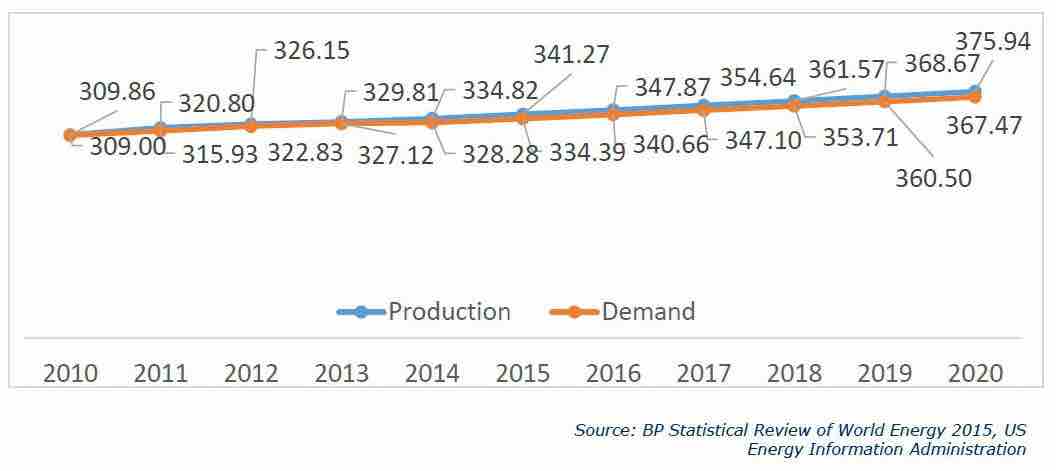

Due to high levels of energy consumption in Asia and Oceania, particularly in India and Japan, and major pipeline infrastructure investments in Africa and Europe, the global oil and gas leak detection market is poised to grow at a steady rate in the coming years.

This according to TechSci Research, which also points to rising incidents of oil and gas pipeline spills caused by corrosion and pilferages that have led to growing concerns regarding pipeline leak detection syste

Globally, pipeline networks should see sluggish growth until 2018 due to weak crude oil prices; however, this is expected to stabilize after 2018. A total of $3.16 trillion is expected to be invested on the global pipeline infrastructure until 2035, out of which 52% will be spent for construction of natural gas pipelines, TechSci Research said.

Still, over the next five years, the oil and gas pipeline leak detection market is forecast to exhibit slow growth due to the low level of investment anticipated in oil and gas downstream sector.

Global pipeline infrastructure grew significantly for a decade, until 2013, especially in North America, the Middle East and China, regions that experienced increased oil and gas production. Increasing reliance on natural gas after phasing out plans of nuclear power development in Europe further contributed to the growth, and, consequently, higher investments in pipeline infrastructure. This, however, led to a decline in crude oil prices, which brought on the emergence of a challenging market scenario for industry giants, including Shell, ExxonMobil, BP, Chevron and Total.

Over 90% of global oil and gas pipelines are located underground, with the remainder above the surface, primarily as refinery and petrochemical pipelines. As of 2015, underground oil and gas pipelines constituted over 70% of the oil and gas pipeline leak detection market, followed by subsea pipelines (25%).

Oil and gas pipeline leak detection is a capital-intensive process because leaks can occur at any point across pipelines that cover thousands of miles. Internal methods of leak detection are preferred since this process involves use of already installed equipment, such as flowmeters and pressure sensors.

In case of external leak detection, the systems are associated with software and supervisory control and data acquisition (SCADA) systems. However, the use of external leak detection systems is limited due to the high cost of installation, despite the equipment’s ability to provide greater accuracy. External methods are more prevalent in the Americas than in other regions.

In the internal method, hydrocarbon pipeline leak detection technologies are used within the pipeline and are also known as computational pipeline monitoring (CPM) systems. CPM techniques use algorithmic tools to assess pipeline leaks through one or a combination of hydrocarbon parameters based on pressure, temperature and flow measurement. For example, internal methods of leak detection, such as RTTM and mass volume balance, use either flow measurement or flow and pressure measurement for leak detection.

Internal methods of leak detection are prominent in Africa, Europe, Asia and Oceania, and should see substantial growth in Europe through 2020. In other regions, despite the fact of being more prominent, internal methods will likely lose market share to external leak detection methods (such as acoustic sensors).

Flowmeters are the most widely adopted type of leak detection equipment. However, with the growing popularity of acoustic sensors in the Americas, these are expected to see less growth over the next five years. Over 60% of the pipelines using acoustic sensors are natural gas. Apart from these, pressure sensors and intelligent pigging technology is also expected to grow, primarily in Asia and Oceania.

North America, which is the largest market for oil and gas infrastructure, is at quite a mature stage and is expected to taper off while Western Europe should see high growth in onshore pipeline infrastructure.

One major reason for the decline in global oil and gas pipeline leak detection market in the Americas is price uncertainty. The Americas entered into a market share war with Saudi Arabia and the Russian Federation in the wake of the shale revolution.

The offshore pipeline network is expected to grow between now and 2020 due to investments in global offshore pipelines, projected to rise over 35% during the same period. Europe is expected to lead the global pipeline investments, accounting for nearly 23%, followed by Latin America and Asia, with 21% and 17%, respectively. Italy is expected to fuel the pipeline investment scenario in Europe with its upcoming Trans-Adriatic Pipeline and GALSI pipeline linking Algeria and Italy.

During 2010-15, oil and gas pipeline investments were highly concentrated in the North American market, which constituted over 84% of the total pipeline infrastructure development in 2015. However, the market share of internal leak detection methods in the Americas’ oil and gas pipeline leak detection market is expected to decline due to the continuing increased use of external leak detection methods. This has been brought about due to increasingly stringent regulations for oil and gas pipeline leak detection systems.

Over 80% of the Americas’ oil and gas activities occur onshore, with the offshore market largely concentrated in Latin America, South America and the Gulf of Mexico. The Asia, Oceania and Middle East pipeline leak detection market is expected to grow at a slower rate during the next five years. This decline can be attributed to fewer planned and under construction pipeline projects in these regions.

Internal leak detection is the preferred method in the region since this is more cost-effective vs. external methods. External methods find limited application in the region and are used mainly in Malaysia and Indonesia.

The share of external methods is expected to decline further during the forecast period. Flowmeters and pressure sensors should dominate the detection market in Asia, Oceania and Middle East. Flowmeters and pressure sensors have been preferred in the region due to their comparatively low cost.

Onshore pipeline infrastructure development in Asia, Oceania and Middle East is expected to decline due to slow growth and low investments in the oil and gas downstream sector. Since over 70% of oil and gas production in these regions comes from onshore oil and gas fields, low infrastructure development would greatly affect the market.

In 2014, Nigeria was the largest crude oil-producing nation in Africa, followed by Angola and Algeria. Major pipeline investments in the region cover 280 miles of multi-product Kenya Pipeline Co. pipelines. This is in addition to 220 miles of product pipelines being constructed to connect Eldoret Kenya, Kampala Uganda and Rwanda. In 2015, Uganda announced $11 billion in investments to boost the country’s infrastructure over the next 10 years. This investment includes construction of crude oil and products pipelines, and small-scale refineries.

Internal methods of leak detection hold a larger share of the region’s market due to the low cost of installation. Internal methods should continue to dominate through the next five years, supported by less stringent regulations pertaining to leaks.

External methods of leak detection hold the market mostly in the offshore fields of Africa but are expected to decline in market share due to increased use of internal leak detection methods. Integrated leak detection systems, employing flowmeters and acoustic sensors, are increasingly preferred in the region.

Onshore pipeline development projects in Africa should see a boom through 2020. Despite low crude oil prices, government initiatives for the development of oil and gas pipeline infrastructure will drive the market for pipeline leak detection in the region. Additionally, Eastern Africa recently made large onshore discoveries in Kenya, Mozambique, Tanzania, Somalia and Uganda, which have attracted oil and gas companies across the globe.

Most of the pipelines planned or under construction in Africa are off the shores of Angola, Cameroon, Ghana and Tanzania. Over 80% of the planned projects involving gas pipelines are in Eastern Africa.

The European onshore industry can expect a marginal increase for its leak detection market due to the marginal increase in pipeline infrastructure investment in the region. Pipeline investment will be concentrated mainly in Eastern Europe, with the Russian Federation constituting the largest market. Western Europe will continue to lead the demand for energy in the region and will be the largest importer of oil and natural gas in Europe.

Europe is expected to experience high growth in offshore oil and gas pipeline infrastructure investment, presenting a positive outlook for the leak detection market in that region. Some of the major offshore projects, such as White Stream Gas Pipeline and Nord Stream Pipeline project will be major contributors to the growth.

Comments